Что такое экономический рост и на него влияет обычный человек

Говоря об макроэкономике, часто можно услышать термин экономический рост. Он неразрывно связан уровнем развития страны с экономической точки зрения, а также уровнем жизни каждого отдельного гражданина государства. Что это означает — в статье.

Экономический рост связан с экономическим развитием стран и благосостоянием населения, а повлиять на его может каждый отдельный человек.

- Что такое экономический рост

- Типы и факторы экономического роста: синергетический эффект

- Стадии экономического роста: как развивается бизнес

- Как измеряется экономический рост страны

- Экономическое развитие и его связь с экономическим ростом

- Каким образом можно ускорить или снизить темпы экономического роста

- Как обычный человек может повлиять на экономический рост

- Кто в России отвечает за экономический рост и экономическое развитие страны

- Кратко

Что такое экономический рост

Экономический рост — это процесс улучшения производства, в результате которого увеличивается количество и качество товаров и услуг, которое способна производить экономика. Иными словами, экономический рост показывает, насколько развивается экономика отдельно взятой страны.

Если рассматривать, насколько богат отдельно взятый человек, то это можно понять, прежде всего, по уровню его дохода. Чем больше человек зарабатывает денег, тем больше общественных благ он может себе позволить и тем более качественную жизнь может обеспечить себе и своей семье. То, насколько богат человек, можно оценить по тому, на какой машине он ездит, в каком доме живет, куда ездит отдыхать и даже какими видами спорта увлекается.

С экономикой страны ситуация схожая. Чем больше страна зарабатывает за счет производства товаров и услуг, тем больше могут себе позволить жители страны. Отличие в том, что доходы страны измеряются в ВВП. Соответственно, если растет ВВП, то в стране наблюдается экономический рост.

Типы и факторы экономического роста: синергетический эффект

В экономической науке выделяют два типа экономического роста: экстенсивный и интенсивный.

Экстенсивный экономический рост предполагает увеличение количества производимых товаров и услуг при сохранении на прежнем уровне технической составляющей производства. Инструментом при таком подходе может стать наем дополнительных сотрудников или увеличение инвестиций в производство, закупку сырья и расширение производства. Данные способы позволяют нарастить производство того же товара или услуги и, тем самым, поднять общий уровень ВВП.

Интенсивный экономический рост связан с качественным улучшением производства. Например, проводятся исследования для сокращения потребляемого сырья при производстве единицы продукции, улучшается технология производства. Таким образом, интенсивный экономический рост основывается на использовании более современных и прогрессивных способах производства товаров и услуг.

Важно понимать, что в современном мире не существует примеров, где наблюдается только один из типов экономического роста. К примеру, могут проводиться процедуры найма дополнительных работников и обучение старых сотрудников новым технологиям производства. Согласно исследованиям американских экономистов Кемпбелла Макконнелла и Стэнли Брю экономический рост страны определяется шестью факторами:

- Количество и качество природных ресурсов. От наличия сырья зависит возможность производить больше товаров и услуг.

- Количество и качество трудовых ресурсов. От этого фактора зависят объемы и качество произведенных товаров и услуг.

- Объем основного капитала. Этот фактор ограничивает количество средств, которые можно вложить в развитие производства.

- Технологии. Этот фактор определяет, каким образом можно изготовить товары и услуги.

- Фактор спроса. Необходим для обеспечения экономического роста.

- Фактор эффективности. К этому фактору относятся как природные, так и человеческие ресурсы. Их необходимо задействовать так, чтобы использование ресурсов происходило с наименьшими затратами.

Стадии экономического роста: как развивается бизнес

В 1959 году американский профессор экономики Уолт Ростоу вывел пять стадий экономического роста, а 1971 году в своей работе он добавил шестую.

Первая стадия — традиционное общество. Она характеризуется тем, что большинство человеческих ресурсов занято в сельскохозяйственном производстве. Кроме того, обществу была присуща иерархическая система, где власть принадлежала правительствам и собственникам земель.

Вторая стадия — переходное общество. На этой стадии создаются предпосылки для перехода к более развитому типу производства, что сопровождается радикальными преобразованиями в сельском хозяйстве, внешней торговле и транспорте.

Третья стадия — подъем. Данной стадии характерен рост инвестиций в производство. Он составляет от 5% до 10% национального дохода. Кроме того, происходит развитие одной или нескольких новых сфер промышленности, что приводит к распространению тенденции развития на остальную часть экономики. Появляется новый класс общества — предприниматели. Данная стадия длится приблизительно 30 лет, после которых поддерживать такие темпы роста экономики становится невозможным.

Четвертая стадия — быстрое созревание. На данной стадии происходит развитие урбанизации и повышение качества труда. Помимо этого, наблюдается переход к более качественному управлению производством.

Пятая стадия — эпоха высокого массового потребления. Этот этап характеризуется повышением спроса на товары длительного пользования и услуги, поскольку население уже способно обеспечить себя товарами первой необходимости. Возникает такое явление, как государство всеобщего благосостояния, где высшей целью общества является безопасность и социальное благополучие.

Шестая стадия — поиск качества жизни. Последняя, на данный момент, стадия развития предполагает переход от потребления к духовному развитию. В таких условиях происходит развитие информационного общества.

Как измеряется экономический рост страны

Для измерения экономического роста страны используются количественные и качественные показатели.

К количественным показателям относится ВВП, то есть стоимости выпускаемой продукции в стране. Темпы роста ВВП в год выражаются в процентах и показывают, насколько ежегодно растет экономика страны. Сам по себе этот показатель может говорить об экономическом росте страны в рамках мировой экономики, однако он не показывает, насколько хорошо живет население страны. Для этой цели используется показатель ВВП на душу населения. Он получается при делении ВВП на количество населения страны. Таким образом можно получить информацию о среднем благосостоянии граждан отдельной страны в сравнении с населением других стран.

Качественные показатели описывают социальную составляющую жизни страны. К ним относится количество свободного времени, уровень социальной защиты, уровень образования населения, объемы инвестиций в повышение квалификации сотрудников и т.д.

Экономическое развитие и его связь с экономическим ростом

Экономическое развитие — это процесс улучшения экономики путем изменения способов производства товаров и услуг, качества жизни населения, всестороннего развития человеческого капитала и общественных отношений.

Экономическое развитие имеет связь с качественными показателями экономического роста.

Термин экономическое развитие был введен Йозефом Шумпетером в его его труде «Теория экономического роста» в 1911 году. По его мнению, различие между экономическим развитием и экономическим ростом заключается в качественном изменении экономики страны в отличие от количественных изменений, свойственных экономическому росту. Экономическое развитие подразумевает нововведения в производстве товаров и услуг, инновации и качественное изменение управления производством. Для экономического развития характерен риск и новаторство, проявляющиеся в инвестировании в новые отрасли экономики. Кроме того, качество жизни населения также растет вместе с темпами экономического развития. Ведущая роль в процессе экономического развития отводится человеческому капиталу как драйверу инноваций и технологического развития экономики.

К основным показателям экономического развития страны относят:

- показатели валового внутреннего продукта и валового национального дохода на душу населения;

- конкурентоспособность экономики на мировой арене;

- участие в международных экономических организациях — ВТО, АТЭС, АСЕАН, Всемирный банк и т.д.;

- уровень рейтингов кредитоспособности страны, присваиваемый международными рейтинговыми агентствами — Moody’s, Fitch, Standard & Poor’s;

- уровень инвестиций в развитие человеческого капитала — образование, профессиональная подготовка, обучение передовым навыкам в разных отраслях экономики;

- уровень коррупции в стране.

Каким образом можно ускорить или снизить темпы экономического роста

Чтобы добиться увеличения темпов экономического роста, необходимо в первую очередь, инвестировать средства в развитие собственных производств, новые отрасли экономики и развивать человеческие ресурсы страны. Показательными примерами увеличения темпов экономического роста являются экономики Японии и Китая.

В истории Японии встречается понятие японского экономического чуда. Это период в истории Японии с конца 1950-х годов до нефтяного кризиса 1973 года. Данный период характеризуется беспрецедентными темпами роста японской экономики — 10% ежегодно. Причиной такого бурного подъема японской экономики является совокупность факторов экономического роста. После окончания Второй мировой войны экономика Японии была разрушена, а сама страна была оккупирована США. Для того, чтобы встроиться в новую мировую систему Японии пришлось кардинально перестроить свою милитаризованную экономику и поставить ее на новые рельсы. В течение двух десятилетий в Японии были развиты такие отрасли, как металлургия, нефтехимия и судостроение. Далее к этим отраслям добавились автомобилестроение и бытовая техника. Отрасли развивались и в качественном отношении, благодаря чему весь мир узнал о таких брендах как Toyota, Mazda, Sony и т.д.

Китайская экономика также прошла этап экономического чуда, однако в более поздние сроки. После неудачной политики «Большого скачка вперед», которая привела к голоду в стране, был выбран другой путь для достижения экономического роста. Пришедший к власти в КНР Дэн Сяопин провел реформы, которые изменили экономику Китая. Были привлечены американские инвестиции в экономику и началось создание собственных производств. В то время Китай переживал экстенсивный рост экономики, где качеству труда и произведенных товаров отдавалась второстепенная роль. Главным было количество товаров, которые можно продать за рубеж. Так продолжалось до середины нулевых годов, после чего Китай, уже вступивший в ВТО и считавшийся мировым центром производства любых товаров, стал инвестировать средства в качественный рост экономики. Благодаря этому в стране развились отрасли автомобилестроения, производство микроэлектроники и бытовой техники, развивались информационных технологии. Ежегодные темпы роста экономики какое-то время достигали более 10%. Все это привело к тому, что Китай сегодня является прямым экономическим конкурентом США как в традиционных, так и в новых отраслях экономики.

Эти примеры показывают, что стимулировать экономический рост можно путем развития собственного производства товаров и услуг, создания новых отраслей экономики, привлечения инвестиций в страну. Важную роль играет качественная составляющая в производстве, благодаря развитию которой можно конкурировать с другими странами по части экономики.

Замедление темпов экономического роста едва ли можно назвать осознанным шагом для страны. Более того, умышленное замедление темпов роста экономики не может быть полезным ни в каком случае. Однако неумышленное замедление роста экономики имело место в мировой истории.

Эпоху правления Леонида Брежнева неофициально называют «застоем». Такое название используется из-за практической остановки роста экономики и сельского хозяйства. В период холодной войны большая часть средств направлялась на развитие военной промышленности. В то же время остальные сферы экономики, в том числе агропромышленность, нуждались в реформах, на которые не оставалось средств. Попытки преобразований в отраслях не увенчивались успехом, а сельское хозяйство страдало от так называемых студенческих «поездок на картошку». Из-за этого колхозы фактически лишались работы, а количество испорченного урожая продолжало расти. Наблюдалась и миграция сельского населения в города, что также не способствовало росту сельского хозяйства. Однако эти проблемы не были так заметны, поскольку страна хорошо жила за счет больших доходов от продажи энергоносителей. Ввиду всех этих условий рост экономики СССР значительно замедлился.

Как обычный человек может повлиять на экономический рост

Может показаться, что темпы экономического роста страны зависят от действий крупных компаний и государственных регуляторов, которые имеют значительные ресурсы и могут влиять на развитие производственных мощностей и рост ВВП. Но даже в рамках крупных экономических субъектов каждый отдельный работник вносит свой вклад в общий рост экономики страны. Исходя из этого, каждый гражданин может влиять на темпы роста экономики, даже если вклад незаметен на общих показателях.

Например, индивидуальный предприниматель Иван продает на рынке мясо. Он работает в одиночку и придерживается старых методов ведения бизнеса, которые он выучил в 90-е годы: покупать и перепродавать подороже, не вкладывать много средств в рекламу, не думать о новшествах, так как они могут навредить работающей схеме. Вскоре Иван начинает понимать, что ему хочется большего. Он начинает развивать сеть своих мясных магазинов, привлекает членов семьи к своему делу, запускает рекламу своей сети магазинов. В итоге он создает свое мясное производство, чтобы не тратить средства на закупку товара у других, создает рабочие места и платит зарплату работникам. Вследствие всего этого он вносит дополнительный вклад в ВВП страны, стимулируя рост экономики.

Влияние на экономический рост может быть также негативным. Допустим, студент Алексей, большой любитель читать, регулярно покупал новые книги. В один день он прочитал в новостях, что один из крупнейших пиратских сервисов разблокировали, и решил узнать, есть ли на этом сервисе интересные ему книги. Увидев множество бесплатных произведений, Алексей теперь предпочитает скачивать их с пиратского сайта и не тратить деньги на книги в магазине. Алексей сокращает ВВП на сумму, которую он потратил бы на новые книги, если бы не стал пользоваться пиратским сервисом.

Таким образом, каждый отдельный человек своими действиями может влиять на экономический рост страны как позитивно, так и негативно.

Кто в России отвечает за экономический рост и экономическое развитие страны

В России структурой, ответственной за экономический рост и развитие государства, выступает Министерство экономического развития. В его функции входит контроль внешнеэкономической деятельности, стратегическое планирование экономики страны, поддержка малого и среднего бизнеса в России, инновационная политика государства, предотвращение образования естественных монополий, регулирование инвестиционной политики государства и т.д.

Таким образом Министерство экономического развития курирует микро- и макроэкономику России, а также создает правовую основу по вышеназванным направлениям деятельности. Его деятельность заключается в контроле использования государственных субсидий для эффективного внедрения новшеств в экономику страны.

Еще одним регулирующим органом является Министерство финансов. Его вклад в регулирование экономического роста заключается в контроле над использованием государственных денег.

Кроме того, частные компании оказывают влияние на уровень развития экономики и темпы экономического роста. При здоровой конкуренции в стране создаются такие условия, при которых компаниям необходимо прибегать к экстенсивным и интенсивным методам роста, чтобы поддерживать и наращивать конкурентное преимущество. Вследствие конкуренции появляются инновации в различных секторах экономики, создаются более эффективные способы производства товаров и услуг, наблюдается развитие человеческого капитала.

Таким образом не только государство находится в ответе за экономический рост и развитие в стране, но и частный сектор. Все зависит от степени вмешательства государства в экономику.

Кратко

- Экономический рост — это процесс, который характеризуется увеличением производства товаров и услуг. Он выражается в ВВП. Выделяют экстенсивный и интенсивный типы экономического роста. История насчитывает 6 этапов роста мировой экономики — от традиционного общества до поиска качества жизни.

- Экономическое развитие подразумевает качественный рост экономики страны и благосостояния общества, инновации в производстве и общий уровень социальной жизни населения страны.

- Темпы экономического роста зависят от вложений в развитие и расширение производственных мощностей страны, уделения достаточного внимания развитию человеческих ресурсов и создания новых отраслей экономики.

- Каждый житель отдельно взятой страны оказывает своими действиями влияние на экономический рост и итоговые объемы ВВП страны.

Данный справочный и аналитический материал подготовлен компанией ООО «Ньютон Инвестиции» исключительно в информационных целях. Оценки, прогнозы в отношении финансовых инструментов, изменении их стоимости являются выражением мнения, сформированного в результате аналитических исследований сотрудников ООО «Ньютон Инвестиции», не являются и не могут толковаться в качестве гарантий или обещаний получения дохода от инвестирования в упомянутые финансовые инструменты. Не является рекламой ценных бумаг. Не является индивидуальной инвестиционной рекомендацией и предложением финансовых инструментов. Несмотря на всю тщательность подготовки информационных материалов, ООО «Ньютон Инвестиции» не гарантирует и не несет ответственности за их точность, полноту и достоверность.

Читайте также

По мнению экспертов Форума, чтобы выйти на темпы экономического роста выше 3%, нужны дополнительные меры и стимулы. Среди них — изменение качества производственного капитала и рабочих мест, поддержание доходов населения, увеличение инвестиций в основной капитал, вложений в «экономику знаний», развитие жилищного строительства и отечественного экспорта.

«Можно отметить, что меры, которые приняло правительство, уменьшили масштабы спада российской экономики в 2020 году, по нашей оценке, на 1,8%, — подчеркнул Андрей Клепач. — В реальные доходы населения они добавили более 3 процентных пунктов. Иначе мы получили бы падение не около 5%, а 7-8%».

Главный экономист ВЭБ РФ отметил, что прекращение действия большинства мер в конце 2020 года и ограниченный эффект бюджетного правила будут препятствовать V-образному отскоку экономики в 2021 году и сдержат рост ВВП в 2021-2024 годах.

По словам эксперта, чтобы выйти на темпы роста выше 3%, нужны дополнительные социальные и секторальные меры, в том числе — для поддержания доходов населения.

«Ситуация с доходами населения, как мы видим за последние 7 лет, является крайне болевой точкой, серьезным социальным вызовом и ограничением для экономического роста», — отметил Андрей Клепач.

Президент ВЭО России и Международного Союза экономистов Сергей Бодрунов напомнил, что основной целью модернизации не только социальной, но в целом экономической политики является устойчивое повышение уровня и качества жизни населения, именно на это должны быть направлены все преобразования.

«Оценка всех проводимых реформ должна проводиться именно через призму роста благосостояния россиян и уровня их жизни», — процитировал Сергей Бодрунов академика Леонида Абалкина.

Директор Института народнохозяйственного прогнозирования РАН, член Правления ВЭО России Александр Широв отметил, что главная проблема — в социальной сфере.

«Наша экономика — это на 50% потребительский спрос, — уверен Александр Широв. — Понятно, что ни уровень, ни качество жизни, ни та оплата труда, которую получают большая часть работников, нас устроить не могут. — отметил ученый. — Нужно изменить качество производственного капитала, тех рабочих мест, которые у нас сейчас есть, потому что когда 30% рабочих мест являются низкотехнологичными и малооплачиваемыми, трудно ожидать высокий уровень доходов населения в этих секторах».

«Перед экономикой стоят фундаментальные вызовы и главный из них — это повышение уровня жизни и доходов населения, — поддержал коллег президент ИМЭМО имени Е.М. Примакова РАН, вице-президент ВЭО России Александр Дынкин. — Есть два взаимосвязанных пути — экономический рост и инновационная экономика. И здесь нет того звена, потянув за которое, можно вытащить всю цепь, нет одного волшебного рецепта».

По словам академика Дынкина, пространство инновационной конкуренции в экономике ограничивает значительная доля госсектора. «Тиражирование инноваций означает способность создавать на своей территории высокую добавленную стоимость, — отметил Александр Дынкин. — Если это происходит, значит доля высококвалифицированного труда в национальной экономике растет и соответственно растет уровень жизни. Какие ресурсы можно использовать? Хотел бы отметить, что в странах инновационных лидерах госсобственность составляет 5-10%. Китай демонстрирует блестящие инновационные достижения при доле госпредприятий в выпуске ВВП порядка 30%.У нас, по скромным оценкам,государственная собственность составляет 45-50%».

«В России слабы институты защиты интеллектуальной собственности, высоки риски венчурных инвестиций, мы по-прежнему ориентируемся на линейные и вертикально интегрированные инновационные модели, в то время ка весь мир перешел к нелинейным, плоским структурам, -добавил Александр Дынкин. При определении посткризисной стратегии эти обстоятельства стоит учитывать».

Академик Абел Аганбегян назвал четыре главных драйвера экономического роста:инвестиции в основной капитал, вложения в «экономику знаний», жилищное строительство и развитие экспорта.

«Нам нужен финансовый форсаж — следует перейти с 2021 года на 10-14% рост этих драйверов, — уверен Абел Аганбегян. — У нас огромные внутренние резервы. В этом году они впервые перевалили за 600 млрд долларов».

По словам Абела Аганбегяна, переход к стимулированию экономического роста требует изменения бюджетного правила и «распечатывания» резервов. Эти средства, используя долгосрочные низкопроцентные инвестиционные кредиты, следует направить на технологическое перевооружение, создание новой транспортно-логистической инфраструктуры, введение новых мощностей высокотехнологичных отраслей.

Заведующий отделом международных рынков капитала ИМЭМО имени Е.М. Примакова РАН, член Правления ВЭО России Яков Миркин согласился с необходимостью использовать до 30-40% резервов для стимулирования инвестиций внутри страны, в том числе на закупки технологий и оборудования.

Ученый привел формулу сверхбыстрого роста экономики, которая включает умеренный, осторожный финансовый форсаж, рост монетизации, насыщенности кредитами и финансовыми инструментами при значимом сокращении процента и инфляции,регулирование счета капитала рыночными методами, снижение налоговой нагрузки до 31-32% ВВП и введение максимум стимулов для прямых иностранных долгосрочных портфельных инвестиций.

По словам Якова Миркина, необходим взвешенный рост торгового протекционизма, который через торговые и неторговые барьеры стимулирует перемещение в Россию производства, а также программа дешевой ипотеки и программа инвестиций для выравнивания уровня жизни для 15-20 регионов, являющихся зонами национального бедствия.

Все эти меры, по словам ученого, дадут 4-5% рост российского ВВП и масштабную реструктуризацию экономики, создадут основы для массовых прямых иностранных инвестиций и трансфертов технологий из-за рубежа.

По итогам форума будут подготовлены и направлены в органы государственного управления экспертные предложения в «Единый план достижения национальных целей до 2030 года».

Трудно не заметить, что еще пять лет назад, а то и год, многие товары стоили существенно дешевле. В ликбезе мы расскажем об основных типах инфляции, ее причинах и о том, как сохранить сбережения

В этой статье:

- Что такое инфляция?

- Виды инфляции

- Как рассчитывается инфляция

- Причины инфляции

- Последствия инфляции

- Инфляция в России

- Меры борьбы с инфляцией

- Как защитить доходы от инфляции

- Плюсы и минусы инвестирования в инфляцию

Что такое инфляция?

Инфляция — это темп устойчивого повышения общего уровня цен на товары и услуги за определенный промежуток времени, также инфляция показывает степень обесценивания денег. Чаще всего инфляцию принято указывать в годовом выражении, или, как еще говорят, год к году. Так, если инфляция в годовом выражении составила 8,4%, то имеют в виду, что набор одних и тех же товаров, который год назад стоил 100 рублей, сейчас стоит 108,4 рубля. Соответственно, 100 рублей обесценились или потеряли покупательную способность на 8,4%. Это и есть инфляция. В России помимо годовой инфляции Росстат измеряет еженедельную и ежемесячную.

Как инфляция отразилась на стоимости сахара в 2000-2021 годах. Инфографика

Конкретное и единое численное обозначение нормы инфляции не существует. Это связано с тем, что «нормальность» уровня инфляции зависит от множества факторов и условий для каждой конкретной страны или рынка, а также от цели определения нормы инфляции. В целом, оптимальным, комфортным считается тот уровень инфляции, при котором продолжается, а не замедляется, экономический рост и при этом сохраняется низкий уровень безработицы.

«Строго говоря, согласно выводам теоретической экономики и различных равновесных моделей, идеальным значением инфляции является ноль, что соответствует стабильному/неизменному уровню цен, — рассказал эксперт института «Центр развития НИУ ВШЭ» Игорь Сафонов. — Однако на практике центральные банки различных стран все же стремятся поддерживать темп прироста общего уровня цен на товары и услуги (т. е. инфляцию) на небольшом положительном уровне. Главной причиной этого является непропорциональный рост издержек на борьбу с инфляцией по мере приближения к нулевому значению, в связи с чем оптимальным является удержание темпов прироста цен в пределах некоторой величины больше нуля. Также в условиях умеренного роста цен ряд поведенческих факторов и особенностей реального производства могут оказывать стимулирующий эффект для экономического развития».

Сочетание высокой инфляции, которая сопровождается ослаблением экономики и ростом безработицы, называется стагфляцией.

Виды инфляции

Инфляция может расти до бесконечных значений

(Фото: Shutterstock)

Виды инфляции по темпам роста

- Низкая (ползучая) инфляция — до 5-6% в год.

- Умеренная — до 10% в год.

- Высокая (галопирующая) — до 50% в год.

- Гиперинфляция — свыше 50% в месяц. В Германии в начале 1920-х годов инфляция достигла 30 000% в месяц. В Зимбабве ежемесячный рост цен в ноябре 2008 года достиг примерно 79 600 000 000%.

- Дефляция — отрицательная инфляция, которая характеризуется повышением покупательной способности денег на фоне устойчивого снижения общего уровня цен. На 100 рублей можно купить больше, чем раньше.

- Дезинфляция — это замедление темпов инфляции. Например, когда говорят, что уровень инфляции снизился с 8,4% до 6%, это означает что общий уровень цен продолжает расти, но более медленными темпами, чем раньше.

Дефляция — отрицательная инфляция

(Фото: Shutterstock)

В экономическом смысле дефляцию — устойчивое снижение общего уровня цен на товары и услуги, следует отличать от кратковременного снижения уровня цен, вызванного сезонными факторами, а также снижения цен на отдельные товары и услуги, вызванного, например, техническим прогрессом в указанной области, рассказал эксперт института «Центр развития НИУ ВШЭ» Игорь Сафонов. «Выгоды от нее [дефляции], несмотря на видимую привлекательность ситуации, обычно оказываются краткосрочными и заключаются в возможности приобретения потребителями товаров по более низкой, чем раньше цене. Однако, стремление подождать удешевления товаров приводит к сокращению текущего спроса и, как следствие, производства. При этом компании начинают испытывать сложности с обслуживанием кредитных обязательств, а также сокращать

инвестиции

, издержки и персонал, его заработную плату в связи со снижением уровня выпуска. Рост безработицы и проблемы с обслуживанием кредитов предприятиями реального сектора снижают финансовую устойчивость банков и создают риски для сбережений, которые формировало население для приобретения товаров в будущем. Сомнения в надежности банковского сектора приводят к изъятию населением денег из него, что лишь усугубляет проблему. Сбережения при этом часто реинвестируются в более надежные финансовые инструменты других стран. Спираль сокращения потребления, производства, инвестиций и занятости/зарплат, как показывает практика, может иметь устойчивый долговременный характер, с которым очень тяжело бороться», — отметил эксперт.

Виды инфляции по управляемости

- Открытая инфляция — не сдерживаемая инфляция, показывающая реальное повышение цен без скрытых факторов и давления. Открытая инфляция адекватно отражает происходящие в рыночной экономике изменения, рост или падение спроса и предложения.

- Скрытая (подавленная) инфляция — регулируемая государством инфляция. Замораживание цен, установление их максимальных порогов (лимитов), максимальных надбавок и тому подобные меры ведут к появлению дисбаланса на рынке между спросом и предложением. Кроме того, регулирование цен государством замедляет выход на рынок новых товаров, технологически более высокого качества. У производителя нет стимула и экономической выгоды представлять новый продукт, если его придется продавать по заранее известной цене.

- Таргетируемая инфляция — центральным банком страны (регулятором) устанавливается конкретная цель (таргет, целевой уровень) или допустимый диапазон инфляции. Меры регуляции начинают применяться государством при отклонении от целевого уровня. Для разных стран таргеты инфляции различаются. Несмотря на то, что четкого понятия оптимальной инфляции в экономической науке не существует, исторические данные свидетельствуют, что страны с развитой экономикой чаще всего устанавливают таргет по инфляции на уровне 2%, а страны с формирующимся рынком — от 3% и выше. Таргетируемая инфляция положительно влияет на экономику, если она предсказуема и долгосрочна, когда все участники экономики понимают, чего ждать от политики государства в плане экономического развития.

Как рассчитывается инфляция

Инфляция — один из макроэкономических показателей

(Фото: Shutterstock)

Для расчета индекса инфляции существуют формулы Ласпейреса, Пааше и Фишера. Чаще всего страны, в том числе Россия, используют формулу Ласпейреса, которая выявляет удорожание или удешевление стоимости потребительской корзины на текущий период и на базисный период.

Индекс инфляции общепринято указывать по формуле «Инфляция = Индекс потребительских цен — 100%». Индекс потребительских цен (ИПЦ) отражает изменение стоимости набора определенных товаров и услуг. Значения выше 100% показывают уровень инфляции, ниже — дефляции.

Например, сообщение Росстата о величине индекса потребительских цен на уровне 108,4% за 2021 год свидетельствует о темпе роста инфляции на 8,4% за период с конца декабря 2020 года на конец декабря 2021 года.

Индекс потребительских цен рассчитывается на основе статистических данных об уровне цен на определенное количество товаров и услуг, так называемой потребительской корзины. Корзина не содержит все товары или услуги в стране, но она дает достаточно полное представление как о типах товаров, так и об их количестве, которые обычно потребляют домохозяйства.

В России с 2022 года в «корзину» товаров и услуг включено 558 наименований. В список отслеживаемых Росстатом товаров и услуг попадают те траты, на которые приходится больше 0,1% расходов домашних хозяйств. Замеры проводятся в 282 российских городах. На основе полученных данных высчитывается индекс потребительских цен (ИПЦ).

Инфляция потребительских цен в зоне евро ежемесячно рассчитывается Евростатом. Гармонизированный индекс потребительских цен (HICP) охватывает в среднем около 700 товаров и услуг. Он отражает средние расходы домохозяйств в зоне евро на корзину продуктов. Замеры проводятся почти в 1600 городах по всей зоне евро.

В США ежемесячно сообщает об ИПЦ Бюро статистики труда США (BLS) на основе регистрации цен на около 80 000 наименований товаров и услуг.

Помимо индекса потребительских цен при расчете инфляции также используются:

- индекс оптовых цен — следит за изменением цен на товары до их попадания в розницу, используется компаниями и государствами для фиксации в договорах гарантий стоимости;

- индекс цен производителей — следит за отпускными ценами промышленных и сельскохозяйственных товаров, а также стоимостью грузовых транспортных перевозок;

- индекс цен на импорт/экспорт — измеряет цены на ввозимые из-за рубежа товары и вывозимые.

Дополнительные индексы применяются, когда необходимо конкретизировать и проследить определенный аспект инфляции.

Нетрадиционные (альтернативные) способы расчета инфляции

«Индекс мармеладных мишек» зафиксировал в ноябре 2021 года инфляцию 26,1%, официально по Ростату она составила 8,4%

(Фото: Shutterstock)

Для решения задач, которые не удовлетворяются стандартными индексами от госстатистики, применяются альтернативные методики отслеживания инфляции.

Например, в магазинах торговой сети «Пятерочка» подсчитывают стоимость условного продовольственного набора по средним/минимальным ценам и публикуют индекс «Пятерочки».

Сбербанк рассчитывает индекс потребительских расходов, который в полной мере нельзя считать аналогом индекса потребительских цен, но тем не менее он отражает в некоторой степени скорость инфляции со стороны потребителя. Банк ВТБ совместно с РАНХиГС собирает собственную базу данных по ценам крупнейших магазинов.

Экономист из РАНХиГС Александр Абрамов рассчитывает «индекс мармеладных мишек», в который включены цены на импортные мишки-конфеты для учета обменного курса, а также еще 11 основных продуктов, таких как хлеб, молоко и куриное мясо. По индексу Абрамова инфляция в ноябре 2021 года достигла 26,1%, в то время как данные Росстата показывали рост 8,4%.

Российский Росстат ситуативно рассчитывает индексы салатов оливье и сельди под шубой (в преддверии Нового года), Банк России — индекс блинов (перед Масленицей), исследователи Сбербанка — индекс шашлыка (перед майскими праздниками). Также известен индекс биг-мака, который был придуман авторами журнала The Economist и отражает относительную стоимость товаров и услуг в разных странах. Индекс биг-мака используется для оценки покупательной способности различных валют, исходя из гипотезы, что составляющие данного блюда должны одинаково стоить во всех странах.

Личная инфляция часто не совпадает с официальной

(Фото: Shutterstock)

Отдельно экономисты указывают на существование понятия личной (персональной) инфляции, которая отражает разность оценки инфляции различными домохозяйствами из-за несовпадения их корзины товаров и услуг и средней корзины индекса потребительских цен. Условно говоря, семья Ивановых может посчитать инфляцию в своей отдельно взятой ячейке, и она окажется 20%, а в семье Сидоровых — 35% из-за того, что они покупают разные товары.

Например: если цены на бензин растут намного больше, чем цены на другие товары и услуги, люди, часто пользующиеся автомобилем, могут «почувствовать» уровень инфляции, превышающий ИПЦ, потому что их личные расходы на бензин выше среднего. Напротив, у тех, кто ездит на машине редко или вообще не ездит, будет наблюдаться более низкий «личный» уровень инфляции. Кроме того, в оценке личной инфляции играет роль тот факт, что люди склонны сравнивать цены не год к году, как это делают официальные ведомства, а, допустим, в январе 2022 года вспоминать, сколько стоили яйца в 2009 году. Так как в течение длительного времени цены имеют тенденцию к существенному росту, то даже при низком годовом уровне инфляции рост окажется внушительным.

Причины инфляции

Кейнсианцы и монетаристы объясняют различные причины инфляции

(Фото: Shutterstock)

Причины инфляции описывают две наиболее влиятельные школы — это кейнсианская и монетаристская экономические теории.

Кейнсианские экономисты утверждают, что инфляция является результатом экономического давления, такого как рост себестоимости продукции, и рассматривают вмешательство государства как решение. Кейнсианская школа различает два основных типа инфляции: инфляцию издержек и инфляцию спроса.

- Инфляция издержек — это общее увеличение стоимости факторов производства. Эти факторы, в том числе, капитал, земля, труд и предпринимательство, являются необходимыми условиями для производства товаров и услуг. Когда стоимость этих факторов возрастает, производители, желающие сохранить свою норму прибыли, повышают цены на свои товары и услуги. Когда эти производственные издержки растут на уровне всей экономики, это может привести к росту потребительских цен во всей экономике, поскольку производители перекладывают свои возросшие издержки на потребителей.

- Инфляция спроса — это превышение совокупного спроса над совокупным предложением. Например, если спрос на популярный продукт выше, чем его предложение, то цена на него вырастет. Теория инфляции спроса заключается в том, что если совокупный спрос превышает совокупное предложение, то цены будут расти в масштабах всей экономики.

Экономисты-монетаристы считают, что инфляция связана с расширением денежной массы и что центральные банки должны поддерживать стабильный рост денежной массы в соответствии с ростом валового внутреннего продукта (ВВП). В противном случае, чем больше печатается денег, необеспеченных реальным увеличением производства товаров и услуг, которые можно купить на эту напечатанную сумму, тем быстрее будет разгоняться инфляция.

Последствия инфляции

Последствия инфляции могут быть одновременно положительными и отрицательными

(Фото: Shutterstock)

Инфляция может быть истолкована как положительно так и отрицательно, в зависимости от того, на чьей стороне и как быстро происходят изменения.

Общий рост экономики

Умеренная инфляция рассматривается экономистами как драйвер роста экономики.

Инфляция создает мотивацию для формирования сбережений, без которых, в свою очередь, невозможны инвестиции как для расширения производства, так и для внедрения новых технологий — здесь инвестиции, инфляция и сбережения становятся перекрестно взаимосвязаны между собой, объясняет Игорь Сафонов.

«Необходимость формировать сбережения и в то же время поддерживать уровень потребления, в свою очередь, формирует мотивацию к повышению отдачи от имеющихся факторов производства — главным образом, труда, но также и земли, капитала, предпринимательских способностей, что положительно сказывается на экономическом росте.

Определенного ответа на вопрос относительно конкретного числового значения инфляции, при котором сохраняются положительные эффекты, не существует, в том числе потому, что величину данных эффектов в реальной экономике выделить и посчитать практически невозможно. Тем не менее, очевидно, что по сравнению со стимулирующими сторонами негативные последствия инфляции являются существенно более тяжелыми, в связи с чем регуляторы стараются постепенно снизить её до как можно меньшего стабильного уровня», — заключил эксперт.

Снижение реальных доходов населения

Для людей, чьи пенсии или доходы фиксированы в номинальном выражении, рост цен подрывает реальную покупательную способность этих доходов и пенсий. Даже если рабочие получают повышение заработной платы в соответствии с инфляцией, то и уплачиваемый налог с зарплаты (НДФЛ) также увеличивается. Тем более, что зарплата и пенсии, как правило, повышаются уже постфактум, а не на опережение инфляции. В итоге доходы после уплаты налогов не поспевают за более высокими ценами.

Поощрение трат, инвестиций

Инфляция вызывает рост трат — люди торопятся купить товары по старой цене, пока она не выросла еще больше, в этот период доля сбережений и инвестиций может падать. Однако, в то же время при повышении ключевой ставки на фоне высокой инфляции, население переходит обратно к поведению накопления, стараясь повысить доходность консервативных инвестиций.

Ускорение инфляции

Инфляция раскручивает маховик роста цен или создает потенциально катастрофическую петлю обратной связи. Чем больше и быстрее люди и предприятия тратят деньги, пытаясь избавиться от обесценивающейся валюты, тем больше в экономике оказывается наличных. В результате предложение денег превышает спрос, и цена денег — покупательная способность валюты — падает все более быстрыми темпами.

Повышение стоимости кредитов и доходности вкладов

Для сдерживания инфляции государства повышают ключевые ставки. Соответственно, повышаются ставки на кредиты для населения и бизнеса. Дорогие кредиты снижают возможности начать свой бизнес, получить образование, нанять новых работников или модернизировать производство. Высокие ставки дестимулируют расходы и инвестиции, что, в свою очередь, обычно охлаждает инфляцию.

Одновременно с этим, коммерческие банки повышают ставки по вкладам. Это заставляет людей вместо трат вернуться к поведению накопления, чтобы заработать на процентах. Уменьшение в обороте денег увеличивает их стоимость.

Безработица

Безработица может как расти, так и падать при инфляции. Так, инфляция, которая стимулирует экономический рост подразумевает тенденцию нанимать больше людей на работу, но она сохраняется только до определенного момента.

Если рассматривать инфляцию и безработицу в краткосрочной перспективе, то между ними существует явная отрицательная взаимосвязь, известная как кривая Филлипса, объясняет профессор Российской экономической школы Валерий Черноокий. «В периоды повышенного спроса, бурного экономического роста и низкой безработицы, компании часто сталкиваются с дефицитом работников и вынуждены предлагать более высокую заработную плату. Рост издержек на труд в свою очередь заставляет фирмы повышать свои цены, что отражается в увеличении темпов инфляции. Однако, эта взаимосвязь не является устойчивой. Со временем высокая инфляция вызывает рост инфляционных ожиданий, и дальнейшее стимулирование спроса только усиливает инфляционное давление без какого-либо положительного влияния на занятость. Кроме того, различные экономические шоки со стороны предложения, такие как рост цен на энергоносители, техногенные катастрофы или нарушение логистических цепочек могут вызывать одновременно и рост инфляции, и рост безработицы, искажая кривую Филлипса даже в краткосрочном плане», — отметил эксперт.

Ослабляет или укрепляет валюту

Высокая инфляция может вызвать падение курса национальной валюты. Хотя обычно все наоборот- слабая валюта ведет к инфляции. Страны, которые импортируют значительные объемы товаров и услуг вынуждены платить больше за этот импорт в местной валюте, когда их валюты падают по отношению к валютам их торговых партнеров.

Укрепление валюты на фоне инфляции может произойти в ситуации, когда деньги какой-то страны начинают выглядеть более привлекательны, чем другие. Например, после победы Трампа курс доллара относительно валют других развитых стран рос. Причина заключалась в том, что процентные ставки в других странах были крайне низкими, а инфляционные ожидания в США повысились на фоне прогнозов скорого экономического роста.

Инфляция в России

Исторический максимум инфляции в России — 2508,8% годовых в 1992 году

(Фото: Shutterstock)

Официально в СССР индекс инфляции не рассчитывался. Рост экономики достигался директивными методами плановой экономики. При этом люди были склонны к долгосрочным накоплениям и цены на большую часть товаров не менялись годами и десятилетиями. При переходе России на рыночную экономику с 1991 года начал рассчитываться индекс инфляции. Исторический максимум значения инфляции в РФ был зафиксирован в 1992 году на уровне 2508,8% годовых. Исторический минимум был в 2017 году, когда инфляция в России составила по итогам года 2,5%.

Уровень годовой инфляции в России в 2000-2021 годах, согласно индексу потребительских цен (ИПЦ). Инфографика

С ноября 2014 года Банк России установил целевой уровень по инфляции на уровне 4%, с тех пор он неизменен, в том числе, и на 2022 год.

Обоснования оптимальности инфляции в России на уровне 4% не существует, говорит Игорь Сафонов. «Как показывает практика мирового инфляционного таргетирования оно находится ближе в середине между целевыми значениями, принятыми в развитых странах (чаще всего около 2%) и в развивающихся (наиболее часто 6%). Слишком низко установленная цель (ближе к нулевой отметке) может потребовать значительного ограничения экономической активности и спровоцировать дефляцию и

экономический спад

в отдельных отраслях экономики, не говоря уже о значительном падении доверия к ЦБ в случае её недостижения. В то же время центральные банки, ставящие целевое значение слишком высоко, гораздо чаще допускают выход инфляции за его пределы как в целом, так и в отдельных отраслях и также испытывают проблемы с доверием населения к проводимой политике из-за недостаточных по его мнению усилий по борьбе с ростом цен», — заключил эксперт.

Банк России дает объяснение, почему таргетом инфляции выбран показатель в 4%, так:

Переходя с начала 2015 года к таргетированию инфляции, Банк России выбрал целевой ориентир в 4% с учетом существовавших на тот момент особенностей ценообразования и структуры российской экономики, а также обширного опыта таргетирования инфляции в мире. Цель по инфляции вблизи 4% установлена несколько выше, чем в странах с развитыми рыночными механизмами, многолетним опытом сохранения ценовой стабильности, высоким доверием к монетарным властям и низкими инфляционными ожиданиями. В таких странах цель по инфляции обычно устанавливается на уровне от 1 до 3%. Банк России оценивал, что постоянное поддержание инфляции в России вблизи этих значений мерами денежно-кредитной политики сильно затруднено из-за высоких и незаякоренных инфляционных ожиданий компаний и граждан на фоне продолжительной высокой инфляции предыдущих десятилетий; недостаточной развитости рыночных механизмов и невысокой отраслевой диверсификации экономики. Кроме указанных факторов, на выбор в пользу 4% повлияла и необходимость минимизировать риски возникновения дефляционных тенденций на рынках отдельных товаров.

В 2022 году на уровень инфляции в России будут влиять те же факторы, что и в прошлом году, рассказал главный экономист SberCIB Investment Research Антон Струченевский.

Проинфляционными факторами, по мнению эксперта, остаются:

- глобальная инфляция на рынке товаров;

- рост внутреннего спроса под влиянием растущего кредитования;

- ограничения на путешествия россиян за границу из-за пандемии, что разогревает внутренний туристический рынок;

- ассиметричное восстановление на рынке труда в условиях ограниченной миграции, что привело к резкому росту зарплат в ряде сегментов (сельское хозяйство, курьерские службы, строительство, гостиничный бизнес) и, соответственно, цен.

Меры борьбы с инфляцией

Излишнее накачивание экономики деньгами может привести к инфляции

(Фото: Shutterstock)

Таргетирование инфляции

Установка таргета — это один из способов держать инфляцию на оптимальном уровне, при котором сохраняется положительный эффект от нее без снижения роста экономики.

Центральные банки чутко следят за тем, чтобы ситуация не скатилась к дефляции. При таргетировании инфляции важнейшими условиями являются ее предсказуемость на долгосрочном периоде. В таком случае все экономические агенты могут спокойно прогнозировать свои собственные расходы и находить способы увеличения доходов, накоплений и инвестиций, не переживая за их непредсказуемое обесценение. Кроме того, достижение целевых показателей по уровню инфляции способствует формированию более низких ставок в экономике и повышает доступность кредитов.

Контроль денежной массы

Вливание в экономику денег, необеспеченных реальными товарами и услугами, ведет к их обесцениванию и, соответственно, разгону инфляции. Именно это произошло, когда Германия для выплат по репарации за Первую мировую войну запустила печатные станки, и когда слитки ацтеков и инков наводнили Испанию в 16-ом веке.

В современных условиях для повышения ставок центральные банки увеличивают выпуск государственных ценных бумаг и забирают выручку от денежной массы. По мере того, как денежная масса уменьшается, снижается и уровень инфляции. Обратной формой является количественное смягчение, при которой центральный банк покупает долгосрочные ценные бумаги на открытом рынке, чтобы увеличить денежную массу и стимулировать кредитование и инвестиции. Покупка ценных бумаг добавляет новые деньги в экономику, а также служит для снижения процентных ставок за счет повышения цен на

ценные бумаги

с фиксированным доходом. Количественное смягчение обычно применяется, когда процентные ставки уже близки к нулю, потому что в этот момент у центральных банков меньше инструментов для влияния на экономический рост.

Текущая высокая инфляция является результатом целого ряда причин, говорит главный исполнительный директор ВТБ Капитал Инвестиции, старший вице-президент ВТБ Владимир Потапов. По его мнению, это структурное изменение спроса — люди стали меньше денег тратить на услуги и больше на товары длительного пользования, проблемы с цепочками поставок — недостаточное количество рабочих, локдауны и ограничения в работе транспортных хабов, масштабные бюджетные и монетарные стимулы — поддержали совокупный спрос и доходы людей.

«Для снижения «спросовой» стороны инфляции необходимы нормализация бюджетной политики и ужесточение денежно-кредитных условий, которые уже наблюдаются по всему миру. Однако для полного возврата инфляционного давления к норме необходимо увидеть улучшение эпидемиологической ситуации в мире, ослабление карантинных ограничений и, в результате, нормализацию цепочек поставок», — заключил Потапов.

Валерий Черноокий обращает внимание то, что в настоящее время высокая инфляция связана с комбинацией факторов со стороны спроса и предложения.

«С одной стороны, масштабные программы поддержки экономики во время пандемии, сверхмягкая денежная политика в развитых странах и отложенный потребительский и инвестиционный спрос вызвали быстрый рост мировой экономики, восстановление рынков труда и повышение инфляции. С другой стороны, эти же факторы привели к буму на рынках сырьевых товаров и значительному росту цен на продовольствие и энергоносители. Вкупе с нарушением логистических и транспортных цепочек поставок эти шоки предложения не только сдерживают полное восстановление мировой экономики, но и усиливают инфляционное давление.

Для борьбы с шоками предложения инструменты денежно-кредитной политики практически бесполезны, и связанная с ними инфляция будет ослабляться только вслед за исправлением вызвавших их причин, например, вслед за восстановлением международных цепочек поставок или увеличением производства сырья», — отметил эксперт.

Эффективность мер кредитно-денежной политики в борьбе с инфляцией сильно отличается от страны к стране, добавил Валерий Черноокий. В развитых странах, где значительно ниже доля продовольствия и энергоресурсов в потребительской корзине, где прочнее заякорены инфляционные ожидания и где сильнее развиты финансовые рынки, небольшое повышение ставки процента может оказать более значимое влияние на спрос и инфляцию, чем в странах с развивающимися рынками. На эффективность денежно-кредитной политики влияют также открытость экономики, доля импорта в потреблении и промежуточных затратах фирм, используемый режим валютного курса, степень монополизации экономики и многие другие факторы.

Можно ли защитить свои доходы от инфляции

В периоды разгона инфляции инвестору важно чутко следить за портфелем и вовремя его диверсифицировать

(Фото: Shutterstock)

Для потребителей инфляция может означать в лучшем случае увеличение номинальной зарплаты, но инвесторы могут использовать ее для получения прибыли, главное, правильно выбрать активы.

Недвижимость

Рост цен на недвижимость со временем увеличивает стоимость собственности при перепродаже, кроме того, недвижимость можно использовать для получения дохода от аренды. При этом стоимость арендной платы также растет с инфляцией. Это позволяет владельцу получать доход за счет инвестиционной собственности и помогает ему идти в ногу с общим ростом цен в экономике. Инвестиции в недвижимость включают прямое владение недвижимостью и косвенные инвестиции в ценные бумаги, такие как инвестиционный фонд недвижимости (REIT).

Товары

Когда у валюты возникают проблемы инвесторы могут обратиться к материальным активам. На протяжении многих лет традиционным убежищем считалось золото и другие драгоценные металлы. На данный момент эта догма подвергается сомнению, тем не менее классические долгосрочные инвесторы не скидывают его со счетов. Помимо прямых покупок физического золота, можно инвестировать в акции компании, занимающейся добычей золота или в биржевой фонд (

ETF

), который специализируется на золоте.

Среди товаров, которые могут рассматриваться как средство хеджирования или защиты от инфляции также относят нефть. Цена на нее перетекает в цену бензина, а затем в цену каждого потребительского товара, перевозимого или производимого. Поскольку современное общество не может пока функционировать без топлива для движения транспортных средств, нефть имеет сильную привлекательность для инвесторов, когда цены растут.

Облигации

Инвестиции в облигации могут показаться нелогичными, поскольку инфляция губительна для любого инструмента с фиксированным доходом. Однако, на фондовом рынке существуют

облигации

, доходность которых привязана к индексу потребительских цен.

«Для защиты от инфляции в рублевых активах инвесторы могут рассмотреть облигации с плавающим купоном (флоатеры) или облигации, номинал которых индексируется на величину роста инфляции (линкеры), например, ОФЗ-ИН, — говорит Дмитрий Макаров, стратег по рынку акций SberCIB. — От долларовой инфляции можно спастись в TIPS — «трежерис» казначейства США, которые индексируются с учетом инфляции. Интересной выглядит стратегия по покупке долларов на бирже и вложении их в короткие еврооблигации надежных

эмитентов

и ETF на казначейские облигации с защитой от инфляции. Среди таких фондов VTIP US (только для квалифицированных инвесторов) и FXIP, который торгуется на МосБирже и доступен неквалифицированным инвесторам».

Акции

У акций есть шансы идти в ногу с инфляцией, но не все акции одинаково полезны в качестве защитного инструмента. Например, акции, приносящие высокие

дивиденды

, как и облигации с фиксированной процентной ставкой, имеют тенденцию падать во времена инфляции. Выигрывают, как правило, те компании, которые могут переложить на клиентов свои растущие затраты на продукцию, например, в секторе потребительских товаров.

Плюсы и минусы инвестирования в инфляцию

У каждого типа инвестиционного хеджирования есть свои плюсы и минусы, так же как и у любого вида инвестиций есть плюсы и минусы.

Основное преимущество инвестирования во время инфляции — это сохранение покупательной способности портфеля. При более удачном варианте сбережения вырастут. Для достижения этих целей инвестиционные консультанты рекомендуют диверсифицировать портфель. Распределение риска между различными активами — проверенный временем способ борьбы с инфляцией.

Плюсы

- Сохранение стоимости портфеля

- Диверсификация активов

- Сохранение покупательной способности дохода

Минусы

- Увеличение потенциального риска

- Изменение долгосрочных целей

- Перегрузка портфеля в некоторых классах

Традиционно защитой от высокой инфляции принято считать сырьевой сектор, говорит Владимир Потапов. «Инвесторы могут увеличить экспозицию портфеля на золото и другие сырьевые товары — нефть, газ, металлы и т. д. напрямую или через релевантные инструменты, например, акции сырьевых компаний. Тем не менее, стоит учитывать, что позиционирование в сторону высокой инфляции началось еще в середине 2021 года, поэтому котировки на эти инструменты во многом уже закладывают инфляционный сценарий, а значит для их существенного роста необходимо увидеть новую волну заметного ускорения инфляции, что сейчас не выглядит самым вероятным сценарием», — заключил эксперт.

Больше новостей об инвестициях вы найдете в нашем телеграм-канале «Сам ты инвестор!»

Биржевой фонд, вкладывающий средства участников в акции по определенному принципу: например, в индекс, отрасль или регион. Помимо акций в состав фонда могут входить и другие инструменты: бонды, товары и пр.

Макроэкономический термин, обозначающий значительное снижение экономической активности. Главный показатель рецессии – снижение ВВП два квартала подряд.

Лицо, выпускающее ценные бумаги. Эмитентом может быть как физическое лицо, так и юридическое (компании, органы исполнительной власти или местного самоуправления).

Финансовый инстурмент, используемый для привлечения капитала. Основные типы ценных бумаг: акции (предоставляет владельцу право собственности), облигации (долговая ценная бумага) и их производные.

Подробнее

Долговая ценная бумага, владелец которой имеет право получить от выпустившего облигацию лица, ее номинальную стоимость в оговоренный срок. Помимо этого облигация предполагает право владельца получать процент от ее номинальной стоимости либо иные имущественные права.

Облигации являются эквивалентом займа и по своему принципу схожи с процессом кредитования. Выпускать облигации могут как государства, так и частные компании.

Инвестиции — это вложение денежных средств для получения дохода или сохранения капитала. Различают финансовые инвестиции (покупка ценных бумаг) и реальные (инвестиции в промышленность, строительство и так далее). В широком смысле инвестиции делятся на множество подвидов: частные или государственные, спекулятивные или венчурные и прочие.

Подробнее

Дивиденды — это часть прибыли или свободного денежного потока (FCF), которую компания выплачивает акционерам. Сумма выплат зависит от дивидендной политики. Там же прописана их периодичность — раз в год, каждое полугодие или квартал. Есть компании, которые не платят дивиденды, а направляют прибыль на развитие бизнеса или просто не имеют возможности из-за слабых результатов.

Акции дивидендных компаний чаще всего интересны инвесторам, которые хотят добиться финансовой независимости или обеспечить себе достойный уровень жизни на пенсии. При помощи дивидендов они создают себе источник пассивного дохода.

Подробнее

Если не изменить модель развития, а ждать роста цен на нефть, то нас всех ждет прозябание на задворках мировой экономики или даже возврат во времена СССР

За три месяца, прошедших с момента появления программы Столыпинского клуба «Экономика роста», разрослась настоящая экономическая дискуссия. В этой связи стоит вспомнить высказывание Махатмы Ганди: «Сначала над тобой смеются, затем с тобой спорят, потом ты побеждаешь». Задачу номер один мы выполнили: прошли период насмешек, расшевелили спящее аморфное общество — заставили его задуматься о стратегиях, программах, о будущем.

Задача номер два — выиграть теоретический спор разных экономических концепций. Стране нужен дополнительный источник роста, помимо нефтегазового сектора. Им может стать только внутреннее производство, МСБ, экспорт продуктов глубокой переработки сырья, импортозамещение. Однако принять столь необходимые шаги мешает инертность мышления Центробанка и экономического блока правительства. Ей на руку играет обскурантизм ряда дворцовых экономических экспертов. Конечно, мы спорим не с огульной (каковой больше всего), а с умной критикой от профессиональных апологетов экономического догмата, главенствующего в стране уже 25 лет. Она требует ответа.

Надо понимать, что наши оппоненты не совсем либералы. Той экономике, которую начали строить в начале 2000-х, «рентной» экономике, основанной на доходах от экспорта природных ресурсов, нужна была соответствующая политика, препятствующая попыткам все раздать и украсть, то есть политика эффективного казначейства, или «копилки». Ей нужно было теоретическое обоснование, например в духе «монетаризма» Милтона Фридмана, основанного на утверждении о товарной природе денег.

Можно соглашаться с этой теорией или нет, но она не о том. Практика сильно отличалась от всех либеральных теорий, в том числе — от монетаристской. Нам предложили жесточайшую финансовую политику, бескомпромиссную централизацию ресурсов у государства, денежное иссушение рынка (политика высокой процентной ставки) и при этом дали полную валютную свободу спекулятивному капиталу, что привело к процветанию сarry trade и невероятной популярности этой политики среди портфельных инвестиционных фондов.

Между тем именно Милтон Фридман, вместе с Анной Шварц, писал в «Монетарной истории Соединенных Штатов, 1867—1960» следующее: «Нехватка денег выступает главной причиной возникновения депрессии. Исходя из этого, монетаристы полагают, что государство должно обеспечить постоянную денежную эмиссию, величина которой будет соответствовать темпу прироста общественного продукта».

На практике проведение в России жесткой денежно-кредитной и ограничительной бюджетной политики на фоне крайне либерального валютного законодательства способствует, с одной стороны, закреплению высоких процентных ставок по кредитам, порождает недостаток денег в экономике, сокращает инвестиции в реальном выражении, что отрицательно сказывается на темпах и качестве роста экономики России.

При этом мы должны признать, что для той, рентной модели экономики эта политика была весьма успешной, мы не разбрасывались ресурсами, скопили резервы, вот, правда, с инфляцией у нас по-прежнему не очень. Но для периода низких цен на сырье, когда надо учиться зарабатывать по-новому, такой курс уже не подходит. Финансово-экономический блок правительства должен теперь думать о том, как инвестировать в новые точки роста в новую современную экономику. А здесь уже нужен не жесткий финансовый директор, а менеджеры по развитию.

Так в чем же нас критикуют?

Главная претензия к нашей программе, которую не высказал только ленивый, – дополнительная эмиссия вызовет неконтролируемую инфляцию.

Тут наши экономисты красок не жалеют. Первую скрипку играет, конечно, Алексей Кудрин, который заявил, что реализация наших идей за два года разрушит экономику страны. Не менее пугающие прогнозы выдает и Сергей Алексашенко, пообещавший нам Зимбабве с огромным количеством нулей на банкнотах. Такие прогнозы, безусловно, завораживают, но имеют мало общего с реальностью. Повышение денежного предложения, «количественное смягчение» в той или иной форме – путь, по которому идет сейчас весь мир, в том числе США, Европа, Япония и даже Китай.

Именно активная стимулирующая денежно-кредитная политика, активное опережающее предложение кредитных ресурсов в экономику стало ключом к успеху практических всех стран, совершивших экономическое чудо: Япония, Чили, Южная Корея, Сингапур и т. д.

Деньги – кровь экономики. И у России малокровие.

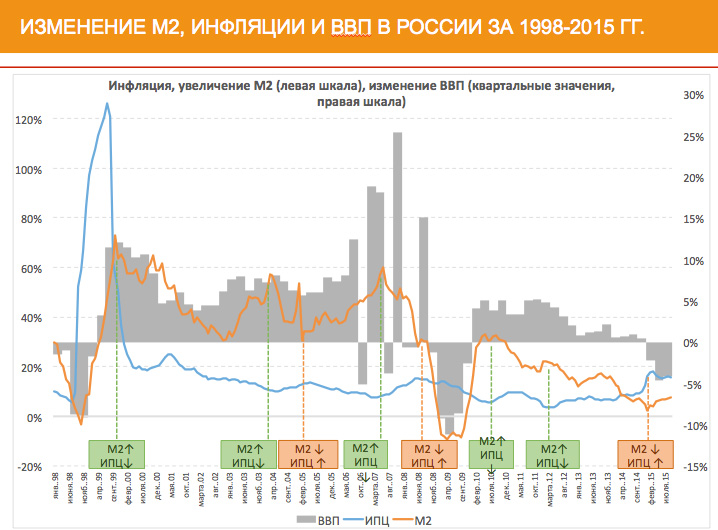

Коэффициент М2 (соотношение денежной массы к ВВП) у нас составляет 45%, для сравнения: в КНР – 195%. Сейчас же под лозунгами борьбы с инфляцией еще и началась политика искусственного сжатия денежной массы. Это весьма скоро приведет к дефициту оборотных средств и кризису неплатежей. У предприятий не будет денег для закупки сырья, для выплаты заработных плат и т. д. Вот где будет полноценное возвращение в 1990-е годы.

Что характерно, несмотря на таргетирование ЦБ, инфляция меньше не становится. И понятно почему. Инфляция в России связана не с количеством денег в экономике, а с зависимостью рынка от импорта, ростом тарифов, недостаточным предложением товаров и услуг, отсутствием конкуренции в ряде отраслей. Это немонетарная инфляция. Увеличение денежной массы не приведет к ее росту, а сжатие – к снижению, что мы и видим.

Кроме того, мы предлагаем всю возможную эмиссию направить в производство. Речь идет о целевой связанной эмиссии, которая создаст опережающее предложение денег в реальном секторе. Финансовые ресурсы будут направляться на инвестиционные проекты, в модернизацию и расширение существующих производственных мощностей и в инфраструктуру (транспорт, энергетика и др.). Сам механизм такой эмиссии исключает возможность направления средств куда-либо еще.

Тут уместно упомянуть второй бросаемый нам упрек, а именно то, что эмитированные деньги хлынут на валютный рынок. Главред «Финансовой газеты» Николай Вардуль пишет: «Искушение, получив деньги по сверхнизкой ставке, уйти в валюту настолько велико, что все запреты будут обходиться».

Искушение велико, но механизм который мы предлагаем, исключает такую возможность.

Мы подразумеваем рефинансирование ЦБ коммерческих банков и/или капитализация институтов развития для финансирования частных производственных проектов под залог проектных облигаций и/или выкупа проектных облигаций компаний-инвестиционных агентов (специальных обществ проектного финансирования СОПФ). Это вполне принятая и весьма распространенная в мире практика финансирования.

Деньги будут выдаваться только проектам, прошедшим независимый аудит, и софинансируемым инвестором, коммерческим банком, и рефинансируемым ЦБ только на часть общего объема. Все это снимает риски.

Много упрекают нас и в отсутствии должного числа проектов, которые смогут освоить эмиссионные деньги.

Вот как поэтично описывает это Вячеслав Иноземцев в своей колонке на Slon.ru: «Отличие наших экономик состоит в том, что в России «производственный сектор» просто отсутствует. Это как полить водой пересохшую землю – вода в нее впитается, появятся ростки. Почему не получится у нас? Потому что вместо земли у нас покрытый лаком паркетный пол, в который ничего не впитается».

Определенная правда в этих словах есть. Действительно, Россия сильно деиндустриализировалась. Число промышленных предприятий у нас невелико и продолжает, к сожалению, сокращаться. Так это и подтверждение того, что у нас большой потенциал, если, конечно, изменить экономическую политику. Это показывает работа Фонда развития промышленности Минпромторга. Средства фонда — это возвратные деньги, выдаваемые под 5% годовых сроком до 5 лет. И есть существенные ограничения по финансированию по направлениям и возможностям использования средств. На 2016 год получено 1282 заявок на сумму 449 млрд рублей, по состоянию на конец декабря 531 заявка на сумму 141 млрд рублей прошла экспертную оценку фонда. В бюджете на фонд предусмотрено, к сожалению, только 20 млрд рублей, недавно президент объявил о докапитализации еще на 20 млрд. Результаты первого года работы ФПИ показывают, что большинство одобренных проектов имеют прибыль даже больше запланированных, что позволяет надеяться на успешное масштабирование этого опыта.

Недавно было совещание у председателя правительства, где мы дали наш взгляд на возможные точки роста. Мы считаем, что их вполне достаточно, чтобы мы могли расти и 5%, и 6% в год, а если сложится благоприятная конъюнктура — то и все 10%, как в 2000 году.

У страны много точек роста и без нефти, мы можем сегодня предложить много проектов. Главное, чтобы эти проекты опять не стали неэффективными монстрами по отмыванию средств, связанными с государством структурами, а были реализованы многочисленными частными предприятиями, жили бы в конкурентной среде.

В этой связи нельзя пройти мимо обвинений от целого ряда политиков и экономистов левого толка, которые считают, что наша программа носит исключительно лоббистский характер и направлена только на интересы бизнеса. Об этом же говорит и первый проректор НИУ ВШЭ Лев Якобсон, хотя он и подчеркивает, что вкладывает в понятие «лоббизм» положительный смысл. Вынужден не согласиться. Да, «экономика роста» — это про бизнес, про МСП и промышленные предприятия. Но именно они выполняют главную социальную задачу: они создают рабочие места и выплачивают налоги! Если у нас будет политика экономического роста, то инструменты для развития и возможности для процветания будут даны не только частному бизнесу, но и всем людям «дела», и предпринимателям, и ученым, врачам и военным и рабочим. Всем тем, кто не хочет прозябать, а стремится к развитию, росту – своему, своей семьи, росту страны.

Вызывает опасения и наше предложение создать систему управления реформами.

Если отмести высказанные в наш адрес бредовые обвинения в желании возродить Госплан (тут людям надо просто почитать, что такое индикативное планирование), то суть основных претензий в том, что это вызовет рост бюрократического аппарата. Так, по мнению Андрея Мовчана, создание Администрации развития — это «откровенное и кардинальное увеличение числа чиновников».

В бизнесе очень хорошо знают, что такое проектное управление и что “project management” всегда должен быть отделен от управления «текущим состоянием» или “run management”.

Весь опыт успешных государств говорит об этом, в каждой из них управление развитием было выделено в отдельную структуру. Для всех экономик, которые осуществляют догоняющее развитие, исключений нет: КНР, Корея, Сингапур, Таиланд, Малайзия, Индонезия и т. д.

Что касается дополнительной численности Администрации развития, мы предлагаем: во-первых, сократить, прежде всего, число чиновников, отвечающих за развитие в существующих ведомствах, за ненадобностью. Во-вторых, значительного персонала вообще не потребуется, это должна быть мобильная оперативная группа, но с особыми полномочиями и прямым подчинением президенту страны. В-третьих, все это окупится сторицей и, что немаловажно, можно будет сэкономить на похоронах (шутка).

И в завершении надо сказать еще об одном, но очень важном, на самом деле, главном аргументе наших критиков: никакие экономические реформы у нас в стране невозможны в принципе, пока не будут проведены политические и институциональные реформы – реформы правоохранительных органов, независимого суда и т. д. Конечно, и политическая конкуренция, и правовое государство — важнейшие составляющие успешных стран. А для бизнеса, особенно малого и среднего, независимый суд просто необходим. Но как показывает мировой опыт, создание таких институтов, во-первых, заняло не один десяток лет, а кроме того, шло не впереди, а за экономическими реформами. Ведь спрос рождает предложение – пока рынок слабый, любые институты или простаивают, или ими манипулируют. Как только появится спрос со стороны бизнеса, все начнет развиваться. Сначала — развитие рынка, увеличение числа и силы его субъектов, а уже потом, в ходе развития экономики — политические и институциональные реформы.

Поэтому задача номер три – выиграть – создать новую экономику России.

Реализация нашей программы даст возможность гражданам достойно зарабатывать, а пенсионерам — достойно жить на пенсию и сбережения. Если же сейчас ничего не менять, а только ждать, когда же снова вырастет нефть, нас всех ждет прозябание на задворках, или, что еще хуже, изоляция – возврат в СССР. Молодая, образованная и активная часть населения эмигрирует, бизнес уйдет в тень, работу найти будет все сложнее, и у государства будет все меньше средств для выполнения социальных обязательств

Да, риски реформ высоки, нужна решимость и даже отвага. Но риски ничего не делать для страны значительно выше.

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP.[1]

Growth is usually calculated in real terms – i.e., inflation-adjusted terms – to eliminate the distorting effect of inflation on the prices of goods produced. Measurement of economic growth uses national income accounting.[2] Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantages and drawbacks of that measure. The economic growth-rates of countries are commonly compared using the ratio of the GDP to population (per-capita income).[3]

The «rate of economic growth» refers to the geometric annual rate of growth in GDP between the first and the last year over a period of time. This growth rate represents the trend in the average level of GDP over the period, and ignores any fluctuations in the GDP around this trend.

Economists refer to economic growth caused by more efficient use of inputs (increased productivity of labor, of physical capital, of energy or of materials) as intensive growth. In contrast, GDP growth caused only by increases in the amount of inputs available for use (increased population, for example, or new territory) counts as extensive growth.[4]

Development of new goods and services also generates economic growth.[5] As it so happens, in the U.S. about 60% of consumer spending in 2013 went on goods and services that did not exist in 1869.[6]

Measurement[edit]

The economic growth rate is calculated from data on GDP estimated by countries’ statistical agencies. The rate of growth of GDP per capita is calculated from data on GDP and people for the initial and final periods included in the analysis of the analyst.

Long-term growth[edit]

Living standards vary widely from country to country, and furthermore, the change in living standards over time varies widely from country to country. Below is a table which shows GDP per person and annualized per person GDP growth for a selection of countries over a period of about 100 years. The GDP per person data are adjusted for inflation, hence they are «real». GDP per person (more commonly called «per capita» GDP) is the GDP of the entire country divided by the number of people in the country; GDP per person is conceptually analogous to «average income».

| Country | Period | Real GDP per person at beginning of period | Real GDP per person at end of period | Annualized growth rate |

|---|---|---|---|---|

| Japan | 1890–2008 | $1,504 | $35,220 | 2.71% |

| Brazil | 1900–2008 | $779 | $10,070 | 2.40% |

| Mexico | 1900–2008 | $1,159 | $14,270 | 2.35% |

| Germany | 1870–2008 | $2,184 | $35,940 | 2.05% |

| Canada | 1870–2008 | $2,375 | $36,220 | 1.99% |

| China | 1900–2008 | $716 | $6,020 | 1.99% |

| United States | 1870–2008 | $4,007 | $46,970 | 1.80% |

| Argentina | 1900–2008 | $2,293 | $14,020 | 1.69% |

| United Kingdom | 1870–2008 | $4,808 | $36,130 | 1.47% |

| India | 1900–2008 | $675 | $2,960 | 1.38% |

| Indonesia | 1900–2008 | $891 | $3,830 | 1.36% |

| Bangladesh | 1900–2008 | $623 | $1,440 | 0.78% |

Seemingly small differences in yearly GDP growth lead to large changes in GDP when compounded over time. For instance, in the above table, GDP per person in the United Kingdom in the year 1870 was $4,808. At the same time in the United States, GDP per person was $4,007, lower than the UK by about 20%. However, in 2008 the positions were reversed: GDP per person was $36,130 in the United Kingdom and $46,970 in the United States, i.e. GDP per person in the US was 30% more than it was in the UK. As the above table shows, this means that GDP per person grew, on average, by 1.80% per year in the US and by 1.47% in the UK. Thus, a difference in GDP growth by only a few tenths of a percent per year results in large differences in outcomes when the growth is persistent over a generation. This and other observations have led some economists to view GDP growth as the most important part of the field of macroeconomics:

…if we can learn about government policy options that have even small effects on long-term growth rates, we can contribute much more to improvements in standards of living than has been provided by the entire history of macroeconomic analysis of countercyclical policy and fine-tuning. Economic growth [is] the part of macroeconomics that really matters.[8]

Growth and innovation[edit]

The system of economic growth in developed regions

It has been observed that GDP growth is influenced by the size of the economy. The relation between GDP growth and GDP across the countries at a particular point of time is convex. Growth increases as GDP reaches its maximum and then begins to decline. There exists some extremum value. This is not exactly middle-income trap. It is observed for both developed and developing economies. Actually, countries having this property belong to conventional growth domain. However, the extremum could be extended by technological and policy innovations and some countries move into innovative growth domain with higher limiting values.[9]

Determinants of per capita GDP growth[edit]

Historic world GDP per capita

In national income accounting, per capita output can be calculated using the following factors: output per unit of labor input (labor productivity), hours worked (intensity), the percentage of the working-age population actually working (participation rate) and the proportion of the working-age population to the total population (demographics). «The rate of change of GDP/population is the sum of the rates of change of these four variables plus their cross products.»[10]

Economists distinguish between long-run economic growth and short-run economic changes in production. Short-run variation in economic growth is termed the business cycle. Generally, economists attribute the ups and downs in the business cycle to fluctuations in aggregate demand. In contrast, economic growth is concerned with the long-run trend in production due to structural causes such as technological growth and factor accumulation.

Productivity[edit]

Increases in labor productivity (the ratio of the value of output to labor input) have historically been the most important source of real per capita economic growth.[11][12][13][14][15] In a famous estimate, MIT Professor Robert Solow concluded that technological progress has accounted for 80 percent of the long-term rise in U.S. per capita income, with increased investment in capital explaining only the remaining 20 percent.[16]

Increases in productivity lower the real cost of goods. Over the 20th century the real price of many goods fell by over 90%.[17]

Economic growth has traditionally been attributed to the accumulation of human and physical capital and the increase in productivity and creation of new goods arising from technological innovation.[18] Further division of labour (specialization) is also fundamental to rising productivity.[19]