What Is an Error of Principle?

An error of principle is an accounting mistake in which an entry violates a fundamental principle of accounting or a fundamental accounting principle established by a company.

Key Takeaways

- Errors of principle typically include correct amounts but violations of company accounting principles.

- Common errors of principle can include: mixing up debits and credits, using the wrong liability account for an expense, crediting the wrong type of asset account for a payment, or potentially debiting the wrong client account in an accounts receivable transaction.

- Resolving errors of principle after final financial statement reporting has been released is typically the most costly for a company in both resolution and reputation.

Understanding Error of Principle

There can be several types of accounting errors. Different types of errors in accounting may be classified as: errors of original entry, errors of duplication, errors of omission, errors of commission, errors of entry reversal, compensating errors, and an error of principle.

Companies strive to hire experienced employees and incorporate protocols that help to mitigate accounting errors. However, errors can still happen. If they do occur and are identified, companies and Generally Accepted Accounting Principles (GAAP) provide guidance for correcting them. Many companies, particularly large companies with complex accounting, may also purchase Errors and Omissions Insurance, which provides some monetary protections if substantial errors are found.

Types of Errors of Principle

Errors of principle are often simply accounting entries recorded in the incorrect account. The amounts are often correct, unlike an error of original entry. Oftentimes, the error of principle is a procedural error, meaning that the value recorded is correct but the entries are made in the wrong accounts. These types of errors can be difficult to identify if they occur because they can still lead to appropriate balancing of debits and credits on the balance sheet, as well as appropriate summations carrying over to the income statement and cash flow statement.

Errors of principle can also be a concern when a company changes an established principle already in processing to another, new principle. From time to time, companies may change certain principles within GAAP parameters to better represent their company’s activities or to integrate a new type of dashboard metrics monitoring system that helps them more efficiently manage the performance measures of a business.

Examples of Errors of Principle

At a base level, accounting clerks are responsible for learning and maintaining a working knowledge of the account categories a company uses on its balance sheet. These categories are particularly important because they lead to the analysis of asset and liability balances on the balance sheet. Account categories also flow over into the income statement where expenses are reported as either direct, indirect, or capital expenses.

The complexity of a company’s balance sheet accounts can affect how easily errors of principle can be to initiate. Most companies keep their balance sheet expense accounts fairly simplified as to avoid the potential for errors of principle. Common expensing accounts for current liabilities include: accounts payable, notes payable, wages payable, and taxes payable. The appropriate expensing entries would be to debit the liability account and credit an asset account. Using the wrong liability accounts or crediting the wrong type of asset account would result in an error of principle. Mixing up the credits and debits or potentially debiting the wrong client account in an accounts receivable transaction can also be common errors.

When a company incorporates a new type of reporting or integrates new account categories within its asset and liability reporting, errors of principle can become more likely. This can happen when a company overhauls its reporting to create new business segments. New business segments may be integrated from time to time as a company grows or enters into a new segment. Taking extra care to ensure that errors of principle do not occur in these transitions will be very important for a company’s accounting success.

Resolving Errors of Principle

Discovering an error of principle usually takes some detective work, since looking at a trial balance, which contains the name of the account and its value, only shows whether debits equal credits. How the error is corrected will depend on the type of error.

Many errors of principle will be detected before a company issues its final financial statements at the end of a reporting period. Errors may be found in the final review of reporting or spotted by financial managers working in conjunction with accounting teams on performance reporting. If an error of principle is identified prior to the release of a final financial report, it can be most easily resolved by making appropriate correcting entries to reverse and appropriately categorize the transaction. In most accounting systems this is a fairly straightforward move that results in a fast resolution.

If an error of principle is identified after final financial statements are released, the Financial Accounting Standards Board requires companies follow Accounting Standards Codification 250 under GAAP to make necessary resolutions. Errors found after financial statement releases can be the most harmful both in cost and reputation. These types of errors will typically require some type of restatement or disclosures for shareholders.

If an error is drastic enough, a company may file a claim for coverage under its Errors and Omissions Insurance Policy, if one is in place. Errors and Omissions Insurance can provide monetary remuneration for errors of principle made by employees, negligence, or company policies.

Что такое принципиальная ошибка?

Принципиальная ошибка – это бухгалтерская ошибка, при которой запись нарушает основополагающий принцип бухгалтерского учета или основополагающий принцип бухгалтерского учета, установленный компанией.

Ключевые выводы

- Принципиальные ошибки обычно включают правильные суммы, но нарушения принципов бухгалтерского учета компании.

- Общие принципиальные ошибки могут включать в себя: смешение дебетов и кредитов, использование неправильного счета пассивов для расходов, кредитование неправильного типа счета актива для платежа или возможное дебетование неправильного счета клиента в транзакции с дебиторской задолженностью.

- Устранение принципиальных ошибок после публикации окончательной финансовой отчетности обычно является наиболее дорогостоящим для компании как с точки зрения разрешения проблем, так и с точки зрения репутации.

Понимание принципиальной ошибки

Бухгалтерских ошибок может быть несколько типов. Различные типы ошибок в бухгалтерском учете могут быть классифицированы как: ошибки первоначальной записи, ошибки дублирования, ошибки упущения, ошибки комиссии, ошибки сторнирования записи, ошибки компенсации и принципиальная ошибка.

Компании стремятся нанимать опытных сотрудников и внедрять протоколы, которые помогают уменьшить ошибки бухгалтерского учета. Однако ошибки все равно могут возникать. Если они действительно возникают и выявляются, компании и Общепринятые принципы бухгалтерского учета (GAAP) предоставляют рекомендации по их исправлению. Многие компании, особенно крупные компании со сложным бухгалтерским учетом, могут также приобрести страховку от ошибок и пропусков, которая обеспечивает некоторую денежную защиту в случае обнаружения существенных ошибок.

Типы принципиальных ошибок

Принципиальные ошибки часто представляют собой просто бухгалтерские записи, внесенные в неправильный счет. Суммы часто верны, в отличие от ошибки первоначального ввода. Часто принципиальной ошибкой является процедурная ошибка, означающая, что записанное значение верное, но записи сделаны в неправильных учетных записях. Ошибки такого типа бывает трудно идентифицировать, если они возникают, потому что они по-прежнему могут привести к соответствующему сальдированию дебетов и кредитов в балансе, а также к переносу соответствующих сумм в отчет о прибылях и убытках и отчет о движении денежных средств.

Принципиальные ошибки также могут вызывать беспокойство, когда компания меняет установленный принцип, уже находящийся в процессе обработки, на другой, новый принцип. Время от времени компании могут изменять определенные принципы в параметрах GAAP, чтобы лучше представлять деятельность своей компании или интегрировать новый тип системы мониторинга показателей информационной панели, которая помогает им более эффективно управлять показателями эффективности бизнеса.

Примеры принципиальных ошибок

На базовом уровне бухгалтеры несут ответственность за изучение и поддержание рабочих знаний о категориях счетов, которые компания использует в своем балансе. Эти категории особенно важны, потому что они приводят к анализу остатков активов и пассивов в балансе. Категории счетов также переходят в отчет о прибылях и убытках, где расходы отражаются как прямые, косвенные или капитальные.

Сложность балансовых отчетов компании может повлиять на то, насколько легко могут быть совершены принципиальные ошибки. Большинство компаний ведут свои балансовые отчеты о расходах довольно упрощенными, чтобы избежать возможных принципиальных ошибок. Общие расходы по текущим обязательствам включают: кредиторскую задолженность, векселя к оплате, задолженность по заработной плате и задолженность по налогам. Соответствующие проводки по расходам будут для дебетования счета обязательств и кредитования счета активов. Использование неправильных счетов пассивов или зачисление средств на счет активов неправильного типа может привести к принципиальной ошибке. Смешивание кредитов и дебетов или возможное дебетование неправильного клиентского счета в транзакции с дебиторской задолженностью также могут быть распространенными ошибками.

Когда компания включает новый тип отчетности или интегрирует новые категории счетов в свою отчетность по активам и пассивам, принципиальные ошибки могут стать более вероятными. Это может произойти, когда компания пересматривает свою отчетность для создания новых бизнес-сегментов. Новые бизнес-сегменты могут время от времени интегрироваться по мере роста компании или выхода в новый сегмент. Особое внимание к тому, чтобы не допустить возникновения принципиальных ошибок при таких переходах, будет очень важно для успеха бухгалтерского учета компании.

Устранение принципиальных ошибок

Выявление принципиальной ошибки обычно требует некоторой детективной работы, поскольку просмотр пробного баланса, который содержит название учетной записи и ее стоимость, показывает только, были ли списаны равные кредиты. Способ исправления ошибки будет зависеть от типа ошибки.

Многие принципиальные ошибки будут обнаружены до того, как компания выпустит свою окончательную финансовую отчетность в конце отчетного периода. Ошибки могут быть обнаружены в окончательной проверке отчетности или обнаружены финансовыми менеджерами, работающими совместно с бухгалтерскими группами над отчетностью о производительности. Если принципиальная ошибка выявляется до выпуска окончательного финансового отчета, ее проще всего устранить, сделав соответствующие корректирующие записи, чтобы сторнировать и соответствующим образом классифицировать операцию. В большинстве систем бухгалтерского учета это довольно простой шаг, который приводит к быстрому разрешению проблемы.

Если после выпуска окончательной финансовой отчетности выявляется принципиальная ошибка, Совет по стандартам финансового учета требует, чтобы компании следовали Кодификации стандартов бухгалтерского учета 250 согласно GAAP для принятия необходимых решений. Ошибки, обнаруженные после публикации финансовой отчетности, могут быть самыми опасными как с точки зрения затрат, так и с точки зрения репутации. Ошибки такого типа обычно требуют пересмотра или раскрытия информации для акционеров.

Если ошибка является достаточно серьезной, компания может подать иск о покрытии в соответствии со своим полисом страхования ошибок и пропусков, если таковой имеется. Страхование от ошибок и пропусков может обеспечить денежное вознаграждение за принципиальные ошибки, допущенные сотрудниками, халатность или политику компании.

Asked by: Lavern Wolf

Score: 4.5/5

(13 votes)

An error of principle is an accounting mistake in which an entry violates a fundamental principle of accounting or a fundamental accounting principle established by a company.

What is the error of omission and error of principle?

The error of omission refers to the error in which a transaction is not at all recorded in the books, either completely or partially. … Errors of principle indicate the error of recording a transaction against the basic convention or principle of accounting.

What is error of principle in trial balance?

An error of principle is when the entries are made to the correct amount, and the appropriate side (debit or credit), as with an error of commission, but the wrong type of account is used. For example, if fuel costs (an expense account), are debited to stock (an asset account). This will not affect the totals.

What are the types of error in accounting?

Types of accounting errors include: Error of omission — a transaction that is not recorded. Error of commission — a transaction that is calculated incorrectly. … Error of principle — a transaction that is not in accordance with generally accepted accounting principles ( GAAP).

Which of the following is not an error of principle?

Explanation: While doing the accounting, if the basic rule of accounting is not followed, there is an error of principle. For example, purchase of machinery is debited to purchases account. Its an error of principle as capital expenditure is debited as revenue expenditure.

32 related questions found

What is the error of principle?

An error of principle is an accounting mistake in which an entry violates a fundamental principle of accounting or a fundamental accounting principle established by a company.

What are errors of omission?

Errors of omission are also sometimes called «false negatives.» They refer to instances in which someone or something is erroneously excluded from consideration when they or it should have been included. In survey research, this error typically occurs when the eligibility of a unit is determined.

What are two sided errors?

Two-sided errors are those errors which do not affect the agreement of the trial balance. These errors are occur in two or more accounts. Such errors are rectified by passing journal entries. Errors of complete omission, errors of principle and compensatory errors are examples of two sided-errors.

What are the 4 types of errors in accounting?

Here are some types of mistakes to look for when reviewing accounting reports.

- Data entry errors. …

- Error of omission. …

- Error of commission. …

- Error of transposition. …

- Compensating error. …

- Error of duplication. …

- Error of principle. …

- Error of entry reversal.

What are the four types of errors?

Errors are normally classified in three categories: systematic errors, random errors, and blunders. Systematic errors are due to identified causes and can, in principle, be eliminated.

…

Systematic errors may be of four kinds:

- Instrumental. …

- Observational. …

- Environmental. …

- Theoretical.

What is the example of error of principle?

The error of principle means recording the transaction violating the accounting policies and procedures. For Example: treating the purchase of an asset as an expense, this is an error of principle.

Does error of principle affect trial balance?

As we learned, there are errors that do not affect the trial balance, such as an error of accounting principle or compensating errors. The errors that do affect the trial balance will need to be resolved through the use of a suspense account, or a temporary account opened for the difference in the trial balance totals.

What is the difference between error of principle and error of original entry?

An error of original entry occurs when a figure is entered into the accounts incorrectly. An error of principle is when entries are made into the wrong type of account.

Is an omission a mistake?

a mistake that consists of not doing something you should have done, or not including something such as an amount or fact that should be included: Errors of omission are likely to be more common than errors of commission.

What is typical error chain?

That’s the error chain. Each link in the error chain is an event that contributes to an accident. They can be called contributing factors. … The error chain can be just a single link where just one mistake can end in disaster or it can be many links where things all have to line up perfectly for the accident to happen.

What is the difference between error and omission?

Errors of commission are defined as those errors that occur due to incorrect recording of transactions in the account books. Errors of omission occur due to mistakes on the part of the accountant in recording the transaction.

What is the rule of 9 in accounting?

If a business’ accounting records show a discrepancy, the difference between the correct amount and the incorrectly-entered amount will be evenly divisible by 9.

How do you avoid mistakes in accounting?

6 Tips to prevent accounting mistakes

- Update your accounting books. This tip is pretty straightforward. …

- Save receipts and other documents. It might be tempting to throw out documents like receipts and bank statements when you declutter. …

- Check your records. …

- Separate personal and business funds. …

- Use software. …

- Create budgets.

What is a compensating error?

A compensating error is an accounting error that offsets another accounting error. These errors can be difficult to spot when they occur within the same account and in the same reporting period, since the net effect is zero. A statistical analysis of an account may not find a compensating error.

How do you fix a two sided error?

Two sided errors are rectified by cancelling the effect of wrong debit or credit and restoring the effect of correct debit or credit. Account showing an excess debit should be credited in the rectifying entry, account showing a short debit should be debited in the rectifying entry etc.

What are one-sided and two sided errors?

These errors affect only one account and only one side i.e. debit or the credit side of the account. Errors of partial omission, recording transactions with wrong casting and wrong posting are examples of one-sided errors. One-sided errors are those errors which affect the agreement of the trial balance.

What are the two types of clerical errors?

Errors of Commission:

They are committed while recording transactions. These errors may or may not affect the agreement of trial balance. Mistake in balancing an account. Mistake in posting in so far as the amount is wrongly written.

What are the examples of error of omission?

An error of omission happens when you forget to enter a transaction in the books. You may forget to enter an invoice you’ve paid or the sale of a service. For example, a copywriter buys a new business laptop but forgets to enter the purchase in the books.

How do you fix errors of omission?

We can rectify these by passing a journal entry giving the correct debit and credit to the accounts. In order to rectify an error, we need to cancel the effect of wrong debit or credit by reversing it and restore the effect of correct debit or credit.

What is an error of omission in medication?

A drug omission can be defined as an event in which an appropriate medication is not provided to a patient, either because the medication has not been prescribed or has not been administered.

When running your own business’ finances, you’ll likely make accounting errors from time to time. Even the most qualified accountants do.

And although it’s normal to make mistakes, it’s also essential to always notice them and get things right. At the end of the day, your business is only as reliable as the data you enter.

Now, you probably have a ton of questions.

How can I tell I’ve made an accounting error? Is there a way to prevent them from happening in the first place?

Well, don’t stress! In this guide, we cover everything you need to know about accounting errors for any business. Read on to learn about:

- What Is An Accounting Error?

- What Are the Different Types of Accounting Errors?

- How Can Accounting Errors Affect Your Business?

- How Can You Prevent Accounting Errors?

What Is An Accounting Error?

An accounting error is an unintentional mistake made in an accounting entry. For instance, including an item in the inappropriate account, or writing the incorrect description for it.

Don’t mix up errors with fraud, though. Fraud is intentional and done for ulterior motives such as hiding money to benefit the business.

Now, not all errors are the same.

Sometimes you can spot them right away, and fix them just as easily.

For example, say there’s an unequal ending balance of debits and credits in your trial balance. When this happens, it’s visibly clear which accounts don’t match. All you have to do is scan the document and make a correcting entry.

In other cases, however, the solution isn’t as immediate, and you’ll need to do a further review of your financial statements.

What Are the Different Types of Accounting Errors?

As previously mentioned, accounting errors won’t always be easy to reach. The accounting cycle is a complicated multi-step process, so mistakes can occur at any point in the way.

That’s why we divide accounting errors into two main categories: errors that affect the trial balance, and errors that don’t.

Errors That Affect The Trial Balance

The two most common mistakes that affect the trial balance are one-sided entries and incorrect additions.

Both of these errors leave an unbalanced ending amount, so they’re quickly noticeable in the trial balance.

If you’re using accounting software, the tool will let you know immediately how much that unbalanced amount is. However, if you’re manually recording your entries, you have to differentiate the debit and credit values to figure out the exact result of the error.

After you’ve found out the difference between debits and credits, the next step is to make a suspense account. The suspense account is an entry that holds the unresolved cash until further analysis.

Then, once the issue is identified, a correcting entry of the suspense account is carried out. This last step is known as reconciliation.

Sound confusing? Let’s check out an example.

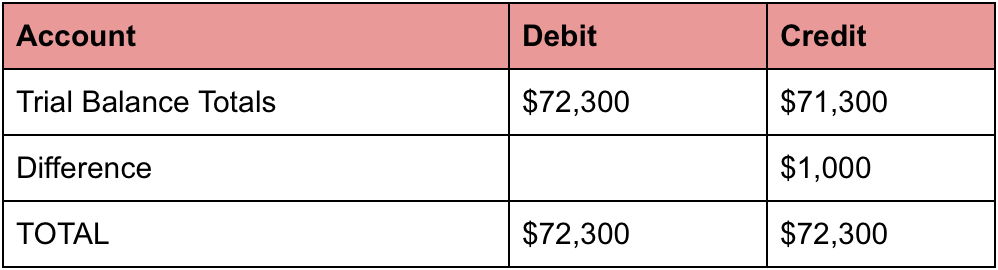

The table below shows a difference of $1,000 between debits and credits.

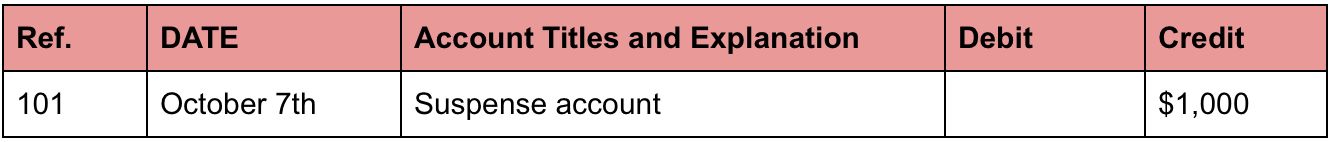

In order for the trial balance to be in equilibrium, a single entry is posted in a suspense account.

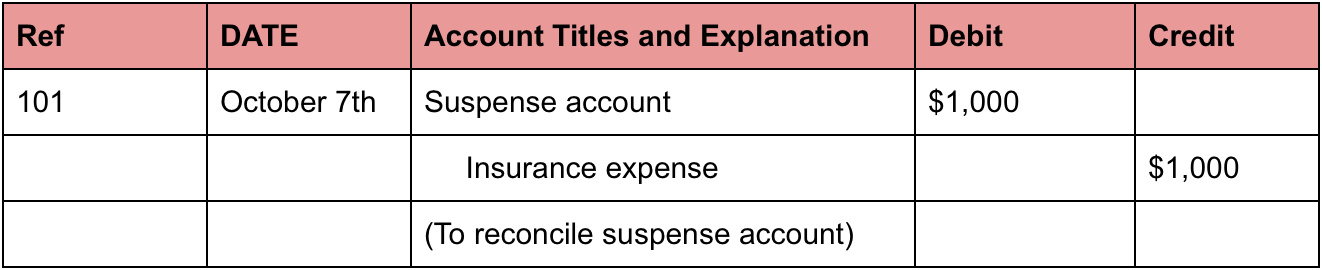

Let’s assume the difference was an addition error on the insurance expense account. This is how the correcting entry would look:

Errors That Don’t Affect The Trial Balance

Errors Of Principle

GAAP (Generally Accepted Accounting Principles) are the accounting rules you are obligated to follow when making financial statements. Violating these guidelines is called an error of principle.

Errors of principle are typically entries made in the wrong account. Meaning, the amounts recorded are correct, but the accounts aren’t.

Let’s check out an example.

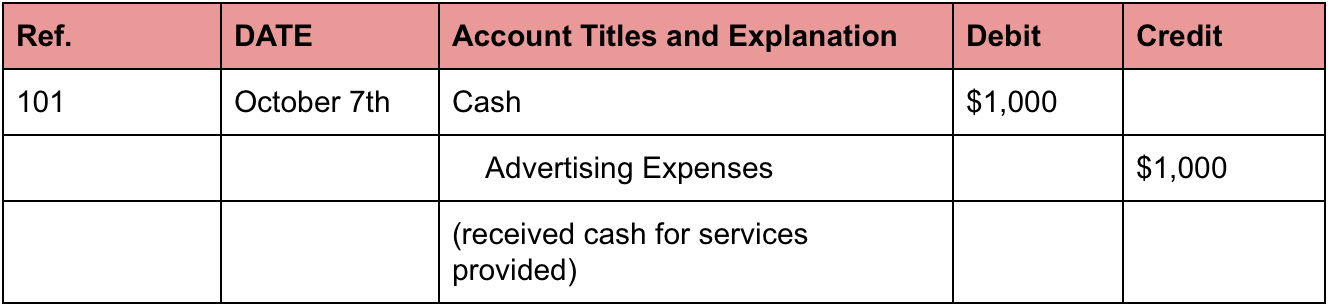

XYZ company receives $1,000 in cash for their advertising services.

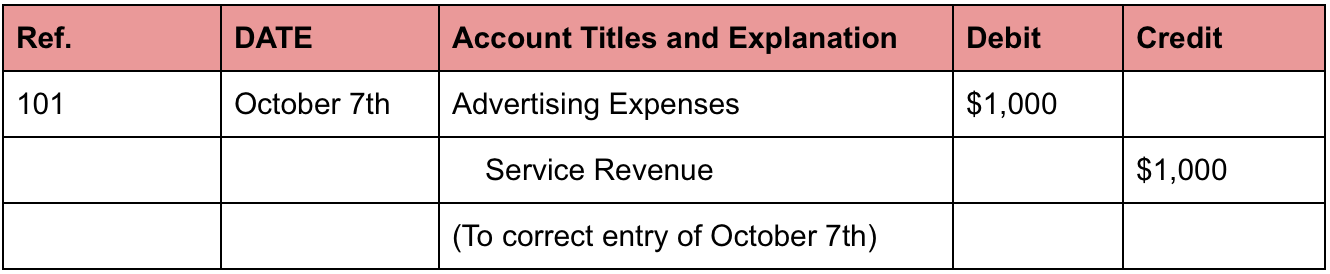

Now, an error of principle gets made. The advertising expenses account is credited for $1,000 instead of the service revenue, as the table below shows.

The correcting entry for this error of principle would be:

Want to learn how to make the perfect journal entry? Check out our full guide with practical examples.

Errors of Omission

When you fail to record a transaction, you make an error of omission. This mistake isn’t intentional, just comes as a result of neglect.

Whether you misplace a receipt or simply forget to make an entry of it, an error of omission is usually difficult to find. The best way to prevent it is through a reliable routine for entering transactions.

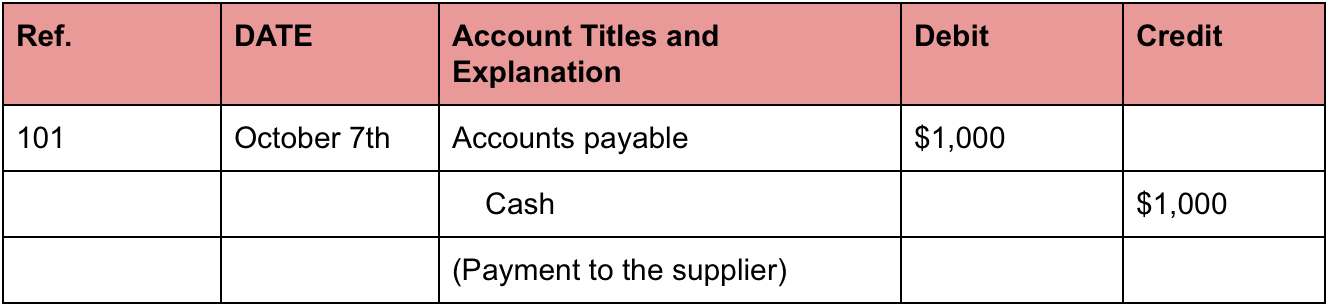

Let’s assume payment of $1,000 to a supplier has been omitted. After the mistake gets noticed, you make the following correcting entry:

Don’t want to manually record all of your transactions? No problem!

Use accounting software to integrate directly with your bank account, so every time a purchase or payment gets made, the journal entry is automatically posted into the correct ledger.

Transposition Error

When dealing with a lot of numbers, your eyes may sometimes deceive you. Digits get easily mixed up or reversed with one another. This mistake is called a transposition error.

Even though this error seems small, writing an expense amount of “$3,678” instead of “$6,378” can throw off your entire finances.

The good news is, there’s a specific way to confirm transposition errors revolving around mathematics and the number 9.

Let’s explain this method step by step.

The first step is differentiating the incorrect and correct amounts.

Now, if the difference between these two numbers is divisible by 9, it’s likely you have a transposition error.

For example, assume a bookkeeper records a revenue of $26 instead of $62.

When you differentiate the two, you’ll get an error of $36. Since $36 divided by 9 equals 4, this could mean that there was a transposition error.

Reversal Of Entry Error

A reversal of entry error occurs when you debit an entry instead of crediting it (or vice versa). The accounts and amounts are still correct, they’re just posted in the wrong direction.

Canceling out this error is fairly easy. The correcting entry has to be double the amount of the previous error.

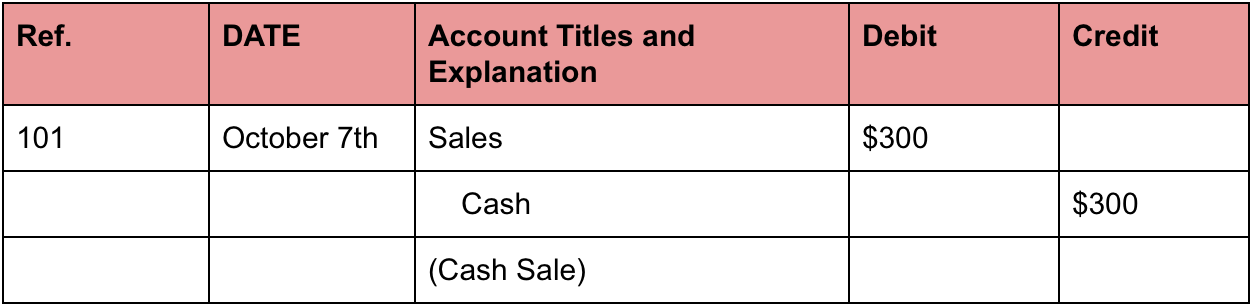

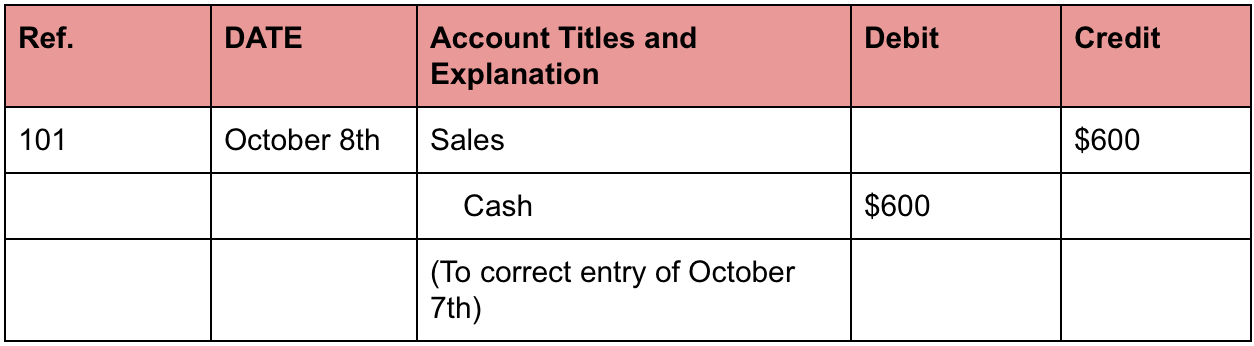

So, if a sale in cash for $300 has been recorded incorrectly like this:

If the error is noticed the day after, the correcting entry would be:

Errors Of Commission

Also known as “the false positives”, errors of commission happen when you enter the correct amount in the right account, but in the wrong subcategory.

What does that mean, exactly?

Say you receive payment from a client. Now, if you hold this receipt against another client’s bills, you’ve made a commission error.

This type of mistake is clearly noticeable because your client’s sub-ledger will be off.

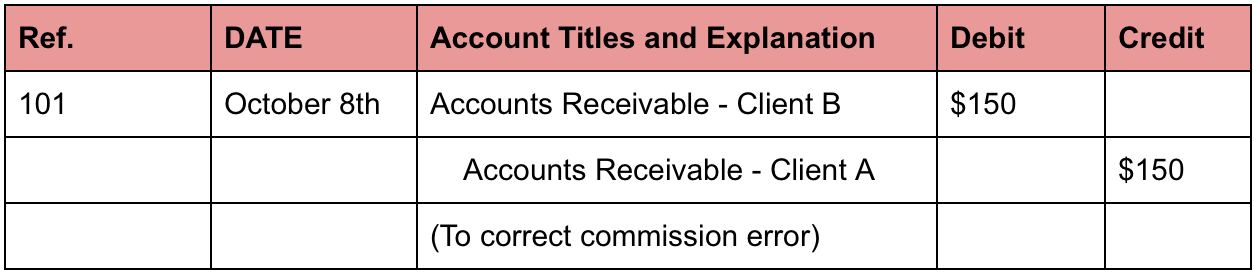

Here’s how you would correct an error of commission if $150 cash received from client A is credited to the account of client B.

Compensating Errors

In some cases, two mistakes can occur at the same time and balance each other out. This is called a compensating error.

Since there’s no net effect, this slip up can be one of the most difficult to notice. Doing a statistical analysis is your best shot at it.

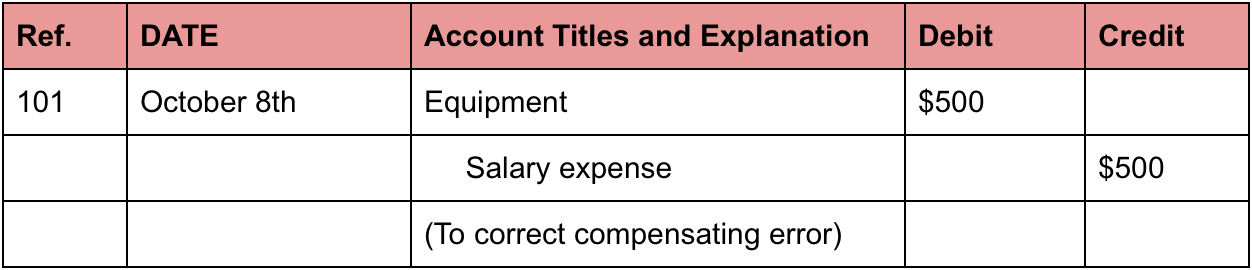

Now, assuming you’ve noticed the compensating error, what’s the practical fix? Let’s check out a practical example.

The equipment account is incorrectly totaled and understated by $500. So is the salary expense account.

The correcting entry, in this case, would be:

How Can Accounting Errors Affect Your Business?

Every accounting error, no matter how minor, can result in severe consequences for the business.

Incorrect reporting

Errors in financial reports, whether of income or expenses, can distort the idea of how much profit a business is actually making. And consequently, a business can end up overspending, paying too much or too little in taxes, or even dealing with tax fines.

Late payment charges

When an error gets noticed late, there could be additional expenses. For example, if you enter an invoice once the deadline for disbursement has passed, you have to pay an additional charge and interest.

Increase in labor expenses

Fixing errors is a time-consuming process. You might have to pay extra hours for the work they put in reviewing and correcting these mistakes.

Loss of reputation and trust

When finances are full of errors, a business becomes unreliable in the eyes of outsiders. Whether these result from process inefficiencies or simple human error, clients and investors will lose trust nonetheless.

How Can You Prevent Accounting Errors?

If you’re careful with your financial details from the beginning, you probably won’t need to worry about fixing them at all.

Luckily, there are plenty of measures that guarantee an error-free accounting process for your business. Let’s check them out one by one.

Put Internal Controls In Action

When managing a business, it’s always better to be safe than sorry.

Consider making monthly reconciliations for both your bank and credit card statements. That way you can catch errors right away and prevent them from loitering around your accounting.

Creating budgets is also a pretty essential tool. Planning business expenses doesn’t just help with making more strategic purchasing decisions, but it also aids in discovering any misclassifications. You can compare budgets to actual expenses to check whether finances are on the right track. Errors usually pop up along the way as well.

Save all receipts

We know it might be tempting to throw out bills and receipts once you’re done with them. But, they serve as proof for the digits in your financial books. Also, in case the IRS audits you, it is good to have them as a backup.

This doesn’t mean you have to hold them forever, though. We recommend keeping the accounting files of the last three years, to protect the business.

Don’t overwhelm employees

Overworked employees are a gateway to errors. If you don’t give them the right time and resources to handle tasks, your business will soon be holding itself with just a bobby pin.

Don’t get us wrong, not falling behind schedule is just as important. However, it’s best to consider ways to simplify the accounting process, such as by using accounting software.

Use online accounting software

Recording your accounting books by hand has gotten old-fashioned for a reason. Not only is it time-consuming, but it opens your business to a ton of potential accounting errors.

Online accounting software, on the other hand, is way more convenient and correct than a human mind.

Some of the main accounting software benefits include:

- Automation of journal entries

- Bank integration

- Professional invoice creation

- Safely securing data on the cloud

- Accessing data from any device

- Sending late payment reminders

- Managing inventory

- Creating financial reports in a few clicks

- And more!

We at Deskera, provide the best accounting software for business, with all of the above features — and so much more. Starting with just $9 per month! We make accounting for small businesses as easy as 1-2-3.

Still not convinced? Try Deskera out yourself! Sign up for our free trial, no credit card required!

Key Takeaways

And that’s a wrap! We hope you found our guide to accounting errors helpful.

Here are some key takeaways:

- Accounting errors are unintentional mistakes made when recording finances.

- We divide them into two main categories: errors that affect the trial balance, and errors which don’t.

- Some of the most severe consequences of accounting errors include incorrect reports, increase in labor expenses, additional fees, and loss of reputation.

- The best way to ensure a well-run accounting process is through accounting software like Deskera.

Related Articles

Basis of Accounting — Complete Guide With Examples

Making money-related decisions is one of the main and probably most stressfulresponsibilities of a business owner. In order to make these decisions the rightway, you need to base them on reliable financial statements. And a crucial step in creating these accurate accounting books is choosing the…

Deskera BlogDeskera

Accounting Systems — What Are They & Which Should You Pick

Picking the right accounting system for your business is the single mostimportant step you’ll have to make in accounting. It can help you keep more accurate records of your company’s finances and saveyou a lot of time and money. And when the time to file taxes comes, you won’t have to scaven…

Deskera BlogSaurabh

Accounting For Startups — The Entrepreneur’s Guide

Establishing a startup can be overwhelming work. And as a founder, you probablydon’t have time to worry about sending invoices or balancing the books. However, it’s still crucial to have some general knowledge of the fundamentalsof accounting. After all, no matter how great an idea is, it wo…

Deskera BlogSaurabh

Error in accounting incurs as a result of the wrong entry recorded by bookkeeper or accountant. There are different types of errors in accounting; some of them can result in an imbalance of trial balance. Error is considered as an unintended mistake during the course of recordkeeping. Typically, material errors would lead to incorrect decision making by the user on the basis of the financial statements that contain such errors.

What is Error in Accounting?

Error in accounting or accounting error is the omission or misstatement in the financial statements. Material errors are the omission or misstatements that could lead or influence the decision making of the users of financial statements either individually or collectively.

Accounting errors normally discovered through mathematical mistakes, mistakes from applying accounting policies, misinterpretation of facts of transactions, lack of oversights, and fraud.

There are several common types of errors in accounting. These are errors of transposition, omission, principle, commission, compensating errors, errors of original entry, errors of reversal entry as well as other types of errors. We will cover in detail for each of the accounting errors below:

Errors of Transposition

The errors of transposition are one of the accounting errors that incur as a result of the wrong digit of the number has been accidentally recorded the other way round. This error would lead to the unequal double entry.

For example, suppose that the sales revenue is recorded in the sales revenue account as $5,654; however, it is recorded on accounts receivable as $5,645.

From the above example, the error is the transposition of 5 and 4. Thus, this kind of error would lead to the unequal of debit and credit sides. Typically, we can detect such errors by taking the difference between debits and credits and divide it by 9. If such difference can be divided exactly by 9, the error would be the errors of transposition.

Errors of Omission

It is one type of error in accounting. These errors occur as a result of failing or omitting to record a transaction at all or mistakenly record the debit or credit not corresponding to its double entry.

So, we have two cases here. The first one is the whole transactions are missing from the accounting record. While the second one is the debit and credit side is not corresponding to the double-entry of the transaction.

Below are the examples for these two cases:

1. If ABC Co received an invoice from the supplier for $500. This invoice has been omitted from the accounting record entirely. That’s mean the bookkeeper or accountant forget or fail to record this transaction in the book. Therefore, the total debits and credits of the company are out or omitted by $500.

2. If ABC Co received another invoice from its supplier for $450, the accountant posted it into the payable control account on the credit side. However, the debit entry has been omitted in the purchase account but recorded in another account instead.

Errors of Principle

This is one of the accounting errors where transactions have been recorded in accordance with the double-entry at the correct amount. However, subsequently, such transactions are not in compliance or in accordance with the applicable rule or accounting principle or concept.

For instance, ABC Co has recorded the repair of non-current assets as capital expenditure increases the value of the non-current assets. Instead, such repair should have been treated as revenue expenditure and record as repair expense in the profit and loss account.

Errors of Commission

The errors of commission are other accounting errors where the bookkeeper or accountant mistakenly or erroneously recorded transactions in the book. The errors of the commission have two types as follow:

- Record the debit or credit entry of transactions in the wrong account. For instance, the accountant erroneously recorded utility expenses to office rent for $150. This results in understating the utility expense account and overstating the office rent account for the same amount.

- Error of casting: The casting here refers to the adding up of amount. For instance, the daily cash transaction in the cash daybook has been incorrectly added up as $25,250 while it should have been at $25,550.

Compensating Errors

Compensating errors are other types of accounting errors where such errors are coincidentally equal and opposite to one another. This means that two or more errors have occurred and those errors canceled each other; thus the total debits and credits remain the same.

For example, a utility bill of $1,500 has been debited to the utility expense account as $1,700. On the other hand, the casting error of the sales accounts resulted in the overstating of sales by $200. These two errors cancel each other out and the trial balance remains at the same amount both debit and credit.

Therefore, the compensating errors possible overlook without properly casting and review as the trial balance is still balance.

Errors of Original Entry

The errors of the original entry are one of the accounting errors where the double-entry has been correctly recorded but at the wrong amount.

For example, the credit sales of $5,670 have been recorded as $5,760. Both debit which is accounts receivable and credit, sales revenue, has been recorded as $5,706. This results in the overstatement of both credit sales and accounts receivable of $90.

Reversal of Entries

This is another accounting error where the transaction has been recorded at the correct amount; however, that transaction has been recorded on the wrong side.

For instance, cash sales of $2,500 have been recorded on the debit side and credited to bank account.

Other accounting errors

There are also other errors as follows:

- Single-sided entry: This is where only one side has been recorded, either debit or credit.

- Different values on the debit and credit sides have been recorded.

- Two entries have been recorded on the same side.

- Miscasting: This is where incorrect addition has been carried out to each individual account.

- The error as a result of extracting the trial balance. This is called extracting error. This error results in the difference between balances in the trial balance from the relevant account.

- The opening balance of certain accounts has not properly carried down or at the wrong amount.

Summary

The accounting errors, then, can be divided into two main groups; the errors where the trial balance still balances and errors that cause the trial balance imbalance.

| Errors where trial balance still balances | Errors where trial balance does not balance |

|---|---|

| Errors of commission | Errors of transposition |

| Reversal entries | Single-sided entry |

| Errors of principle | Different value of debit and credit |

| Compensating errors | Two entries on the same side |

| Errors of original entry | Miscasting |

| Errors of omission | Extracting errors |

| Errors of carrying down the opening balance |

!

The resource budget contains a separate control total for “near cash” expenditure, that is expenditure such as pay and current grants which impacts directly on the measure of the golden rule.

This paper provides background information on the framework for the planning and control of public expenditure in the UK which has been operated since the 1998 Comprehensive Spending Review (CSR). It sets out the different classifications of spending for budgeting purposes and why these distinctions have been adopted. It discusses how the public expenditure framework is designed to ensure both sound public finances and an outcome-focused approach to public expenditure.

The UK’s public spending framework is based on several key principles:

«

consistency with a long-term, prudent and transparent regime for managing the public finances as a whole;

»

«

the judgement of success by policy outcomes rather than resource inputs;

»

«

strong incentives for departments and their partners in service delivery to plan over several years and plan together where appropriate so as to deliver better public services with greater cost effectiveness; and

»

the proper costing and management of capital assets to provide the right incentives for public investment.

The Government sets policy to meet two firm fiscal rules:

«

the Golden Rule states that over the economic cycle, the Government will borrow only to invest and not to fund current spending; and

»

the Sustainable Investment Rule states that net public debt as a proportion of GDP will be held over the economic cycle at a stable and prudent level. Other things being equal, net debt will be maintained below 40 per cent of GDP over the economic cycle.

Achievement of the fiscal rules is assessed by reference to the national accounts, which are produced by the Office for National Statistics, acting as an independent agency. The Government sets its spending envelope to comply with these fiscal rules.

«

»

Annually Managed Expenditure ( AME), which is expenditure which cannot reasonably be subject to firm, multi-year limits in the same way as DEL. AME includes social security benefits, local authority self-financed expenditure, debt interest, and payments to EU institutions.

More information about DEL and AME is set out below.

In Spending Reviews, firm DEL plans are set for departments for three years. To ensure consistency with the Government’s fiscal rules departments are set separate resource (current) and capital budgets. The resource budget contains a separate control total for “near cash” expenditure, that is expenditure such as pay and current grants which impacts directly on the measure of the golden rule.

To encourage departments to plan over the medium term departments may carry forward unspent DEL provision from one year into the next and, subject to the normal tests for tautness and realism of plans, may be drawn down in future years. This end-year flexibility also removes any incentive for departments to use up their provision as the year end approaches with less regard to value for money. For the full benefits of this flexibility and of three year plans to feed through into improved public service delivery, end-year flexibility and three year budgets should be cascaded from departments to executive agencies and other budget holders.

Three year budgets and end-year flexibility give those managing public services the stability to plan their operations on a sensible time scale. Further, the system means that departments cannot seek to bid up funds each year (before 1997, three year plans were set and reviewed in annual Public Expenditure Surveys). So the credibility of medium-term plans has been enhanced at both central and departmental level.

Departments have certainty over the budgetary allocation over the medium term and these multi-year DEL plans are strictly enforced. Departments are expected to prioritise competing pressures and fund these within their overall annual limits, as set in Spending Reviews. So the DEL system provides a strong incentive to control costs and maximise value for money.

There is a small centrally held DEL Reserve. Support from the Reserve is available only for genuinely unforeseeable contingencies which departments cannot be expected to manage within their DEL.

AME typically consists of programmes which are large, volatile and demand-led, and which therefore cannot reasonably be subject to firm multi-year limits. The biggest single element is social security spending. Other items include tax credits, Local Authority Self Financed Expenditure, Scottish Executive spending financed by non-domestic rates, and spending financed from the proceeds of the National Lottery.

AME is reviewed twice a year as part of the Budget and Pre-Budget Report process reflecting the close integration of the tax and benefit system, which was enhanced by the introduction of tax credits.

AME is not subject to the same three year expenditure limits as DEL, but is still part of the overall envelope for public expenditure. Affordability is taken into account when policy decisions affecting AME are made. The Government has committed itself not to take policy measures which are likely to have the effect of increasing social security or other elements of AME without taking steps to ensure that the effects of those decisions can be accommodated prudently within the Government’s fiscal rules.

Given an overall envelope for public spending, forecasts of AME affect the level of resources available for DEL spending. Cautious estimates and the AME margin are built in to these AME forecasts and reduce the risk of overspending on AME.

Together, DEL plus AME sum to Total Managed Expenditure (TME). TME is a measure drawn from national accounts. It represents the current and capital spending of the public sector. The public sector is made up of central government, local government and public corporations.

Resource and Capital Budgets are set in terms of accruals information. Accruals information measures resources as they are consumed rather than when the cash is paid. So for example the Resource Budget includes a charge for depreciation, a measure of the consumption or wearing out of capital assets.

«

Non cash charges in budgets do not impact directly on the fiscal framework. That may be because the national accounts use a different way of measuring the same thing, for example in the case of the depreciation of departmental assets. Or it may be that the national accounts measure something different: for example, resource budgets include a cost of capital charge reflecting the opportunity cost of holding capital; the national accounts include debt interest.

»

Within the Resource Budget DEL, departments have separate controls on:

«

Near cash spending, the sub set of Resource Budgets which impacts directly on the Golden Rule; and

»

The amount of their Resource Budget DEL that departments may spend on running themselves (e.g. paying most civil servants’ salaries) is limited by Administration Budgets, which are set in Spending Reviews. Administration Budgets are used to ensure that as much money as practicable is available for front line services and programmes. These budgets also help to drive efficiency improvements in departments’ own activities. Administration Budgets exclude the costs of frontline services delivered directly by departments.

The Budget preceding a Spending Review sets an overall envelope for public spending that is consistent with the fiscal rules for the period covered by the Spending Review. In the Spending Review, the Budget AME forecast for year one of the Spending Review period is updated, and AME forecasts are made for the later years of the Spending Review period.

The 1998 Comprehensive Spending Review ( CSR), which was published in July 1998, was a comprehensive review of departmental aims and objectives alongside a zero-based analysis of each spending programme to determine the best way of delivering the Government’s objectives. The 1998 CSR allocated substantial additional resources to the Government’s key priorities, particularly education and health, for the three year period from 1999-2000 to 2001-02.

Delivering better public services does not just depend on how much money the Government spends, but also on how well it spends it. Therefore the 1998 CSR introduced Public Service Agreements (PSAs). Each major government department was given its own PSA setting out clear targets for achievements in terms of public service improvements.

The 1998 CSR also introduced the DEL/ AME framework for the control of public spending, and made other framework changes. Building on the investment and reforms delivered by the 1998 CSR, successive spending reviews in 2000, 2002 and 2004 have:

«

provided significant increase in resources for the Government’s priorities, in particular health and education, and cross-cutting themes such as raising productivity; extending opportunity; and building strong and secure communities;

»

«

enabled the Government significantly to increase investment in public assets and address the legacy of under investment from past decades. Departmental Investment Strategies were introduced in SR2000. As a result there has been a steady increase in public sector net investment from less than ¾ of a per cent of GDP in 1997-98 to 2¼ per cent of GDP in 2005-06, providing better infrastructure across public services;

»

«

introduced further refinements to the performance management framework. PSA targets have been reduced in number over successive spending reviews from around 300 to 110 to give greater focus to the Government’s highest priorities. The targets have become increasingly outcome-focused to deliver further improvements in key areas of public service delivery across Government. They have also been refined in line with the conclusions of the Devolving Decision Making Review to provide a framework which encourages greater devolution and local flexibility. Technical Notes were introduced in SR2000 explaining how performance against each PSA target will be measured; and

»

not only allocated near cash spending to departments, but also – since SR2002 — set Resource DEL plans for non cash spending.

To identify what further investments and reforms are needed to equip the UK for the global challenges of the decade ahead, on 19 July 2005 the Chief Secretary to the Treasury announced that the Government intends to launch a second Comprehensive Spending Review (CSR) reporting in 2007.

A decade on from the first CSR, the 2007 CSR will represent a long-term and fundamental review of government expenditure. It will cover departmental allocations for 2008-09, 2009-10 and 2010 11. Allocations for 2007-08 will be held to the agreed figures already announced by the 2004 Spending Review. To provide a rigorous analytical framework for these departmental allocations, the Government will be taking forward a programme of preparatory work over 2006 involving:

«

an assessment of what the sustained increases in spending and reforms to public service delivery have achieved since the first CSR. The assessment will inform the setting of new objectives for the decade ahead;

»

«

an examination of the key long-term trends and challenges that will shape the next decade – including demographic and socio-economic change, globalisation, climate and environmental change, global insecurity and technological change – together with an assessment of how public services will need to respond;

»

«

to release the resources needed to address these challenges, and to continue to secure maximum value for money from public spending over the CSR period, a set of zero-based reviews of departments’ baseline expenditure to assess its effectiveness in delivering the Government’s long-term objectives; together with

»

further development of the efficiency programme, building on the cross cutting areas identified in the Gershon Review, to embed and extend ongoing efficiency savings into departmental expenditure planning.

The 2007 CSR also offers the opportunity to continue to refine the PSA framework so that it drives effective delivery and the attainment of ambitious national standards.

Public Service Agreements (PSAs) were introduced in the 1998 CSR. They set out agreed targets detailing the outputs and outcomes departments are expected to deliver with the resources allocated to them. The new spending regime places a strong emphasis on outcome targets, for example in providing for better health and higher educational standards or service standards. The introduction in SR2004 of PSA ‘standards’ will ensure that high standards in priority areas are maintained.

The Government monitors progress against PSA targets, and departments report in detail twice a year in their annual Departmental Reports (published in spring) and in their autumn performance reports. These reports provide Parliament and the public with regular updates on departments’ performance against their targets.

Technical Notes explain how performance against each PSA target will be measured.

To make the most of both new investment and existing assets, there needs to be a coherent long term strategy against which investment decisions are taken. Departmental Investment Strategies (DIS) set out each department’s plans to deliver the scale and quality of capital stock needed to underpin its objectives. The DIS includes information about the department’s existing capital stock and future plans for that stock, as well as plans for new investment. It also sets out the systems that the department has in place to ensure that it delivers its capital programmes effectively.

This document was updated on 19 December 2005.

Near-cash resource expenditure that has a related cash implication, even though the timing of the cash payment may be slightly different. For example, expenditure on gas or electricity supply is incurred as the fuel is used, though the cash payment might be made in arrears on aquarterly basis. Other examples of near-cash expenditure are: pay, rental.Net cash requirement the upper limit agreed by Parliament on the cash which a department may draw from theConsolidated Fund to finance the expenditure within the ambit of its Request forResources. It is equal to the agreed amount of net resources and net capital less non-cashitems and working capital.Non-cash cost costs where there is no cash transaction but which are included in a body’s accounts (or taken into account in charging for a service) to establish the true cost of all the resourcesused.Non-departmental a body which has a role in the processes of government, but is not a government public body, NDPBdepartment or part of one. NDPBs accordingly operate at arm’s length from governmentMinisters.Notional cost of a cost which is taken into account in setting fees and charges to improve comparability with insuranceprivate sector service providers.The charge takes account of the fact that public bodies donot generally pay an insurance premium to a commercial insurer.the independent body responsible for collecting and publishing official statistics about theUK’s society and economy. (At the time of going to print legislation was progressing tochange this body to the Statistics Board).Office of Government an office of the Treasury, with a status similar to that of an agency, which aims to maximise Commerce, OGCthe government’s purchasing power for routine items and combine professional expertiseto bear on capital projects.Office of the the government department responsible for discharging the Paymaster General’s statutoryPaymaster General,responsibilities to hold accounts and make payments for government departments and OPGother public bodies.Orange bookthe informal title for Management of Risks: Principles and Concepts, which is published by theTreasury for the guidance of public sector bodies.Office for NationalStatistics, ONS60Managing Public Money

————————————————————————————————————————

«

GLOSSARYOverdraftan account with a negative balance.Parliament’s formal agreement to authorise an activity or expenditure.Prerogative powerspowers exercisable under the Royal Prerogative, ie powers which are unique to the Crown,as contrasted with common-law powers which may be available to the Crown on the samebasis as to natural persons.Primary legislationActs which have been passed by the Westminster Parliament and, where they haveappropriate powers, the Scottish Parliament and the Northern Ireland Assembly. Begin asBills until they have received Royal Assent.arrangements under which a public sector organisation contracts with a private sectorentity to construct a facility and provide associated services of a specified quality over asustained period. See annex 7.5.Proprietythe principle that patterns of resource consumption should respect Parliament’s intentions,conventions and control procedures, including any laid down by the PAC. See box 2.4.Public Accountssee Committee of Public Accounts.CommitteePublic corporationa trading body controlled by central government, local authority or other publiccorporation that has substantial day to day operating independence. See section 7.8.Public Dividend finance provided by government to public sector bodies as an equity stake; an alternative to Capital, PDCloan finance.Public Service sets out what the public can expect the government to deliver with its resources. EveryAgreement, PSAlarge government department has PSA(s) which specify deliverables as targets or aimsrelated to objectives.a structured arrangement between a public sector and a private sector organisation tosecure an outcome delivering good value for money for the public sector. It is classified tothe public or private sector according to which has more control.Rate of returnthe financial remuneration delivered by a particular project or enterprise, expressed as apercentage of the net assets employed.Regularitythe principle that resource consumption should accord with the relevant legislation, therelevant delegated authority and this document. See box 2.4.Request for the functional level into which departmental Estimates may be split. RfRs contain a number Resources, RfRof functions being carried out by the department in pursuit of one or more of thatdepartment’s objectives.Resource accountan accruals account produced in line with the Financial Reporting Manual (FReM).Resource accountingthe system under which budgets, Estimates and accounts are constructed in a similar wayto commercial audited accounts, so that both plans and records of expenditure allow in fullfor the goods and services which are to be, or have been, consumed – ie not just the cashexpended.Resource budgetthe means by which the government plans and controls the expenditure of resources tomeet its objectives.Restitutiona legal concept which allows money and property to be returned to its rightful owner. Ittypically operates where another person can be said to have been unjustly enriched byreceiving such monies.Return on capital the ratio of profit to capital employed of an accounting entity during an identified period.employed, ROCEVarious measures of profit and of capital employed may be used in calculating the ratio.Public Privatepartnership, PPPPrivate Finance Initiative, PFIParliamentaryauthority61Managing Public Money

»

————————————————————————————————————————

GLOSSARYRoyal charterthe document setting out the powers and constitution of a corporation established underprerogative power of the monarch acting on Privy Council advice.Second readingthe second formal time that a House of Parliament may debate a bill, although in practicethe first substantive debate on its content. If successful, it is deemed to denoteParliamentary approval of the principle of the proposed legislation.Secondary legislationlaws, including orders and regulations, which are made using powers in primary legislation.Normally used to set out technical and administrative provision in greater detail thanprimary legislation, they are subject to a less intense level of scrutiny in Parliament.European legislation is,however,often implemented in secondary legislation using powers inthe European Communities Act 1972.Service-level agreement between parties, setting out in detail the level of service to be performed.agreementWhere agreements are between central government bodies, they are not legally a contractbut have a similar function.Shareholder Executive a body created to improve the government’s performance as a shareholder in businesses.Spending reviewsets out the key improvements in public services that the public can expect over a givenperiod. It includes a thorough review of departmental aims and objectives to find the bestway of delivering the government’s objectives, and sets out the spending plans for the givenperiod.State aidstate support for a domestic body or company which could distort EU competition and sois not usually allowed. See annex 4.9.Statement of Excessa formal statement detailing departments’ overspends prepared by the Comptroller andAuditor General as a result of undertaking annual audits.Statement on Internal an annual statement that Accounting Officers are required to make as part of the accounts Control, SICon a range of risk and control issues.Subheadindividual elements of departmental expenditure identifiable in Estimates as single cells, forexample cell A1 being administration costs within a particular line of departmental spending.Supplyresources voted by Parliament in response to Estimates, for expenditure by governmentdepartments.Supply Estimatesa statement of the resources the government needs in the coming financial year, and forwhat purpose(s), by which Parliamentary authority is sought for the planned level ofexpenditure and income.Target rate of returnthe rate of return required of a project or enterprise over a given period, usually at least a year.Third sectorprivate sector bodies which do not act commercially,including charities,social and voluntaryorganisations and other not-for-profit collectives. See annex 7.7.Total Managed a Treasury budgeting term which covers all current and capital spending carried out by the Expenditure,TMEpublic sector (ie not just by central departments).Trading fundan organisation (either within a government department or forming one) which is largely orwholly financed from commercial revenue generated by its activities. Its Estimate shows itsnet impact, allowing its income from receipts to be devoted entirely to its business.Treasury Minutea formal administrative document drawn up by the Treasury, which may serve a wide varietyof purposes including seeking Parliamentary approval for the use of receipts asappropriations in aid, a remission of some or all of the principal of voted loans, andresponding on behalf of the government to reports by the Public Accounts Committee(PAC).62Managing Public Money

————————————————————————————————————————

GLOSSARY63Managing Public MoneyValue for moneythe process under which organisation’s procurement, projects and processes aresystematically evaluated and assessed to provide confidence about suitability, effectiveness,prudence,quality,value and avoidance of error and other waste,judged for the public sectoras a whole.Virementthe process through which funds are moved between subheads such that additionalexpenditure on one is met by savings on one or more others.Votethe process by which Parliament approves funds in response to supply Estimates.Voted expenditureprovision for expenditure that has been authorised by Parliament. Parliament ‘votes’authority for public expenditure through the Supply Estimates process. Most expenditureby central government departments is authorised in this way.Wider market activity activities undertaken by central government organisations outside their statutory duties,using spare capacity and aimed at generating a commercial profit. See annex 7.6.Windfallmonies received by a department which were not anticipated in the spending review.

————————————————————————————————————————

From CEOpedia | Management online

| Error Of Principle | |

|---|---|

| See also |

|

Error Of Principle — is one of the types of error appears when a registration for the appropriate amount is occurred on the appropriate side, but to the improper class of account. A transaction can be entered into a right account when it ought to be entered into a nominal account. This is contrary with an elementary rules of book-keeping. The most popular of this errors appears, when the buying or selling of an asset is considered as the buying or selling of goods for resale (Thompson Hosein, 2004, pp. 108-110).

Examples Errors Of Principle

Two examples of occurring Errors Of Principle are presented below:

- A typewriter was purchased from Business Supplies Ltd credit on 21 March. Purchases were debited and credited Business Supplies Ltd by the book-keeper. This error will not appeal to the agreement of the trial balance, for a debit entry has been caused with an analogous credit entry. Nonetheless, an error of principle has been caused because of the book-keeping’s state rules that every time an asset is bought, the asset account which is a genuine account has to be debited along with the cost of the asset. A nominal account like the purchases account is applied only if items are bought for resale, or if raw materials are bought for using into the manufacture of goods (Whittington, 2012, p. 113).

- Another general error of principle appears when the selling of an asset is considered as the selling of goods. A credit entry is caused into the selling account instead of into the asset account. An old typewriter assess the value of the books at $350 and sold at that amount to A. Melville and he paid for it by cheque. The bank account was debited but the sales account was credited by the book-keeper. Even though the trial balance will still stability, an error of principle has been caused, because the genuine asset account should be credited every time when as asset is sold. A nominal account which is the sales account is only applied when goods are sold (Waddams, 2012, pp. 123-125).

Causes occurring Errors Of Principle

Errors can stem from (Mukherjee, Hanif, 2010, pp. 18-20):

- An inappropriate use of an accounting principle or technique;

- The use of wrong accounting principle;

- The failure to use the essential accounting principle.

Types of Errors

Errors, in the books of account, could be classify into two main types (Monte- Galanza, 2006, pp. 138-140):

- Accounting errors – these errors could be intentional or unintentional and could be divided into three classes:

- Errors of principle;

- Errors of omission;

- Error of commission.

- Systems errors – these errors are deficiencies in the inner control system and are categorized into:

- Compliance errors;

- Systems design error.

Advantages of Error Of Principle recognition

Error of principle has several advantages. Firstly, it helps to correctly identify and recognize mistakes in the accounts. Secondly, it helps to identify if there has been an improper use of funds or resources. Thirdly, it helps to detect any discrepancies in the accounts and to prevent further losses. Fourthly, it helps to identify and correct any accounting errors that may have been made. Finally, this type of error can be easily rectified with minimal disruption to the business and its accounts.

Limitations of Error Of Principle

- Error of principle may lead to inaccurate financial records and inaccurate reporting. This can cause confusion for the management, as well as for the outside stakeholders and auditors.

- Error of principle can have a negative effect on the company’s reputation, as it is a clear indication of a lack of managerial oversight.

- Error of principle can lead to significant financial losses for the company if the mistake is not detected and corrected in a timely manner.

- Error of principle can create a hostile work environment if employees are held accountable for mistakes that were due to errors of principle.

- Error of principle can lead to legal action against the company if the mistake is deemed material by the regulators.

One approach to Error Of Principle is to make sure to adhere to the fundamental principles of accounting. This includes:

- Ensuring that all transactions are recorded accurately on the correct side of the ledger, and that the correct account is used.

- Making sure that all transactions are documented fully, with supporting documentation such as receipts and invoices.

- Ensuring that all capital investments are accurately recorded and that the resulting depreciation is accounted for.

- Double-checking all entries for any errors or inconsistencies.

By following these principles, it is possible to avoid making costly errors of principle. Additionally, it is important to ensure that all accounting staff are properly trained in the fundamentals of accounting and that periodic reviews are conducted to ensure that all staff are following the correct procedures. In summary, careful adherence to the fundamental principles of accounting will help to avoid errors of principle.

References

- Monte- Galanza R., (2006), A procedural Approach to Auditing Principles, REX Book Store, pp. 138-140.

- Mukherjee A., Hanif M., (2010), Modern Accountancy, Tata McGraw-Hill, Vol I, pp. 18-20.

- Thompson Hosein F., (2004), Principles of Accounts, Heinemann, pp. 108-110.

- Waddams S., (2012), Principle and Policy in Contract Law: Competing or Complementary Concepts?, Cambridge University Press, pp. 123-125.

- Whittington O., Delaney P., (2012), Wiley CPA Examination Review, CPA, Vol I, p. 113.

Author: Patrycja Wojcik