Содержание

- List of Credit Card Decline Codes in 2022

- What are Credit Card Decline Codes ?

- Common Reasons Credit Cards are Declined

- List of Credit Card Decline Codes

- Call/Decline Codes

- Hold-Call Codes

- Credit Card Error Codes

- How to Train Employees in Detecting and Acting on Credit Card Decline Codes

- Conclusion

- Help Center

- Decline codes explanation Print

List of Credit Card Decline Codes in 2022

Share this Article:

Revel Blog | Revel Systems | June 9, 2022 |

Sooner or later, all merchants will experience a credit card being declined. While it may be embarrassing for the customer, knowing how to address a decline can make or break the customer experience.

Credit card declines happen when a payment can’t be processed for one reason or another. In response to a decline, your reader will display an error code.

Credit card error codes explain why a transaction was declined, which can help merchants provide advice and support to customers. All credit card processing codes are universal; therefore, they will not differ between point of sale (POS systems).

Here’s what you need to know about the list of credit card declined codes and what each one means.

What are Credit Card Decline Codes ?

Visa declined codes and MasterCard declined codes will appear on your POS system whenever a customer’s card is declined.

Transactions may be declined by the processor, the payment gateway, or the issuing bank. The merchant sees only the credit card declined reason code and an error message.

Processors assign these codes to transactions to inform merchants why a particular transaction was declined.

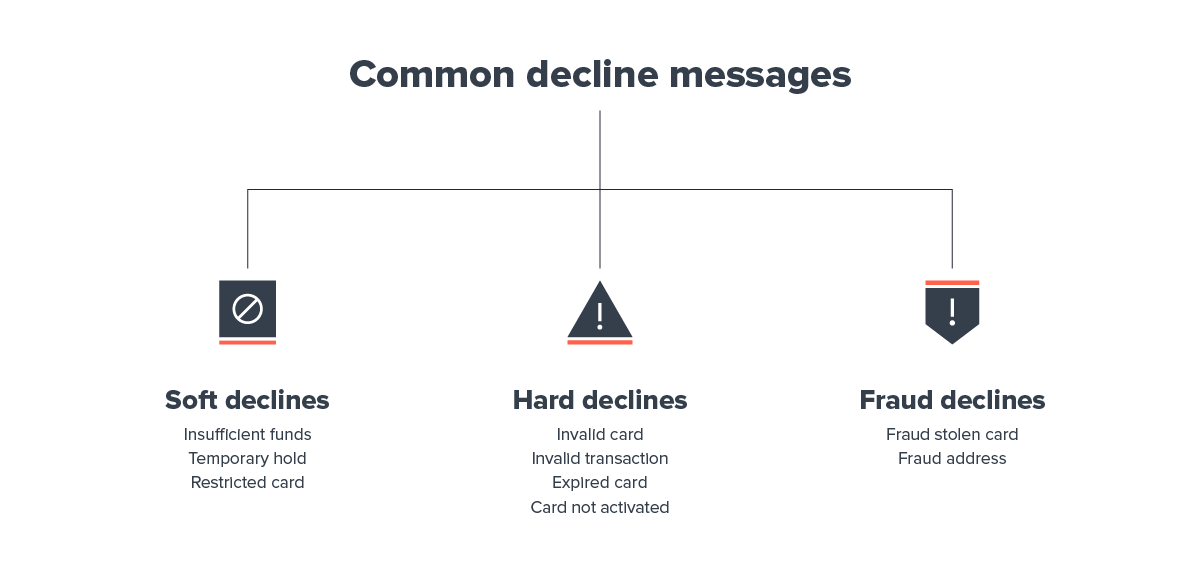

Credit card declines can be separated into two major categories:

- Soft Decline – The issuer has approved the payment, but there’s another problem with the transaction. With a soft decline transaction, retrying the transaction often resolves the issue.

- Hard Decline – These declines occur when the issuing bank refuses to authorize the transaction. There’s typically nothing the merchant can do other than ask whether the customer has another credit card they can use.

Because soft declines are typically temporary, it’s perfectly acceptable to retry the transaction. Hard declines, on the other hand, should never be met with a “brute force” transaction.

Brute forcing a transaction can lead to future credit card chargebacks. If this occurs, you have no recourse, and you’ll be left paying out-of-pocket.

Whenever you resolve a soft or hard decline, it’s always a good idea to keep a record of the action taken in case you need to fight a chargeback dispute at a later date.

Familiarizing yourself with different credit card processing decline codes allows you to protect your business and better support your customers.

Common Reasons Credit Cards are Declined

When credit card declined codes appear, there are many potential causes and possible courses of action.

Here’s a brief overview of the most common reasons credit cards are declined:

- The customer has reached their credit limit

- A purchase was flagged as fraudulent

- The customer already has a large pending transaction

- The credit card has expired

- An account has been closed

The customer themselves can only solve most instances of a credit card decline, so it’s important to be able to provide your customers with the right advice whenever credit card declined reason codes appear.

List of Credit Card Decline Codes

While it may be unreasonable to expect cashiers to remember all credit card authorization response codes, categorizing them appropriately can indicate the right course of action.

It’s important to understand the merchant doesn’t get the full story, even when they receive a decline code. Often, the only thing a merchant can do is retry the transaction (when safe to do so) or encourage the customer to contact their issuing bank.

Let’s examine the various categories of credit card machine error codes.

Call/Decline Codes

When a credit card reader flashes a “CALL” or “DECLINE” code, it indicates that the issuing bank is not permitting the transaction to go through.

There are a variety of reasons this might be the case. The correct course of action is to request that the customer call their bank or use an alternative payment method.

To provide stellar customer service, you can offer to reserve your customer’s items for them for a limited time. Doing your best to accommodate a red-faced shopper can potentially get you a regular.

- 01/Refer to Issuer – There’s something wrong with the card number. The customer should contact the issuing bank.

- 02/Refer to Issuer, Special Condition – Similar to 01, the issuing bank is refusing the transaction. 02 often appears if the customer is making a larger-than-usual purchase or they’ve been traveling. Either way, the customer should contact their issuing bank.

- 04/Pick Up Card (No Fraud) – The card has been reported lost or stolen but not flagged for fraud. This code requests the merchant pick up the card and contact the issuing bank.

- 05/Do Not Honor – The issuing bank will not allow the payment to proceed. The customer is advised to contact their issuing bank.

- 51/Insufficient Funds – The card does not have the necessary funds available to make the full payment.

- 54/Expired Card – The card has expired and cannot be used.

- 57/Transaction Not Permitted, Card – The card cannot be used with this type of transaction. Provide the customer with the transaction details and ask them to contact the issuing bank to authorize the transaction.

- 65/Activity Limit Exceeded – The customer’s withdrawal frequency limit has been exceeded. Ask them to use another card or complete the purchase after limits have been refreshed.

- 93/Violation, Cannot Complete – There is a problem with the customer’s account, and they should contact their issuing bank or use another card.

Hold-Call Codes

Hold-call codes are more serious because they could indicate the credit card has been used fraudulently. In all instances of a hold-call code, the merchant is required to take the card and report it to the issuing bank (usually by calling a toll-free number).

When these credit card error codes are spotted, the business should not honor any transaction or provide any services.

- 07/Pick Up Card, Special Condition (Fraud Account) – The issuing bank has found the customer’s account to be fraudulent.

- 41/Lost Card, Pick Up – This card has been reported as lost. Don’t run the card a second time and don’t serve the customer. If this occurs during a recurring payment, contact the customer.

- 43/Stolen Card, Pick Up – This card has been reported as stolen. Again, don’t provide any goods or services to the customer, retain the card, and immediately report it to the issuing bank.

Credit Card Error Codes

Credit card error codes are more difficult to resolve because they encompass a wide range of potential problems. Usually, credit card machine error codes indicate a problem with your POS system. We recommend having this list handy to avoid the customer getting frustrated.

- 00/Issuer System Unavailable – A temporary communication issue. This can often be resolved by waiting a few minutes and attempting the transaction again.

- 12/Invalid Transaction – The attempted transaction is incorrect or incorrect configuration of payment batches. This often happens when businesses are attempting to issue refunds to the customer’s credit card.

- 13/Invalid Amount – Data entry error. Code 13 occurs when the merchant enters an incorrect symbol or a negative dollar amount.

- 14/Invalid Card Number – Cashier has incorrectly entered the customer’s card number. Clear all fields and enter the string of digits again.

- 15/No Such Issuer – This code is unique to AMEX, Discover, Visa, and MasterCard. They will each start with a different string of digits, but they will all contain “15” at the end. This error occurs when the initial numbers entered fail to match the card type.

- 19/Re—Enter – An unknown error has occurred. The only option is to attempt the transaction again.

- 28/File is Temporarily Unavailable – A glitch has occurred during authorization. Retry the transaction or contact the issuer.

- 58/Transaction Not Permitted, Terminal – Occurs when the merchant processing account is not configured to accept the transaction. Contact your POS issuer to reconfigure your terminal.

- 62/Invalid Service Code, Restricted – Error code 62 occurs when your POS doesn’t accept AMEX or Discover cards. It can also appear when a customer attempts to pay online with a card that isn’t authorized for online payments.

- 63/Security Violation – CVV code was read incorrectly. Retrying the transaction without the CVV code usually works. Inform the customer about this just in case the transaction is subsequently flagged as fraudulent.

- 85/No Reason to Decline – Unexplainable error has occurred. Retry the transaction or contact the issuer.

- 91/Issuer Switch is Unavailable – No specific reason why an error was encountered. Either contact the issuer or your payment processor.

- 93/Violation, Cannot Complete – A problem has occurred with the customer’s account. Ask for an alternative payment method.

- 96/System Error – A system error has occurred. Wait a couple of minutes before retrying. If the error persists, contact your payment processor.

- R0 or R1/Customer Requested Stop of Specific Recurring Payment – This error occurs when a customer has canceled a recurring payment with your business. Contact the customer to make sure this wasn’t a mistake or an outdated card.

How to Train Employees in Detecting and Acting on Credit Card Decline Codes

This long list of credit card declined codes can be daunting for employers. It’s unreasonable to expect cashiers to remember every code and what to do if one appears.

Instead, keep a reference sheet alongside your POS to help cashiers instantly look up each code and what to do in that specific situation.

In the event a hold-call code appears, it’s strongly recommended that you only confiscate the card if it’s safe to do so. Either way, the presence of a hold-call code should be reported, and information sent to the relevant authorities.

Make sure support phone numbers for your POS provider are readily available in case the problem has something to do with your system.

POS problems often occur during the setup process and a simple reconfiguration with the support of your provider can get you up and running again.

Conclusion

Being familiar with credit card authorization response codes and what to do about them are essential for meeting your customers’ needs.

With an increasing number of shoppers relying solely on credit cards to shop, you need a POS system supporting and growing alongside your business.

Contact us to learn how Revel’s leading cloud-native platform and POS can elevate your business and brand.

Источник

Help Center

Decline codes explanation Print

Modified on: Tue, 13 Dec, 2022 at 10:43 AM

Here we help you understand what information decline codes hold and how you can resolve situations when a payment is declined.

The problem here lies with the data format and accuracy, validation error on the acquiring side.

| Code | Description | Description | Recommendations for Merchants | |||||||||||||||||||||

| General decline | The general group of declines. The card issuing bank did not complete the transaction successfully. | Kindly ask the user to try to pay a couple more times. The Chances are high that the next attempt will be successful. | ||||||||||||||||||||||

| Order expired | The user could not finalize the payment during the given timeframe, which resulted in order expiration. | Kindly suggest to the user to try again with the same card. | ||||||||||||||||||||||

| Violation of law | In some cases, the card issuer can block a transaction for law violation reasons. It can be due to a cardholder or due to a sanctioned country. |

Kindly suggest to the user to use another card. Cardholder authentification was not successful. |

Kindly ask the user to try to pay a couple more times. The Chances are high that the next attempt will be successful. | |||||||||||||||||||||

|

||||||||||||||||||||||||

| Invalid Currency | The currency here is not supported. | Kindly contact SolidGate Support. More likely, we will be able to suggest a solution for you. | ||||||||||||||||||||||

| Order not Found | Integration error, request invalid data. | Kindly contact SolidGate Support. More likely, we will be able to suggest a solution for you. | ||||||||||||||||||||||

| Invalid CVV2 code | Invalid CVV2 code

The CVV code is the three-digit code on the back of a MasterCard or Visa, or the four-digit code on the front of an American Express. If it is the first occasion — kindly ask the user to try one more time. If CVV code error is recurring for the same user — potential card fraud. Act accordingly to your policies. |

Invalid Card Number | The user entered an incorrect card number. | Kindly ask the user to enter a valid card number. | ||||||||||||||||||||

| Invalid Expiration Date | Card is expired |

|

||||||||||||||||||||||

| Invalid 3DS flow on the merchant side | 3DS URL was not displayed to the cardholder during 3-D Secure authentification attempts |

Kindly ask a user to recall the step-by-step payment flow and forward information received to SolidGate Support. |

Invalid 3DS flow on the bank’s side | The user went through a payment flow, but the bank did not initiate 3DS authorization. | Kindly ask the user to try one more time or suggest to the user to use another card. | |||||||||||||||||||

| Invalid 3DS flow | User hesitated with 3D Secure authentication. | Kindly ask the user to try one more time or suggest to the user to use another card. | Subscription is locked | The user_id is subscribed to the product_id. |

Our systems check user_id for active subscriptions, and if product_id of active subscription matches the one you are sending in an order for subscription activation, Solid will decline the payment in question. |

SCA require 3D authentication | The order was tried to be processed without 3D verification, in cases of the EU transactions, which require 3D authentication |

Please contact SolidGate Support. |

Card is blocked | The card issuer bank blocked the card for payments. |

Card issuer banks have various logics to block risky transactions: — Limit on online payments; — Daily limit on payments amount; — Daily limit on the number of payments; — Limits for payments with 3DS authorization; It is necessary to explain to the user that the issuing bank is blocking the transaction. Most likely, one of the card limits is triggered. The customer can contact the bank’s support service and ask to remove the limit in question to make the payment. You can also recommend the user try to pay again. For many banks, the rules are not static but triggered based on a scoring system, and repeated attempts to conduct a transaction increase the likelihood of a transaction going through. The user’s card balance has insufficient funds. |

Kindly suggest to the user another card or top-up the current one. | ||||||||||||

| Payment amount limit excess | Card payment/credit limit was reached |

Card issuer banks have various logics to block risky transactions: — Limit on online payments; — Daily limit on payments amount; — Daily limit on the number of payments; — Limits for payments with 3DS authorization; It is necessary to explain to the user that the issuing bank is blocking the transaction. Most likely, one of the card limits is triggered. The customer can contact the bank’s support service and ask to remove the limit in question to make the payment. You can also recommend the user try to pay again. For many banks, the rules are not static but triggered based on a scoring system, and repeated attempts to conduct a transaction increase the likelihood of a transaction going through. |

Card is declined by issuer | Contact the card issuer to determine the reason. |

Card issuer banks have various logics to block risky transactions: — Limit on online payments; — Daily limit on payments amount; — Daily limit on the number of payments; — Limits for payments with 3DS authorization; It is necessary to explain to the user that the issuing bank is blocking the transaction. Most likely, one of the card limits is triggered. The customer can contact the bank’s support service and ask to remove the limit in question to make the payment. You can also recommend the user try to pay again. For many banks, the rules are not static but triggered based on a scoring system, and repeated attempts to conduct a transaction increase the likelihood of a transaction going through. |

Call your bank | Contact card issuer for clarifications. |

Card issuer banks have various logics to block risky transactions: — Limit on online payments; — Daily limit on payments amount; — Daily limit on the number of payments; — Limits for payments with 3DS authorization; It is necessary to explain to the user that the issuing bank is blocking the transaction. Most likely, one of the card limits is triggered. The customer can contact the bank’s support service and ask to remove the limit in question to make the payment. You can also recommend the user try to pay again. For many banks, the rules are not static but triggered based on a scoring system and repeated attempts to conduct a transaction increase the likelihood of a transaction going through. |

Debit card not supported | The card has been declined for an unknown reason. | Kindly suggest using another card. | |||||||||||||

| Card brand is not supported | The card has been declined for an unknown reason. | Kindly ask the user to use another card, the one specified in your payment form. | ||||||||||||||||||||||

| Do not honor | The card has been declined for an unknown reason.

The customer should contact their card issuer for more information. More likely the next attempt will be successful. |

Suspected Fraud | The issuing bank blocked the transaction due to possible fraud. The card wasn’t in use for a long time, unusual activity, etc. |

The customer should contact their card issuer for more information. More likely the next attempt will be successful. |

Card is in blacklist | The card is on the blacklist. | Show general decline to the customer. It is best to check the customer for fraudulent activity. | |||||||||||||||||

| Stolen card | The card in use is stolen, all transactions are restricted. | Show general decline to the customer. It is best to check the customer for fraudulent activity and block if necessary. | ||||||||||||||||||||||

|

The card cannot be used to make this payment (it is possible it has been reported lost or stolen). Kindly suggest using another card. |

Lost Card | The card in use is lost, all transactions are restricted. | Show general decline to the customer. It is best to check the customer for fraudulent activity and block if necessary. | |||||||||||||||||||||

| PSP Antifraud | The acquiring bank blocked the transaction due to possible fraud. The card wasn’t in use for a long time, unusual activity, etc. | Show general decline to the customer. It is best to check the customer for fraudulent activity and block if necessary. | ||||||||||||||||||||||

| Blocked by Country/IP | Blocked by IP mismatch or dye to a high-risk country IP. | Show general decline to the customer. It is best to check the customer for fraudulent activity and block if necessary. Otherwise, kindly suggest to the customer to try one more time. |

||||||||||||||||||||||

| Trusted Anti Fraud system | An antifraud rule was triggered. |

Show general decline to the customer. It is best to check the customer for fraudulent activity and block if necessary. Otherwise, kindly suggest to the customer to try one more time. |

Solid antifraud engine | An antifraud rule was triggered |

Show general decline to the customer. It is best to check the customer for fraudulent activity and block/unblock if necessary. Otherwise, kindly suggest to the customer to try one more time. |

3D Secure verification failed | 3D Secure verification failed |

Show general decline to the customer. It is best to check the customer for fraudulent activity and block if necessary. Otherwise, kindly suggest to the customer to try one more time. |

Invalid Card Token | We received an invalid/nonexistent card token. |

Kindly ask the customer to try one more time or to use another card. Please contact SolidGate Support to let us know. |

Application Error | Processing error. |

Kindly ask the customer to try one more time or to use another card. Please contact SolidGate Support to let us know. |

Merchant is not configured yet | Processing error. |

Please contact SolidGate Support. |

Merchant is not activated yet | Processing error. |

Please contact SolidGate Support. |

Invalid Transaction | Processing error. | Kindly ask the customer to try one more time or to use another card. If another card is not an option — kindly suggest contacting the bank. | |

| Unknown Decline Code | Unknown Decline Code yet to be mapped. | Kindly ask the customer to try one more time or to use another card. If another card is not an option — kindly suggest contacting the bank. | ||||||||||||||||||||||

| Connection Error | A connection is poor or interrupted. | Kindly ask the customer to try one more time or to use another card. | ||||||||||||||||||||||

| Card Token not found | An error occurred and the token was not found. |

More likely card is expired. Kindly check exp. date, available in order details — logs, via Solidgate hub. Otherwise, please contact SolidGate Support. Источник Adblock |

💡Почему важно знать причины неоплаты?

Оплата банковской картой через интернет — эту услугу сейчас предлагает практически любой интернет магазин. Вы можете например купить билет на поезд, оплатив банковской картой, сделать покупку на ozon.ru, купить ЖД билет онлайн.

Я всегда заказывал и оплачивал билеты банковской картой через интернет(я использую только дебетовые карты, у меня нет кредитной карты). Самое интересное, что и эта услуга иногда дает сбой — зависают деньги на карте, не проходит оплата.

Но у меня был случай, когда оплата просто не проходила. Робокасса писала сообщение — оплата отменена. Я не знал, в чем причина. В личном кабинете найти ошибку мне не удалось.

Существует множество разных причин ошибок — они бывают по причине банка или владельца карты. Важно хотя бы предполагать причину ошибки, чтоб понимать как действовать дальше? К примеру, если не удается оплатить горячий билет, то нужно понимать в чем причина и попытаться исправить проблему. Иначе билет может быть куплен другим человеком.

Основные причины ошибок при оплате банковской картой

Первая причина, которая является самой распространенной — отсутствие нужной суммы на карте. Рекомендуется проверить ваш баланс — для этого нужно позвонить в банк или войти в интернет банк. Иногда по карте устанавливают ежемесячный или ежедневный лимит трат. Чтоб это проверить — нужно позвонить в банк.

Эта причина может быть не ясна сразу — при отказе в оплате может не отображаться ваш баланс. Ошибка аутентификации 3D secure может быть также связана с неверным вводом реквизитов карты на предыдущем шаге. В таком случае просто повторите платеж и укажите правильные данные.

Вторая причина — на стороне платежной системы. Например, терминал оплаты РЖД не позволяет платить картами MasterCard. Можно использовать только карты Visa.

Заданный магазин может не поддерживать данный способ оплаты. К примеру, Робокасса, которую подключают к множеству магазинов предлагает различные тарифы для оплаты.

Я сначала хотел оплатить вебмани, однако я позвонил в магазин. Оказалось, оплатить вебмани нельзя. У них не подключена эта опция. Хотя способ оплаты через вебмани предлагается на странице оплаты.

Третья причина — возможно ваша карта заблокирована. Опять же можно позвонить в банк и проверить это. Блокировка может быть осуществлена банком автоматически в случае наличия подозрительных операций у клиента.

Четвертая причина — у вас не подключена опция 3d Secure(MasterCard SecureCode в случае MasterCard).

Технология 3D Secure заключается в следующем: при оплате вам приходит СМС от банка, которую вы должны ввести в специальном окне. Эту СМС знаете только вы и банк. Мошенничество в данном случае достаточно трудно, для него потребуется и ваш телефон.

Эта опция нужна вам для оплаты на сумму больше 3 тыс. рублей. Это как раз мой случай. Я купил в интернет магазине газовую плиту Bosh. При оплате товара на сумму 22 тыс. рублей мне выдалось вот такое сообщение:

Я был в замешательстве, не знал что делать. Сначала я думал, что это проблема магазина. Но сначала я все таки позвонил в банк. В моем случае это был Промсвязьбанк и карта Доходная.

Позвонив в поддержку Промсвязьбанка, мне предложили сначала пройти процедуру аутентификации

- Назвать 4 последних цифры номера карты

- Назвать фамилию имя отчество полностью

- Назвать кодовое слово.

Далее для подключения услуги 3d Secure от меня потребовали 2 номера из таблицы разовых ключей. Вроде как услугу подключили, но через полчаса оплата снова не прошла. Позвонил в банк — сказали ожидайте когда подключится — услуга подключается не сразу. Нужно подождать.

Я решил проверить, подключена ли услуга. Я залогинился в Интернет-банк — увидел, что такая услуга есть(в ПСБ ритейл это можно посмотреть на странице карты, щелкнув по номеру карты)

Еще раз попытка оплаты — мне высветилось окно, где я должен был ввести код подтверждения. После заполнения данных карты мне пришло СМС с кодом для оплаты

Далее вуаля — заказ наконец то оплачен. Я получил следующее окно и статус заказа в магазине изменился на «Оплачен»

Мой заказ доставили в пункт назначения, где я его заберу в течение месяца. Главное оплата прошла.

Самая частая ошибка 11070: ошибка аутентификации 3d-secure — причины

Самая частая ошибка, которая происходит при оплате картой — 11070: ошибка аутентификации 3dsecure. Есть 2 возможных причины этой ошибки

- Введен неверный одноразовый код. Вам пришел код, но при вводе вы допустили ошибку в цифре. В результате получили ошибку

- Одноразовый код протух. Время, которое вам дают на ввод одноразового кода при оплате, составляет не более 5 минут. Далее вам придется повторить оплату.

В любом случае, советуем повторить процесс оплаты и удостовериться, что вы ввели одноразовый пароль 3D Secure сразу после получения и пароль введен верно.

Ошибка процессинга карты — что это такое?

Процессинг банка — это сложная программа, которая отвечает за обработку транзакций по картам. Когда вы снимаете деньги в банкомате, делаете покупку, то идет запрос по интернет в данную систему. Проверяется есть ли на вашей карте деньги. Эта программа находится на серверах в Интернет.

Вы не можете повлиять на данную ошибку никак. Вам стоит обратиться на горячую линию банка или интернет-магазина, где вы осуществляете транзакцию. Исправление ошибки — дело специалистов, поддерживающих данную систему. Остается только ждать.

Вы можете попробовать осуществить оплату повторно примерно через пол-часа. По идее такие ошибки должны исправляться очень быстро. Аналогичная ошибка бывает с сообщением «Сервис временно недоступен». Это значит, что сломалась серверная сторона и сделать ничего нельзя. Только ждать починки

Что значит хост недоступен при оплате картой

Хост — это определенный сетевой адрес. Это может быть ip адрес или же просто доменное имя(к примеру, server1.sberbak.online). При оплате картой через терминал происходит подключение к определенному сетевому адресу(хосту). На данном хосте находится программное обеспечение, которое производит оплату — снимает с карты деньги, проверяет баланс и т.д.

Если хост недоступен, значит деньги снять нельзя. Есть 2 основных причины недоступности:

- Нет интернет на устройстве, с которого производится оплата. В современных терминалах может быть вшит Интернет-модуль, через который терминал связывается с сервером. Возможно он потерял сеть или завис. В этом случае может помочь перезагрузка или же выход по голое небо, где Мобильный интернет ловит отлично

- Хост недоступен по причине поломки. В этом случае рекомендуется обратиться на горячую линию банка, который поддерживает ваш терминал. Данная проблема должна решаться на стороне хоста. Он может быть недоступен по разным причинам: завис, упал сервер, идет обновление программного обеспечения.

Что такое ошибка в CVC карты?

CVC-код — это трехзначный код, который находится на обратной стороне вашей банковской карты. Если появляется ошибка в CVC карты, то рекомендуем проверить, правильно ли вы ввели этот код? Если все правильно, пожалуйста проверьте, введены ли правильно другие данные вашей карты Сбербанка, ВТБ или другого банка.

CVC код нужен для того, чтоб проверить, есть ли у вас на руках данная карта в руках. Данная ошибка значит, что CVC код введен неверно. Просто осуществите оплату повторно и введите все данные верно

Проблема при регистрации токена — как решить?

Проблема при регистрации токена — частая ошибка, которая проявляется на сайте РЖД при оплате билетов.

Токен — это уникальный идентификатор(стока типа 23hjsdfjsdhfjhj2323dfgg), которая формируется когда вы заказываете билет. Это как бы ваша сессия оплаты. Ошибка возникает на стороне сервера оплаты.

Решений может быть два

- Проблемы на сервере РЖД. Сервер оплаты очень занят и перегружен из-за числа заказов. Возможно на нем ошибка. Рекомендуем в этом случае попробывать повторить оплату позднее

- Токен Истек. Это вина того, кто платит. Рассмотрим ситуацию: если вы оформили билет, а потом отошли от компьютера на полчаса, а потом вернулись и нажали оплатить. Ваш заказ аннулирован, т.к. вы не оплатили вовремя. При оплате вы получите ошибку. Нужно заново купить билет и оплатить его в течение 10 минут.

Если ошибка в течение часа сохраняется, рекомендуем обратиться на горячую линию РЖД.

Ошибка банковской карты — карта не поддерживается

Ошибка «карта не поддерживается» может возникать, если вы оплачиваете какую-либо услугу картой другой платежной системы, предоплаченной картой либо же Виртуальной картой. Это не значит, что карта у вас «неправильная», на ней нет денег или еще что-либо. Просто в данном конкретном случае нельзя использовать карту вашего типа. К примеру, виртуальные карты нельзя использовать при оплате в Google Play Market.

Решение простое: попробуйте использовать другую карту. Если ошибка повторится, то обратитесь в службу поддержки интернет-магазина или платежного сервиса, где осуществляете оплату.

Таблица с кодами ошибок при оплате.

Немногие знают, что при оплате картой система обычно выдает код ошибки. Например, E00 при оплате. Иногда по ошибке можно понять, в чем проблема

| Код ошибки и описание |

|---|

| Код 00 – успешно проведенная операция. |

| Код 01 – отказать, позвонить в банк, который выпустил карту. |

| Код 02 – отказать, позвонить в банк, который выпустил карту (специальные условия). |

| Код 04 — изъять карту без указания причины. |

| Код 05 – отказать без указания причины. |

| Код 17 – отказать, отклонено пользователем карты. |

| код 19 — тех. ошибка на стороне банка |

| Код 41 – изъять, утерянная карта. |

| Код 43 – изъять, украденная карта. |

| код 50 — ? |

| Код 51 – отказать, на счете недостаточно средств. |

| Код 55 – отказать, неверно введенный ПИН-код. |

| Код 57 – отказать, недопустимый тип операции для данного вида карты (например, попытка оплаты в магазине по карте предназначенной только для снятия наличных). |

| Код 61 – отказать, превышение максимальной суммы операции для данной карты. |

| Код 62 – отказать, заблокированная карта. |

| Код 65 – отказать, превышение максимального количества операции для данной карты. |

| Код 75 — отказать, превышение максимального количества неверных ПИН-кодов для данной карты. |

| Код 83 – отказать, ошибка сети (технические проблемы). |

| Код 91 – отказать, невозможно направить запрос (технические проблемы). |

| Код 96 – отказать, невозможно связаться с банком, который выдал карту. |

| Код Z3 — онлайн не работает, а в оффлайне терминал отклонил транзакцию. |

Что делать, если с картой все ОК, но оплата не проходит?

Самая типичная проблема, когда оплата не проходит — сбой в банковской системе. В работе банка могут наблюдаться перебои. Это может быть не обязательно ваш банк, а банк который принимает платеж на стороне клиента(которому принадлежит терминал). В этом случае можно дать 2 совета

- Подождать и оплатить позднее. Сбои в работе оперативно решаются и уже через час оплата может пройти без проблем. Обычно о сбоях можно узнать по СМС сообщениям или позвонив на горячую линию вашего банка.

- Использовать другую карту. Если нельзя оплатить одной — нужно попробывать оплатить другой картой. Если оплата и другой картой не проходит, то это скорее всего сбой на стороне, принимающей платеж. Тут остается только ждать.

3 полезных совета при оплате картой через Интернет

Во первых — заведите себе специальную карту. Не используйте для оплаты зарплатную карту, на которой у вас все деньги. Оптимально — кредитная карта. Она позволяет в отдельных случаях вернуть часть суммы покупки(CashBack). Обычно это сумма до 5 процентов от покупки. Будьте внимательны, некоторые сервисы при оплате катой берут комиссии. И конечно же адрес страницы оплаты всегда должен начинаться с https и рядом с адресом должен стоять значок в виде замка(Соединение https).

Во вторых — не держите много денег на карте. На карте должно быть немногим больше суммы, необходимой вам для покупки. Примерно плюс 10% от общей стоимости покупки. Логика проста — с нулевой карты ничего не могут снять.

Делаете покупку — просто пополняете карту в интернет банке и получаете нужную сумму.

В третьих — Делайте оплату картой в известных магазинах. Почитайте отзывы о магазинах на Яндекс.Маркет. Если вы платите картой, будьте готовы к тому, что при отмене заказа могут вернуться на вашу карту не сразу.

В последний раз, когда я делал оплату заказа и потом возвращал заказ и деньги, возврат на карту шел в течение 7 дней. Помните — никто деньги вам сразу не вернет. Будьте готовы ждать.

Популярные вопросы и ответы про оплату

Может ли пройти онлайн-оплата, если вы указали неверный cvv/cvc, но в системе 3d- secure ввели верный код из SMS?

Это вопрос из IT диктанта. Ответ на него ДА, может.

Код cvv/cvc известен только банку, который выпустил карту. И именно банк решает, пропустить транзакцию или нет. Данный код может и не передаваться при оплате, хотя и его нужно будет вводить при оплате. Авторизовать операцию возможно и без данного кода. Т.е. пройдет эта операция или нет — решает банк.

Пройдет ли оплата картой, если неверно ввести ФИО плательщика

ФИО плательщика практически не влияет на успешность оплаты. Можно ввести любое имя, хоть «Котик Вася» и при верном вводе других реквизитов карты оплата пройдет.

Дмитрий Тачков

Работник банка или другого фин. учреждения

Подробнее

Создатель проекта, финансовый эксперт

Привет, я автор этой статьи и создатель всех калькуляторов данного проекта. Имею более чем 3х летний опыт работы банках Ренессанс Кредит и Промсвязьбанк. Отлично разбираюсь в кредитах, займах и в досрочном погашении. Пожалуйста оцените эту статью, поставьте оценку ниже.

76

51

076

9859

116

603

Insufficient funds

Not sufficient funds

Decline, not sufficient funds

— банк-эмитент удерживает дополнительные комиссии с держателя карты. Это может возникать в случаях погашение кредита посредством интернет-платежа, либо если договор на обслуживание банковской карты предусматривает дополнительные комиссии;

— происходит конвертация из валюты покупки в валюту карты. Убедитесь, что средств на карте достаточно для покрытия комиссии за конвертацию валют. Некоторые банки-эмитенты устанавливают комиссии на конвертацию валют как-правило в пределах 1%

50

5

9905

180

Transaction declined

Do not honor

Do not Honour

Transaction declined

Возможные причины:

— карта заблокирована или на ней установлен статус

— на карте не установлен лимит на оплату в интернет, либо этот лимит недостаточный

— сработали настройки системы безопасности банка-эмитента

— сработали ограничения по сумме или количеству операций по карте у банка-эмитента

— банк-эмитент установил ограничения на проведение данного типа транзакций

— по карте не разрешены международные платежи (доместиковая карта)

— банк-эмитент установил ограничение на транзакции с двойной конвертацией валют (DCC)

— банк-эмитент установил ограничения на транзакции в данной валюте

— банк-эмитент установил ограничения на транзакции в данной стране

— банк-эмитент в США ограничил по карте операции в валюте, отличной от USD

— банк-эмитент в США ограничил по карте операции в странах бывшего СНГ и других рисковых регионах

55

055

12

902

9882

9912

Invalid transaction

Invalid transaction card / issuer / acquirer

Decline reason message: invalid transaction

95

095

61

061

121

9861

9863

Decline, exceeds withdrawal amount limit

Exceeds amount limit

Exceeds withdrawal limit

Withdrawal limit would be exceeded

Withdrawal limit already reached

— на карте не установлен лимит операций в интернет или он уже достигнут или будет достигнут с текущей транзакцией

— общий лимит по сумме для операций покупок по карте уже достигнут или будет достигнут с текущей транзакцией

— карта не открыта для расчетов в интернет

— на карте не активирован сервис 3D-Secure из-за чего операции в интернет без 3D-Secure пароля попадают под ограничения банка-эмитента

65

065

82

082

9860

Activity count exceeded

Exceeds frequency limit

Maximum number of times used

— на карте не установлен лимит операций в интернет или он уже достигнут или будет достигнут с текущей транзакцией

— общий лимит по количеству операций покупок по карте уже достигнут или будет достигнут с текущей транзакцией

— карта не открыта для расчетов в интернет

— на карте не активирован сервис 3D-Secure из-за чего операции в интернет без 3D-Secure пароля попадают под ограничения банка-эмитента

57

119

Not permitted to client

Transaction not permitted on card

Transaction not permitted to card

Decline, transaction not permitted to cardholder

Transaction not permitted to card

Not permitted to client

Decline, transaction not permitted to cardholder

Function Not Permitted To Cardholder

Банк эмитент отклонил транзакцию так как она не может быть осуществлена для этой карты или клиента.

Возможные причины (более детально смотрите по банку-эквайеру выше):

— данный карточный продукт не рассчитан для такого типа операции

— для данной карты не настроен такой тип операции на стороне банка-эмитента

58

120

Decline, transaction not permitted to terminal

Not permitted to merchant

The requested service is not permitted for terminal

Function Not Permitted To Terminal

Txn Not Permitted On Term

211

N7

9881

Bad CVV2

Decline for CVV2 Failure

CVV2 is invalid

Invalid CVV2

Decline Cvv2 failure

CVV2 код также может называться CVC2, CID, CSC2 код.

В некоторых случаях такой код отказа может возвращаться и при вводе неверного срока действия карты.

Стоит обратить внимание, если банк эмитент использует динамический код CVV2, генерируемый на короткий промежуток времени в клиент-банке — срок жизни такого CVV2 кода мог истечь на момент совершения операции

058

59

059

62

062

9858

104

Restricted card

Restricted status

Decline, restricted card

Card is restricted

Your card is restricted

— операции по карте в данном регионе/стране не разрешены

— на карте установлен статус, ограничивающий платежи

— для карты не доступны интернет-платежи

56

056

Отказ может возникать в таких случаях:

— оплата картой локальной платежной системы за рубежом. Например картой платежной системы МИР за пределами РФ, картой платежной системы ПРОСТИР за пределами Украины

— оплата картами оплата AMERICAN EXPRESS, Diners Club,JCB, China Union Pay, Discover которые не поддерживаются платежным провайдером

— оплата картой Monobank в счет микро-кредитной организации (погашение кредита), либо выдача кредит. Монобанк блокирует операции в адрес МФО по некоторым типам карт

Монобанк, если карта этого банка

100

1000

Decline (general, no comments)

General decline, no comments

General decline

54

101

Expired card

Decline, expired card

Expired card

Pick-up, expired card

Card expired

— срок действия карты закончился

— указан неверный срок действия карты

— карта была перевыпущена с новым сроком

14

111

9852

1012

305113

Card number does not exist

Invalid card number

No such card

Decline, card not effective

Invalid card

Wrong card number

— неверный номер карты

— карта не действительна

— оплата картой локальной платежной системы за рубежом. Например картой платежной системы МИР за пределами РФ, картой платежной системы ПРОСТИР за пределами Украины

— оплата картами оплата AMERICAN EXPRESS, Diners Club,JCB, China Union Pay, Discover которые не поддерживаются платежным провайдером

— операции по карте в данном регионе/стране не разрешены

— на карте установлен статус, ограничивающий платежи

909

42

7

07

108

9875

207

42

External Decline Special Condition

Special Pickup

Pick up card (special)

Pick up card, special condition (fraud account)

Pick-up, special conditions

Decline, refer to card issuer’s special conditions

122

63

89

Decline, security violation

Security violation

— карточный счет заморожен или заблокирован

— ограничения правил безопасности (система Antifraud на стороне любого из участников)

Банк-эквайер (банк, обслуживающий торговую точку) или к платежному провайдеру

200

76

114

21

Invalid account

Decline, no account of type requested

No To Account

— счет карты закрыт или заблокирован

— по счету запрещены расходные операции

— карта не действительна

— неверный номер карты

— оплата картой локальной платежной системы за рубежом. Например картой платежной системы МИР за пределами РФ, картой платежной системы ПРОСТИР за пределами Украины

— оплата картами оплата AMERICAN EXPRESS, Diners Club,JCB, China Union Pay, Discover которые не поддерживаются платежным провайдером

— операции по карте в данном регионе/стране не разрешены

— на карте установлен статус, ограничивающий платежи

— карта не предназначена для расчетов в интернет

74

074

907

911

910

9872

91

291

82

908

810

Unable to authorize

Decline reason message: card issuer or switch inoperative

Destination not available

Issuer or switch inoperative

Issuer unavailable

Time-out at issuer

Decline reason message: card issuer timed out

Decline reason message: transaction destination cannot be found for routing

Transaction timeout

Ошибка связи: таймаут

Недоступен эмитент/эквайер

Таймаут при попытке связи с банком-эмитентом. Как правило такая ошибка возникает при проблемах технического характера на стороне любого из участников: банка-эквайера, банка эмитента, платежной системы Visa/MasterCard/МИР.

В первую очередь необходимо обратиться в банк-эквайер для выяснения причины и определения, на чьей стороне неисправности.

Банк-эквайер (банк, обслуживающий торговую точку) или к платежному провайдеру

Банк-эмитент (при получении 91 кода)

15

815

92

No such card/issuer

No such issuer

Invalid Issuer

811

96

0

4

04

44

43

200

104

Pick-up (general, no comments)

Pick up card

Your card is restricted

Hot Card, Pickup (if possible)

Hold — Pick up card

Pick-up, restricted card

Pick-up, card acceptor contact card acquirer

Также причиной может быть то, что карта только что выпущена и первой операцией для нее должна быть операция смены PIN-кода

205

110

13

567

9913

9867

Invalid advance amount

Decline, invalid amount

Invalid amount

— слишком маленькая сумма. Если карта открыта в валюте, убедитесь, что сумма транзакции не менее 1 цента доллара США или 1 Евро цента

— слишком большая сумма

— из суммы транзакции невозможно удержать сумму комиссии платежного провайдера. Убедитесь, что сумма транзакции не меньше суммы всех комиссий

— ограничения на карте плательщика на стороне банка, который выпуcтил карту.

— достигнуты лимиты на стороне банка-эквайера.

948

102

202

9934

59

Suspected fraud

Decline, suspected fraud

Также, возможно, что банк-эмитент заблокировал карту/счет в связи с подозрительными действиями, скиммингом, компрометацией

800

904

30

030

9874

574

Format error

Decline reason message: format error

41

540

208

9840

Lost Card, Pickup

Pick up card (lost card)

Lost card

Lost card, pick-up

Pick-up, lost card

93

124

Violation of law

Decline, violation of law

909

96

Decline reason message: system malfunction

System malfunction

01

02

107

108

Refer to card issuer

Decline, refer to card issuer

Decline, refer to card issuer special conditions

Refer to issuer

Также причиной может быть то, что карта только что выпущена и первой операцией для нее должна быть операция смены PIN-кода

43

209

057

9841

Pick up card (stolen card)

Pick-up, stolen card

Stolen card

Stolen card, pick-up

Lost/Stolen

Lost or stolen card

6000

106

Pre-authorizations are not allowed within this context.

Merchant is not allowed preauth

03

3

109

9903

20003

Invalid merchant

Decline, invalid merchant

Также причиной может быть некорректно переданный идентификатор мерчанта в транзакции

If you have problems paying for Google products, you might need to fix a problem with your payments profile.

Find the issue you’re experiencing below:

«Your transaction cannot be completed»

A variety of different situations may trigger this message. Try these suggestions to resolve the issue:

- If this message is followed by instructions for submitting additional information to us, please do so. The other steps listed are unlikely to resolve this issue.

- Check whether the billing address for your payment method (such as a credit card) matches the address recorded in your Google payments center settings. If they don’t match, update your address in your Google payments center, and try the transaction again.

- Try using a Google Play gift card to complete the transaction.

- Try using the best interface for your computing device:

- If you’re using a desktop computer, try the transaction using the Google product’s website.

- If you’re using a mobile device, try using the product’s mobile app (if an app is available).

- If you’re using guest checkout when the error occurred:

- Try signing in to an existing Google account and placing the order again.

- Try creating a new Google account if you don’t already have one and visiting the Google Store to try the transaction again.

«Unable to complete transaction: Expired card»

Check to see if your payment method is up to date. If it isn’t, update it in the Payments center.

«Unable to complete transaction. Please use another form of payment.»

Note: These steps also apply if you see the error message «Your payment didn’t go through. Please try a different payment method or try again later.»

Try the following:

- Check to see if your payment method is up to date. If it isn’t, update it in the Payments center, then try your purchase again.

- Make sure you have enough money in your account for the purchase.

- If you’re still having issues, contact your bank to see if there’s a problem with your account.

- Try making the purchase again with a different payment method.

«Your payment was declined due to an issue with your account»

If you see this message, it might be because:

- We saw a suspicious transaction on your payments profile.

- We need a little more information to protect your account against fraud.

- We need a little more information to comply with EU law (European customers only).

To fix the issue, try the following:

- Go to the Payments center.

- Take action on any errors or requests in the payments center.

- You might need to verify your identity before you can buy anything through your Google Account.

- Make sure your name, address, and payment information are up to date.

«Unable to process payment: Low card balance»

You might not have enough funds in your account to make the payment. Check your account balance or contact your bank.

Ineligible or unavailable credit or debit card

Card is grayed out & says “verify on pay.google.com”

Your card was reported as stolen. You must verify the card before you can use it again:

- Go to pay.google.com and sign in to your account.

- If you have multiple accounts, sign in to the account with the grayed-out card.

- Click Payment methods.

- Next to the card that says “Verification needed,” click Verify

Charge card.

- Within 2 days, you’ll find a temporary charge on your card statement along with an 8-digit code.

- To complete verification, go to pay.google.com and enter the 8-digit code.

If you try to verify the payment method again:

- Confirm which card you want to verify.

- Check how long ago you tried to verify your card.

- If less than 2 days: Wait up to 2 days.

- If more than 2 days: Check your card statement. You should find a temporary charge from Google called “GOOGLE TEST,” with an 8-digit code.

Card is grayed out & says “card is ineligible”

You can’t use this card for this purchase. Try to make the purchase again with a different card.

If the card you want to use isn’t listed, follow the on-screen instructions to add a new card.

Closed payments profile

Learn more about what to do if you temporarily or permanently closed your payments profile.

If you’re still having trouble, contact support.

Was this helpful?

How can we improve it?

This article gives some more information on common transaction declined status codes and reasons, to help understand why transactions have not been successful

Some steps to understand why a payment has failed

- Look at the payment type (summary of payment types given below)

- Check the return/reason code

- View this article to see why the transaction may have failed

Click on the transaction and view the «summary» information, to find the return code.

Please note that these reasons may not always be 100% applicable. This is based on majority of cases seen, for the respective return code — Download the Full List of Available Return Codes (000.000.000 to 999.999.999) at the bottom of this article.

Return codes and typical explanation of failures

| CODE | REASON | EXPLANATION | WHAT TO TELL YOUR CUSTOMER / PAYER |

| 800.100.152 | Transaction declined by authorization system | The risk system of issuing bank (customers bank) has declined the transaction/s for account-related reasons, examples are listed below:

|

Your transaction was declined for the following reason:

Please note, your bank has rejected the transaction/s for account related reasons. If you are using a Virtual Card, please ensure the card is enabled/active on your banking app. We ask that you please contact your bank, as further detail on the reason for the failed transaction can only be communicated/explained to a customer by the customer’s bank. This information is privy only to customer and his/her bank. |

| 100.380.401 | User Authentication Failed | Incorrect OTP. This return code signifies that the bank’s system was unable to authenticate the user | Your transaction failed due to the OTP details either:

not entered correctly, Therefore your bank was unable to successfully authenticate you and process the transaction. |

| 100.396.103 | Previously pending transaction timed out | The registration transaction (RG) was not authenticated and timed out. The debit references the registration token and hence this may also fail. |

See explanation for 800.100.152 |

| 100.380.501 | Risk management transaction timeout | The customer probably did not enter their OTP or possibly did not get shown the 3Dsecure page because something on the customer’s browser was blocking the 3DSecure page from loading:

If the card is 3D enabled, it should get an OTP during the Authentication phase of the payment. Sending out OTP is something the customers’ bank 3D server handles. We can’t tell if an OTP is sent out and we have no control in the 3D authentication process. It’s entirely handled between the customer and their issuing bank. The customer’s bank also authenticates the payment if the correct OTP is entered. Once completed, we then receive a successful payment response. In other cases, if the customer is enrolled for 3D, but during payment, they are not redirected to the 3D page, it could mean there is something wrong with their bank’s 3D server at the time. We waited for the customers’ bank to present the 3D secure page so they could authenticate, it didn’t happen, then the payment timed out. See here for a more technical explanation.NB — We can’t know upfront if the card is enabled for 3D Secure. |

Your transaction was declined for the following reason:

Possibly not entering in the OTP on time or |

| 100.390.112 | Technical Error in 3D system | This occurs when there is an error with the 3DSecure process at the bank. It could be that their 3DSecure system was down at the time. | Your transaction was declined for the following reason:

There could be an issue with the bank 3D server/transaction approval server |

| 100.100.101 | invalid credit card, bank account number, or bank name | See the suggested response to the right | Please note that your transaction failed due to either: Credit card number entered incorrectly and/or Bank Account Number entered incorrectly and/or Bank name entered incorrectly and/or Credit card not activated for online transactions Please try again and/or contact your bank. |

| 100.100.700 | invalid cc number/brand combination | If this happens it usually means that your customer is entering all the digits found on the reverse side of their card. However, they only need to enter the last few digits: For Visa/Mastercard: last 3 digits For AMEX/Diners: last 4 digits (if you have AMEX transactions activated — the default is AMEX is NOT ACTIVATED unless specifically requested by Merchant) Clearly specify to customers during the checkout phase how many digits they should enter in the CVV/CVC field Suggestion: |

Please note that your transaction failed due to either: Credit card number entered incorrectly and/or The credit card is not activated for online transactions and/or The type of credit card is not accepted Please provide the following information for further assistance: Issuing Bank Credit Card Country of issue of Credit card |

| 800.100.153 | transaction declined (invalid CVV) | The card might not be enabled for Online Transactions or the customer is using the wrong numbers/doesn’t know what a CVV number is.

We can’t know exactly what the issue so see the suggested answer to the right |

Please note that your transaction has been declined due to either: an invalid CVV number being entered or, no CVV number entered If you entered your CVV correctly and still had your transaction declined please contact your bank and inform them that you are unable to make E-Commerce transactions. |

| 800.100.169 | transaction declined (card type is not processed by the authorization center) | See the suggested response to the right. | Transaction failed due to either: The bank card is not enabled for online transactions or The bank card type is foreign registered & not VISA or Mastercard or There could be an issue with the bank 3D server/transaction approval server Please try again if you know your bank card is activated for online transactions or contact your bank for further assistance. |

| 800.100.155 | transaction declined — amount exceeds credit | The risk system of issuing bank (customers bank) has declined the transaction/s for account-related reasons, examples are listed below:

|

Please be advised that these transactions failed due to insufficient funds / exceeding the credit available on the customer’s card/account. It is likely that the customer has exceeded their available funds or the limits set on their banking app. |

| 100.150.203 | Registration is not valid, probably initially rejected | When this Result code occurs this would mean that when the customer tried to register their card for the payment there was either no data or incorrect data provided on Registering so this would be rejected by the issuing bank | Please be advised for this transaction that the initial phase of this transaction failed which was Registering It would either mean one of the following points occurred: The Registering of the card contained no Account holder data If they do not succeed they would need to reach out their issuing bank |

| 800.100.170 | Transaction declined (Transaction not permitted) | This is a failure with the issuing bank and the cardholder will need to find out from their bank was caused the transaction to fail. | The transaction was declined from the issuing bank of the Customer. This means that the issuing bank could not process this transaction due to some rules applied to their system Please contact your bank, as further detail on the reason for the failed transaction can only be communicated/explained to a customer by the customer’s bank. This information is privy only to the customer and his/her bank. |

| 800.100.162 | Transaction declined (Limit exceeded) | When this Result code occurs this would mean this is a limit set by the customer’s issuing bank

|

Please be advised that this transaction failed with the Result Description as the Limit was exceeded.

This error means that the transaction will bring the customer’s bank balance below the limit set by their bank or they have exceeded their transaction limit for that day The Customer would need to check their daily limits/available funds in their account to proceed with the transaction |

| 100.390.107 | Transaction rejected | The transaction failed as it was rejected by their issuing bank, see below possibilities:

Either cardholder or card issuing bank is not 3D enrolled or The customer would need to reach out to their bank to check if they are enrolled on 3D Secure alternatively |

Please advise that the transaction failed due to one of the following reasons:

Either cardholder or card issuing bank is not 3D enrolled or The Customer would need to check with the issuing Bank if they are enrolled on 3D Secure alternatively |

| 800.100.203 | Card has insufficient funds | When this Result code occurs this would mean the Customers card has insufficient funds when they tried to do an online transaction.

They would need to check if they have sufficient funds in their account before doing online transactions. |

Please be advised that the transaction failed with the following Result Description, «Insufficient Funds»

Please advise the Card Holder they he/she should have sufficient funds available in order to do Online transactions. If they need any other information or assistance they would need to contact their bank. |

| 800.100.100 | Transaction Rejected by Issuing bank | This would mean that when the customer tried to do a transaction where there was either no data or incorrect data provided on Registering so this would be rejected by the issuing bank | Please be advised that the transaction declined for an unknown reason (800.100.100) — This is an error message from the Issuing/Customer Bank.

Please advise the customer to reach out to their bank for more information regarding this failure. |

| 100.100.303 | Card expired | This would mean that the card might not be enabled for Online Transactions or the customer is using the wrong numbers/doesn’t know what a CVV number is.

We can’t know exactly what the issue so see the suggested answer to the right |

Please note that this transaction failed with the Result Description, «Card expired».

Please advise the Customer that they tried to transact when their Card was picked up as an Expired Card. |

| 800.140.112 | Maximum number of registrations of email per credit card number exceeded | When risk setting is enabled it only allows one email per card number.

This occurs when trying to register a card and email that was already used. Please advise the customer that they should either use their registered email or use a new email when registering with an email. |

Please be advised that we picked up that the Cardholder perhaps tried to register or transact with a different email on the same card number.

This is usually a setting that is enabled on the Merchant’s Website/Business. Please advise the customer that they should use one email per card number. |

| 800.100.165 | Transaction declined (card lost) | Transaction declines occur when the customer’s card issuer or bank does not authorize the transaction, for reasons such as possible fraud, invalid account information, or a lost or stolen card.

In such instances, the customer will have to contact their bank or card issuer immediately to take corrective measures |

Please be advised that we have checked the transaction and the Result Description we received from the Issuing Bank was «Transaction Declined.

In this case, the customer will need to reach out to their bank to find out why the transaction was declined. |

| 800.100.157 | Wrong expiry date entered | The transaction failed due to the customer entering the wrong expiry date which is on the customer’s bank card.

Please advise the customer should double-check their card details before doing online transactions. Please refer to this article explaining the different card numbers, https://peachpayments.freshdesk.com/a/solutions/articles/47001211101 |

Your transaction was declined for one of the following reasons:

One of the following numbers has been entered incorrectly: — Card Number Please double-check the numbers above when doing online transactions» |

| 800.100.151 | Transaction declined (invalid card) | This could mean one of the following reasons from the issuing bank, See below examples:

— The customer’s card might be expired Please advise the customer that they should check with their bank on why the failed the transaction as |

Please be advised that this transaction failed due to a response from the Issuing Bank with a description of «»Invalid Card»»

This could mean one of many things from the issuing bank, See below examples: The customer’s card might be expired In conclusion, please advise the customer that they should check with their bank on why the failed the transaction as |

| 800.100.174 | Transaction declined (Invalid Amount) | This means that the customer is trying to do online payments but exceeding the amount they are allowed to transact with.

The customer would need to check their Daily limits for online transactions before they want to do an online transaction |

Upon further investigation, I could see that the transaction failed with the Result description, Invalid amount.

Please note that the transaction is failing because the Customer exceeded their daily limit. Please advise the customer that they should check their daily limit for Online transactions before transacting with their bank or on their banking app settings. |

| 800.100.171 | Transaction declined (pick up card) | This transaction was rejected by the customer bank because the card has been flagged either as

|

Upon further investigation, we could see that this transaction failed with the result description, Transaction declined (Pick up card).

This could mean one of the following:

In conclusion, you would need to reach out to your issuing bank in order for them to provide you with a reason why this card has been flagged as a pickup card |

| 800.100.158 | Transaction declined (suspecting manipulation) | When this Result code occurs this would mean this is a limit set by the customer’s issuing bank, see below for possible reasons:

This information is privy only to the customer and their bank. |

Upon further investigation, we could see that this transaction failed with the result description, Transaction declined (suspecting manipulation).

This could mean one of the following:

In conclusion, you would need to reach out to your issuing bank in order for them to provide you with a reason why this card has been flagged as fraudulent. |

| 800.100.100 | Duplicate transaction | When this Result code occurs this would mean that the issuing bank has picked either one of the following from a previous transaction:

This would need to be raised with ACI and the acquiring bank of the merchant and they would need to investigate further and advice |

Upon further investigation, we could see that this transaction failed with the Duplicate transaction.

This could mean one of the following:

The Payment Gateway would need to reach out to the acquiring bank in order for them to provide them with a reason why this card has been flagged as a duplicate transaction |

| 800.100.168 | Transaction declined (restricted card) | When this Result code occurs this would mean that the issuing bank has picked either one of the following from a previous transaction:

The customer would need to check this with their issuing bank |

Upon further investigation, we could see that this transaction failed with the result description, Transaction declined (restricted card).

This means the following:

In conclusion, you would need to reach out to your issuing bank in order for them to provide you with a reason why this card has been flagged as a restricted card. |

| 100.396.101 | Canceled by User | This result code occurs when an end user is canceling in one of the processes of a online transaction, here are a few reasons below why an end user would do this:

The suggestion would be to not close the browser when transacting or to wait a while if their internet is slow. |

Upon further investigation, I could see that the transaction failed with the Result description, Canceled by user.

The suggestion would be to not close the browser when transacting or to wait a while if your internet is too slow. |

Sooner or later, all merchants will experience a credit card being declined. While it may be embarrassing for the customer, knowing how to address a decline can make or break the customer experience.

Credit card declines happen when a payment can’t be processed for one reason or another. In response to a decline, your reader will display an error code.

Credit card error codes explain why a transaction was declined, which can help merchants provide advice and support to customers. All credit card processing codes are universal; therefore, they will not differ between point of sale (POS systems).

Here’s what you need to know about the list of credit card declined codes and what each one means.

What are Credit Card Decline Codes?

Visa declined codes and MasterCard declined codes will appear on your POS system whenever a customer’s card is declined.

Transactions may be declined by the processor, the payment gateway, or the issuing bank. The merchant sees only the credit card declined reason code and an error message.

Processors assign these codes to transactions to inform merchants why a particular transaction was declined.

Credit card declines can be separated into two major categories:

- Soft Decline – The issuer has approved the payment, but there’s another problem with the transaction. With a soft decline transaction, retrying the transaction often resolves the issue.

- Hard Decline – These declines occur when the issuing bank refuses to authorize the transaction. There’s typically nothing the merchant can do other than ask whether the customer has another credit card they can use.

Because soft declines are typically temporary, it’s perfectly acceptable to retry the transaction. Hard declines, on the other hand, should never be met with a “brute force” transaction.

Brute forcing a transaction can lead to future credit card chargebacks. If this occurs, you have no recourse, and you’ll be left paying out-of-pocket.

Whenever you resolve a soft or hard decline, it’s always a good idea to keep a record of the action taken in case you need to fight a chargeback dispute at a later date.

Familiarizing yourself with different credit card processing decline codes allows you to protect your business and better support your customers.

Common Reasons Credit Cards are Declined

When credit card declined codes appear, there are many potential causes and possible courses of action.

Here’s a brief overview of the most common reasons credit cards are declined:

- The customer has reached their credit limit

- A purchase was flagged as fraudulent

- The customer already has a large pending transaction

- The credit card has expired

- An account has been closed

The customer themselves can only solve most instances of a credit card decline, so it’s important to be able to provide your customers with the right advice whenever credit card declined reason codes appear.

List of Credit Card Decline Codes

While it may be unreasonable to expect cashiers to remember all credit card authorization response codes, categorizing them appropriately can indicate the right course of action.

It’s important to understand the merchant doesn’t get the full story, even when they receive a decline code. Often, the only thing a merchant can do is retry the transaction (when safe to do so) or encourage the customer to contact their issuing bank.

Let’s examine the various categories of credit card machine error codes.

Call/Decline Codes

When a credit card reader flashes a “CALL” or “DECLINE” code, it indicates that the issuing bank is not permitting the transaction to go through.

There are a variety of reasons this might be the case. The correct course of action is to request that the customer call their bank or use an alternative payment method.

To provide stellar customer service, you can offer to reserve your customer’s items for them for a limited time. Doing your best to accommodate a red-faced shopper can potentially get you a regular.

- 01/Refer to Issuer – There’s something wrong with the card number. The customer should contact the issuing bank.

- 02/Refer to Issuer, Special Condition – Similar to 01, the issuing bank is refusing the transaction. 02 often appears if the customer is making a larger-than-usual purchase or they’ve been traveling. Either way, the customer should contact their issuing bank.

- 04/Pick Up Card (No Fraud) – The card has been reported lost or stolen but not flagged for fraud. This code requests the merchant pick up the card and contact the issuing bank.

- 05/Do Not Honor – The issuing bank will not allow the payment to proceed. The customer is advised to contact their issuing bank.

- 51/Insufficient Funds – The card does not have the necessary funds available to make the full payment.

- 54/Expired Card – The card has expired and cannot be used.

- 57/Transaction Not Permitted, Card – The card cannot be used with this type of transaction. Provide the customer with the transaction details and ask them to contact the issuing bank to authorize the transaction.

- 65/Activity Limit Exceeded – The customer’s withdrawal frequency limit has been exceeded. Ask them to use another card or complete the purchase after limits have been refreshed.

- 93/Violation, Cannot Complete – There is a problem with the customer’s account, and they should contact their issuing bank or use another card.

Hold-Call Codes

Hold-call codes are more serious because they could indicate the credit card has been used fraudulently. In all instances of a hold-call code, the merchant is required to take the card and report it to the issuing bank (usually by calling a toll-free number).

When these credit card error codes are spotted, the business should not honor any transaction or provide any services.

- 07/Pick Up Card, Special Condition (Fraud Account) – The issuing bank has found the customer’s account to be fraudulent.

- 41/Lost Card, Pick Up – This card has been reported as lost. Don’t run the card a second time and don’t serve the customer. If this occurs during a recurring payment, contact the customer.

- 43/Stolen Card, Pick Up – This card has been reported as stolen. Again, don’t provide any goods or services to the customer, retain the card, and immediately report it to the issuing bank.

Credit Card Error Codes

Credit card error codes are more difficult to resolve because they encompass a wide range of potential problems. Usually, credit card machine error codes indicate a problem with your POS system. We recommend having this list handy to avoid the customer getting frustrated.

- 00/Issuer System Unavailable – A temporary communication issue. This can often be resolved by waiting a few minutes and attempting the transaction again.

- 12/Invalid Transaction – The attempted transaction is incorrect or incorrect configuration of payment batches. This often happens when businesses are attempting to issue refunds to the customer’s credit card.

- 13/Invalid Amount – Data entry error. Code 13 occurs when the merchant enters an incorrect symbol or a negative dollar amount.

- 14/Invalid Card Number – Cashier has incorrectly entered the customer’s card number. Clear all fields and enter the string of digits again.

- 15/No Such Issuer – This code is unique to AMEX, Discover, Visa, and MasterCard. They will each start with a different string of digits, but they will all contain “15” at the end. This error occurs when the initial numbers entered fail to match the card type.

- 19/Re—Enter – An unknown error has occurred. The only option is to attempt the transaction again.

- 28/File is Temporarily Unavailable – A glitch has occurred during authorization. Retry the transaction or contact the issuer.

- 58/Transaction Not Permitted, Terminal – Occurs when the merchant processing account is not configured to accept the transaction. Contact your POS issuer to reconfigure your terminal.

- 62/Invalid Service Code, Restricted – Error code 62 occurs when your POS doesn’t accept AMEX or Discover cards. It can also appear when a customer attempts to pay online with a card that isn’t authorized for online payments.

- 63/Security Violation – CVV code was read incorrectly. Retrying the transaction without the CVV code usually works. Inform the customer about this just in case the transaction is subsequently flagged as fraudulent.

- 85/No Reason to Decline – Unexplainable error has occurred. Retry the transaction or contact the issuer.

- 91/Issuer Switch is Unavailable – No specific reason why an error was encountered. Either contact the issuer or your payment processor.

- 93/Violation, Cannot Complete – A problem has occurred with the customer’s account. Ask for an alternative payment method.

- 96/System Error – A system error has occurred. Wait a couple of minutes before retrying. If the error persists, contact your payment processor.

- R0 or R1/Customer Requested Stop of Specific Recurring Payment – This error occurs when a customer has canceled a recurring payment with your business. Contact the customer to make sure this wasn’t a mistake or an outdated card.

How to Train Employees in Detecting and Acting on Credit Card Decline Codes

This long list of credit card declined codes can be daunting for employers. It’s unreasonable to expect cashiers to remember every code and what to do if one appears.

Instead, keep a reference sheet alongside your POS to help cashiers instantly look up each code and what to do in that specific situation.

In the event a hold-call code appears, it’s strongly recommended that you only confiscate the card if it’s safe to do so. Either way, the presence of a hold-call code should be reported, and information sent to the relevant authorities.

Make sure support phone numbers for your POS provider are readily available in case the problem has something to do with your system.

POS problems often occur during the setup process and a simple reconfiguration with the support of your provider can get you up and running again.

Conclusion