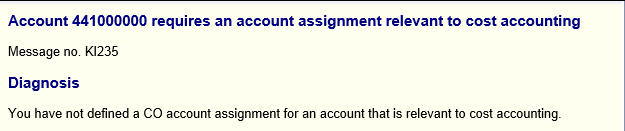

What can you do if the system displays error message KI235?

Check the account determination:

An account assignment is required not only for consumption postings (GBB) but also for price differences (PRD/AUM).

Certain account groupings should not be assigned to a cost element:

- GBB VAX (goods issues for sales orders without account assignment object)

- GBB VQP (sampling without account assignment)

Check field selection (T156B.OMBW, OMCJ, OMJA, centrally via Transaction OMJJ):

Check whether the field selection of the movement type is set correctly. At least one account assignment field should be ready for input.For special stock E/Q:see Note 117596. For Transaction MIGO Release 4.6C, the Enjoy field selection should be maintained.

‘Check account assignment’ field (T156X-XPKON.OMWN, centrally via Transaction OMJJ)

An account assignment is only copied for the accounting line (GBB/KBS) with the indicator ‘Check account assignment’.SAP recommends that you do not set the indicator for other lines (PRD/AUM) (see above). Use Transaction OKB9 for the PRD line

Check automatic account assignment (Transaction OKB9)

If no manual entry is possible, an automatic account assignment can be defined.Check that an automatic account assignment is defined for the account in the company code.

Remember that an automatic account assignment is only possible if the account assignment is not a required entry field, as the required entry field check forces you to make a manual entry.

Check automatic account assignment per business area:

— the business area field must be ready for input (field selection)

— the material must have a division (MARA-SPAR)

— the combination valuation area/division must be maintained (T134H)

Check the automatic account assignment per profit center:

— the field profit centers must be ready for input (field selection)

— the material must have a profit center at the plant (ARNB PRCTR)

Problems with profitability segment:

check Notes 70159, 75653, 80466 and 95031

Goods receipt for subcontract order:

Set the field selection of movement type 543 — 546 so that you can maintain a manual account assignment in Transaction MB01 (or Release MIGO as of Release 4.6C) for the components.This is not possible in Transaction MIGO Release 4.6B (see Note 213318). For Transaction MB01, the classic field selection (as of 201) should be maintained for Transaction MIGO the Enjoy field selection.

For a purchase order with account assignment, the account assignment of the main line can be passed on to the components: see Note 68105.

Transfer posting with non-valuated material:

Check that no valuation class is maintained in the material master of the material (accounting view).Also make sure that you implemented Note 158220 in your system.

Cancellation GR from Release 3.1:only via Transaction MB01 102 (note in process)

Просмотр нерешенных тем

Сообщения без ответов | Активные темы

| Автор | Сообщение |

|---|---|

|

Гость |

Заголовок сообщения: Ошибка KI235 при проводке амортизации (AFAB)

|

|

Гость |

Добрый день!! В 5.0 при проведении внеплановой амортизации через AFAB выдается ошибка KI235: «Счет & требует соответствующей учету затрат контировки». При этом в карточке ОС МВЗ указано (интервал времени прописан для МВЗ нормально). Вроде уже все проверила..но ошибка остается.

|

| Вернуться к началу | |

|

Lys |

Заголовок сообщения:

|

|

|

МВЗ не блокировано для проводок?

|

| Вернуться к началу |

|

|

Natka |

Заголовок сообщения:

|

||

|

U menya tochno takaya je oshibka voznikla pri provodke amortizatsii. Zdesi nujno libo prisvoiti KOSTL v ‘additional account assignment objects’ libo posmotreti kak sozdan schet. On ne doljen byti sozdan kak cost element.

|

||

| Вернуться к началу |

|

||

Кто сейчас на конференции |

|

Сейчас этот форум просматривают: нет зарегистрированных пользователей |

| Вы не можете начинать темы Вы не можете отвечать на сообщения Вы не можете редактировать свои сообщения Вы не можете удалять свои сообщения Вы не можете добавлять вложения |

SAP Sales & Distribution deals with sales to customers. So it a process where sales is made to customer against sales order and revenue is realized. That,s why SD is also called O2C (Order to Cash).

O2C consist of Order, delivery & billing. At the time of Sales Order creation there is no Accounting document. Accounting document is creating when goods issue is posted. So FI integration with SD starts from Outbound delivery PGI (Post Goods Issue)

1. Preparation for SD-FI Integration

We will create the sales order first . Then on the basis of sales order, we will create outbound delivery. At the time of goods issue to outbound delivery, system posts the respective amount to the corresponding GL account. This is SD-FI integration area.

We have customized our sales cycle as below. Sales Order (YOR) –> Outbound Delivery (YOBD) –> Billing (YF2) Note : Please check the below post to see the configuration of all the above three sales documents step by step Configure SAP S4 HANA Sales Documents in 10 Minutes To Check the SD-FI integration we need to reach till outbound delivery creation & subsequently PGI to outbound delivery.

1.1 Creation of Sales Order & Outbound Delivery

In the below post the process of sales order creation, Outbound delivery creation & subsequently PGI (Post Goods Issue) has been explained step by step.

Please check the below post thoroughly before proceeding further to SD-FI integration An Ultimate guide to Sales Order in SAP S4 HANA SD

2. SD-FI Integration starts From PGI of OBD

In the above post we have explained that since SD-FI configuration is still not done, so as soon as we tried to post goods issue to outbound delivery, system throws the below error.

2.1 Accounting entries at PGI

At the time of goods issue , stock is lessened by the quantity & value equal to the quantity & value of goods issue.

The offsetting entry is done on COGS (Cost of Goods Sold) account

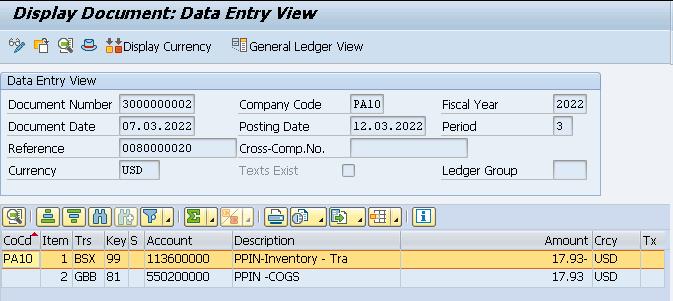

Accounting entries at the time of Goods issue Cr Stock Account (-) Dr COGS (Cost of Goods Sold) (+) --> Stock account is credited on the basis of BSX key configuration from OBYC setting of MM-FI configuration. Please check the below post to see the step by step configuration of BSX Ultimate guide to configure S4 HANA MM-FI Integration For our car business BSX posting is done on GL 113600000 (Inventory Trading goods) Please click HERE to check the creation of GL account 113600000 --> COGS account is debited on the basis of GBB-VAX key. We will configure GBB-VAX key it in the next section.

As soon as we tried to post goods issue system throws the error due to absence of SD-FI integration configuration

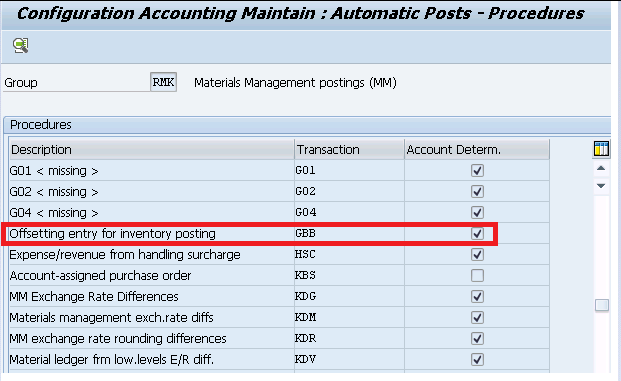

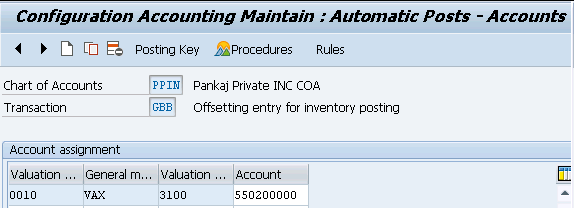

2.1.1 First Error M8147 -Account determination for entry PPIN GBB not possible

This error is coming because of absence of configuration of inventory offsetting. We need to configure account determination of VAX key

VAX: for goods issues for sales orders without account assignment object (the account is not a cost element)

COGS account at the time of goods issue is determined based on this key.

For our car business GBB-VAX posting is done on GL 550200000 (PPIN-Cost of Goods Sold (Trade w/o Cost Element).

Please click HERE to check the creation of GL 550200000 step by step

Start OBYC and double click on GBB

3. Now try to post Goods Issue again

After GBB VAX configuration now try to post PGI again

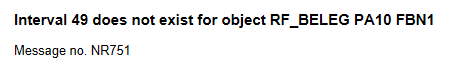

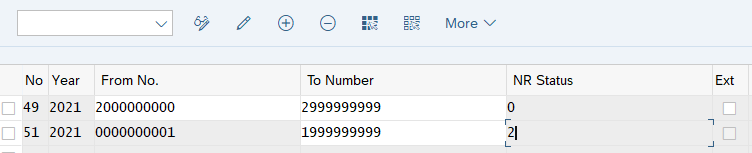

3.1 Error NR751

3.1.1 Number Range 49 Maintenance for object RF_BELEG

Try PGI now

PGI is done successfully this time

Material document & accounting document is generated

3.2 FI Postings (SD-FI Integration OBD PGI Part)

System creates a material document to update the quantity in the Plant/SLOC. On the back of it, system generates an accounting document to post the values on the respective GL accounts.

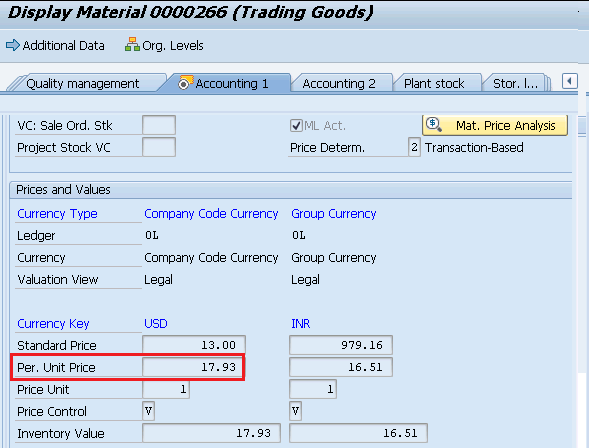

3.2.1 Reminder -Check the FI document above in light of the Material Pricing

Check the material price i the material master “Accounting 1” view.

4. Account Determination in SD

Account determination in SD is also called revenue account determination

Revenue account determination in SD is a process to determine the relevant revenue accounts to which prices, discounts, and surcharges are posted. The system uses conditions to determine the relevant accounts.

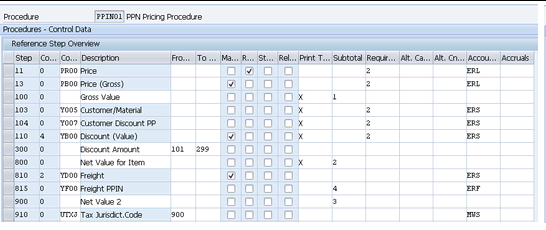

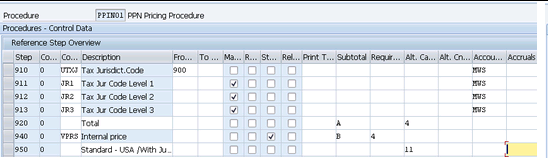

We have configured our own customized pricing procedure in the post below

The Ultimate SAP S4 HANA Sales Pricing Guide with FAQ

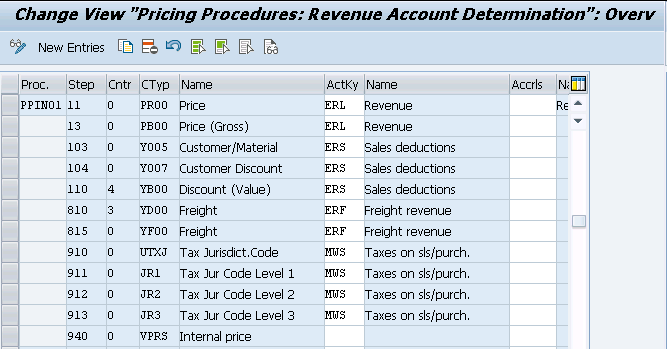

Account Keys (for example ERL, ERS, MWS etc. in the above screenshot) are assigned to the different conditions in the pricing procedures.

Condition technique is used for account determination to allocate the correct general ledger account to the account keys as assigned in the pricing procedure. So determination procedure to find the accounts, called the account determination procedure.

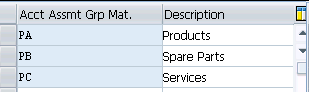

4.1 Account Assignment Groups for Materials

Account assignment groups are used to classify a material as a

product, service, or equipment for the purpose of GL account differentiation.

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Check Master Data Relevant For Account Assignment –> Define Account Assignment Groups for Materials

We have defined below account assignment groups for materials.

Account keys are assigned to the material master record on the material sales org 2 view.

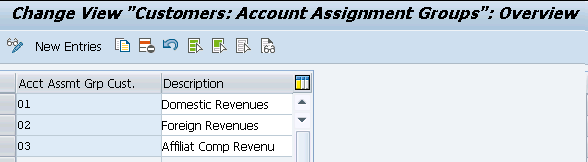

4.2 Account Assignment Groups for Customers

Account assignment groups for customers are useful if we want to post let,s say domestic sales revenue into different account while international sales revenue should be posted into different account.

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Check Master Data Relevant For Account Assignment –> Define Account Assignment Groups for Customers

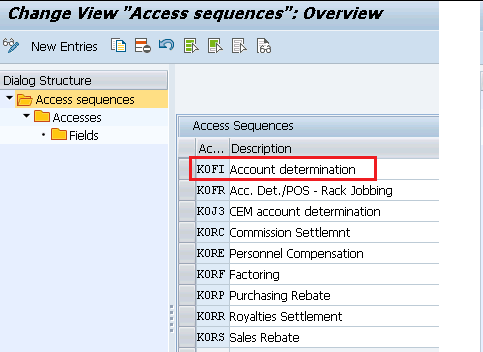

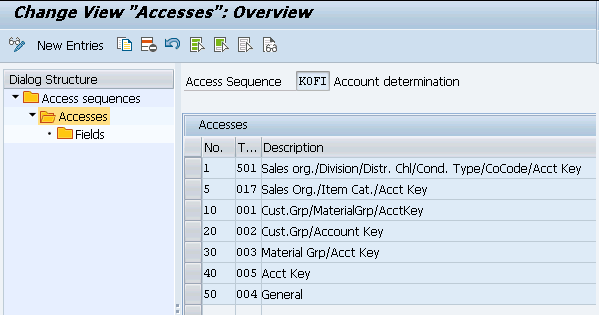

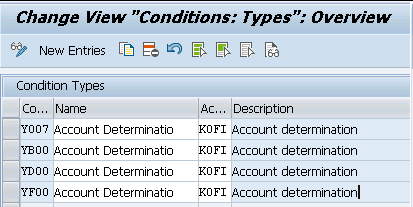

4.3 Define Access Sequences and Account Determination Types

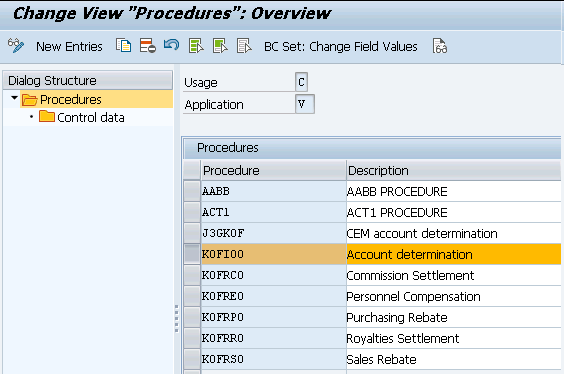

The Standard SAP has two condition types: KOFI (account determination) and KOFK (account determination with CO).

For our car business we will use the standard condition type KOFI,

which uses the access sequence with the key KOFI.

The KOFI access sequence has five condition tables assigned to it

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define Access Sequences and Account Determination Types –> Define Access Sequences for Revenue Account Determination

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define Access Sequences and Account Determination Types –> Define Account Determination Types

We can now allocate our chosen access sequence KOFI to the relevant account determination type (condition type) of our pricing procedure.

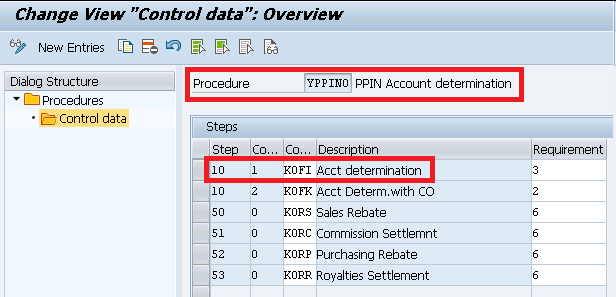

4.4 Define & Assign Account Determination Procedures

Here we define account determination procedures and allocate them to the billing types.

In an account determination procedure, we define the sequence in which the system should read the account determination types (condition types).

For our car business, we will use the standard account determination procedure (KOFI00) with the key "KOFI00" has already been defined. This will serve our purpose. We will copy KOFI00 and create our own as YPPIN0

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define And Assign Account Determination Procedures –> Define account determination procedure

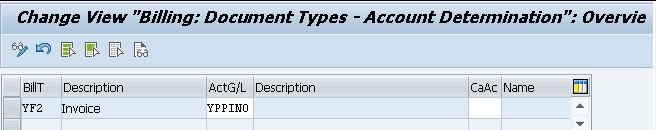

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define And Assign Account Determination Procedures –> Assign Account Determination Procedure

Here we will assign our account determination procedure YPPIN0 to our customized billing type YF2

Please click HERE to check the configuration of our billing type “YF2”

4.5 Define And Assign Account Keys

We define account keys here and allocate them to the condition types in the pricing procedures. We have already defined and assigned account keys to our pricing procedure PPIN01

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Define And Assign Account Keys –> Assign Account Keys

With the account keys, we group together similar accounts in financial accounting.

Using the account key, system finds the relevant GL account.

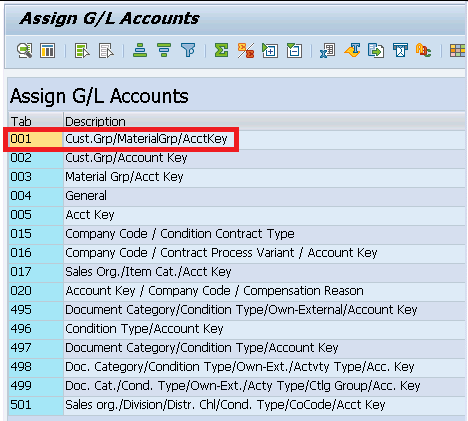

4.6 Assign G/L Accounts (VKOA)

Here based on the access sequence of tables for KOFI, we will select the

table “001” Cust.Grp/MaterialGrp/AcctKey. Here we will assign all the relevant GL accounts.

Below are the components for GL assignment

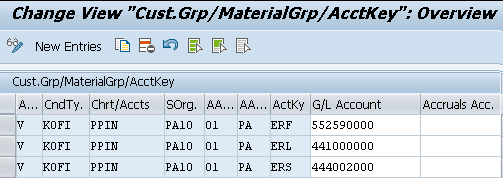

• V (application) : Sales • CndTy (condition type) : KOFI • ChAc (chart of accounts) : PPIN • Sorg (sales organization) : PA10 • AAG (customer account assignment group) : From our list • AAG (material account assignment group) : From our list • ActKy (account key) : The key from our procedure • Assigned general ledger account : Relevant GL to the key selected above

SPRO –> IMG –> Sales and Distribution –> Basic Functions –> Account Assignment/Costing –> Revenue Account Determination –> Assign G/L Accounts

We have created GL account corresponding to the every key of our pricing determination.

--> Please check HERE to see the GL creation corresponding to ERL (Revenue) key --> Please check HERE to see the GL creation corresponding to ERS (Sale Deductions) key --> Please check HERE to see the GL creation corresponding to ERF (Freight Revenue) key

Now assign all the three GL accounts to the respective keys

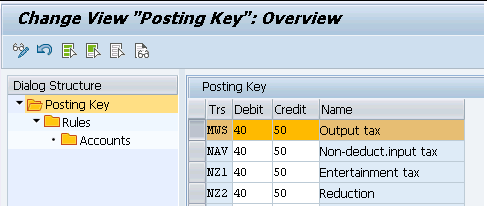

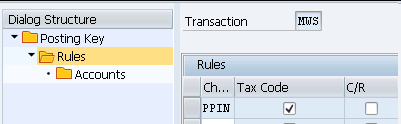

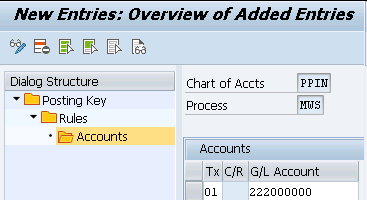

4.7 Assign G/L Accounts For Tax Posting

Here we first create the tax account for output tax and assign this to the respective key (MWS)

GL 222000000 – PPIN-Output Tax (MWS) will be used to post tax amount.

Please see HERE to see the step by step GL 222000000 account creation

Assign the GL for tax posting as per the below

SPRO –> IMG –> Financial Accounting Global Settings –> Tax on Sales/Purchases –> Posting –> Define Tax Accounts

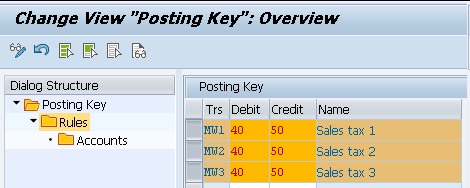

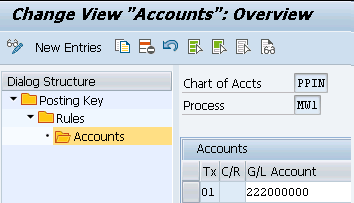

4.8 Tax Accounts Keys MW1, MW2 & MW3

Since tax keys MW1, MW2 & MW3 are given in our output tax determination schema so system will post the tax amounts on the GL accounts corresponding to these three keys

We have given GL 222000000 for all the three tax keys

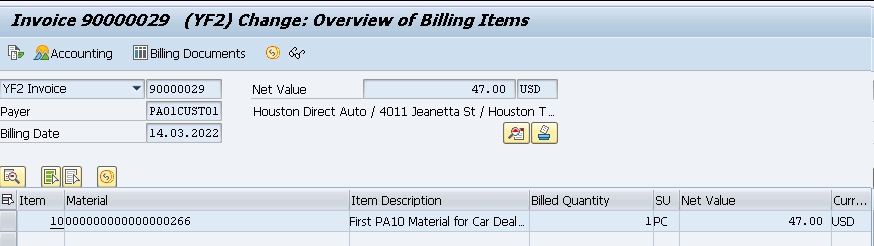

5. Create Billing

now the next part of the O2C cycle is to post the billing. At the time of billing system will post the respective values onto the determined & assigned GL accounts as per the revenue account determination procedure.

start VF01 and input our Outbound delivery number

Create the billing and click on

Billing Documents –> Release to Accounting

system throws the below error

5.1 Error KI235 -GL requires an account assignment relevant to cost accounting

system throws the below error.

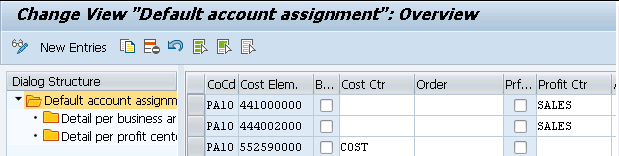

Here requirement is to assign the Sales Revenue cost element to a profit center --> The sales order and further any posting based on it (goods issue, billing, payment receipt) picks the profit center from the material master (costing view/sales org view). --> Or we can assign Profit center to the revenue element or cost center to the other cost element in the transaction OKB9

To resolve this error we need to activate profit center accounting as well as cost center accounting for our controlling area.

5.1.1 Profit Center Accounting

First we need to set our controlling area PPIN to set up Profit Center Accounting.

Then we need to maintain the global settings for Profit Center Accounting in our controlling area PPIN.

5.1.1.1 Controlling Area setting for Profit Center Accounting

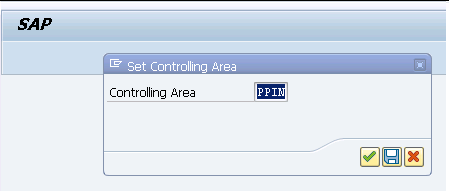

We will set our controlling area PPIN

SPRO –> IMG –> Controlling –> Profit Center Accounting –> Profit Center Accounting –> Set Controlling Area

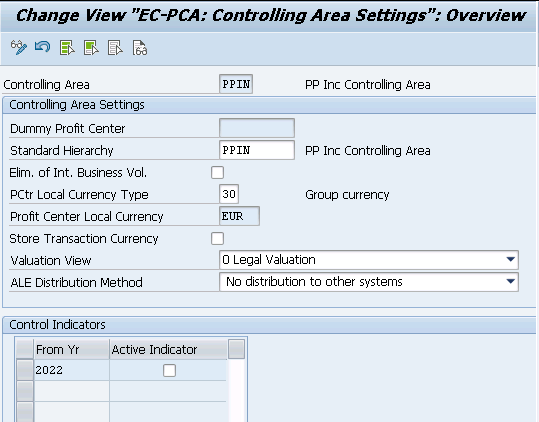

5.1.1.2 Maintain Controlling Area setting

Maintain the PPIN controlling area setting as below

SPRO –> IMG –> Controlling –> Profit Center Accounting –> Controlling Area Settings–> Maintain Controlling Area Settings

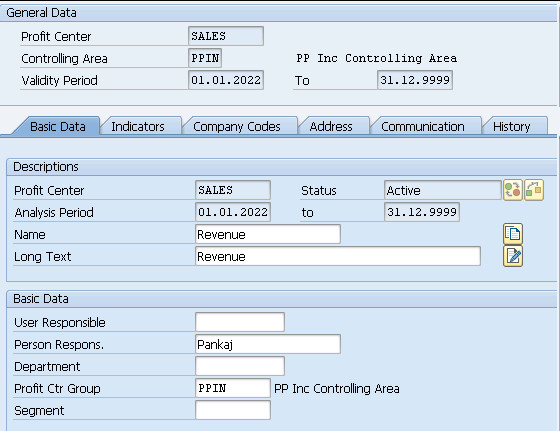

5.1.2 Create Profit Center

Run KE51 and created profit center “SALES”

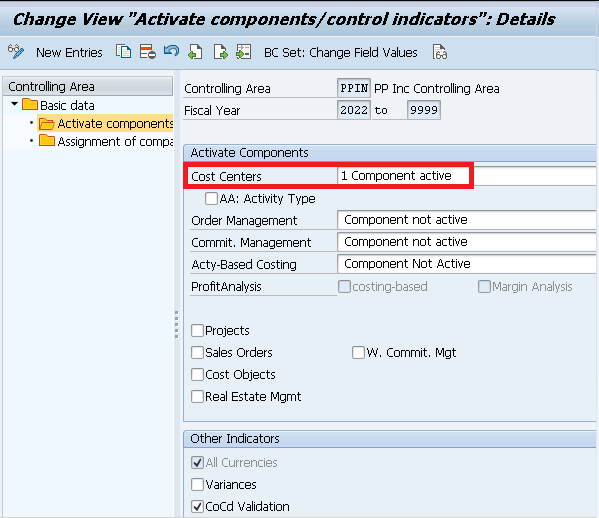

5.1.3 Cost Center Accounting

we need to first activate cost center accounting on our controlling area.

SPRO –> IMG –> Controlling –> Cost Center Accounting –> Activate Cost Center Accounting in Controlling Area

activate for our controlling area PPIN

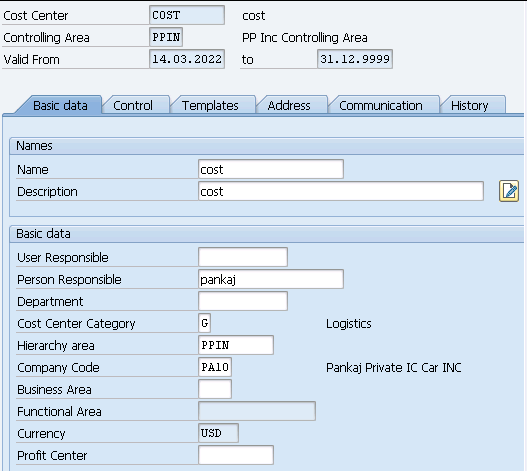

5.3.1.1 Create Cost Center

Start KS01 and create cost center “Cost”

5.2 Error KI235 -Resolution (OKB9)

Since now we have created profit center & cost center so assign them to the respective cost element under OKB9 to resolve this error

6. Create Billing – Retry after Error Resolution

Start VF01 and input outbound delivery number and press enter

Now go to

Billing Documents –> Release to Accounting

Billing document is successfully posted to accounting

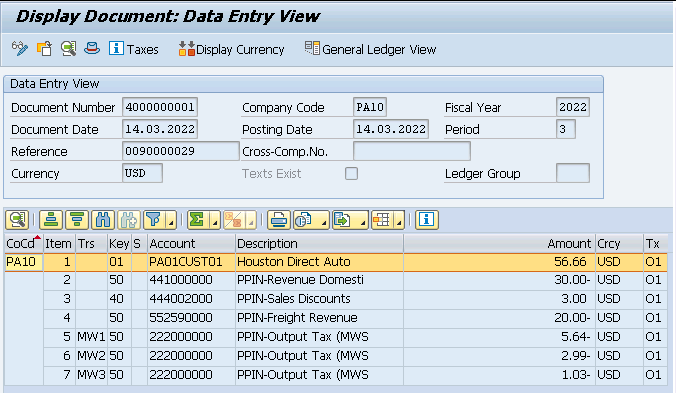

6.1 Accounting Entries at Billing

Billing is now created and released to accounting

Display accounting document

SD-FI integration completes here.

Picture Courtesy : Inter vector created by rawpixel.com – www.freepik.com

SAP ABAP Message Class KI Message Number 235 (Account & requires an assignment to a CO object)

Hierarchy

Hierarchy

☛

BBPCRM (Software Component) BBPCRM

⤷

CRM (Application Component) Customer Relationship Management

⤷

CRM_APPLICATION (Package) All CRM Components Without Special Structure Packages

⤷

KBAS (Package) Overhead Cost Controlling

Attribute

Attribute

| Message class | KI | ||

| Short Description | |||

| Message Number | |

235 | |

| Documentation status | |||

| Authorization check Error Message | |||

| Changed On |

Message Text

Message Text

Account & requires an assignment to a CO object

History

History

| Last changed on/by | 20130531 | SAP | |

| SAP Release Created in |

SAP OSS Note 710742 version 0001 contains details of a know issue related to Error message KI235 after implementing Note 653490 . This includes any associated symptoms and instructions on how to fix it, see below for full details. Also check out the comments section to view/add related contributions, questions or screen shots, based on real life experience of this oss note and problem.

…For more information about the SAP support system known as OSS please check out the SAP OSS NOTES SECTION, whih includes how to download & implement them onto your SAP system using transaction code SNOTE.

Note 710742 Details:

When does this problem occur

After you have implemented Note 653490, the system generates error messa

ge KI235 (Account & requires an assignment to a CO object) from within the accounting interface.

Description of problem

NAV, NVV

BAPI_ACC_EMPLOYEE_EXP_CHECK, BAPI_ACC_EMPLOYEE_EXP_POST

BAPI_ACC_EMPLOYEE_REC_CHECK, BAPI_ACC_EMPLOYEE_REC_POST

BAPI_ACC_EMPLOYEE_PAY_CHECK, BAPI_ACC_EMPLOYEE_PAY_POST

HR posting transfer

RPCIPE00, PCP0, PCPO

Cause of the problem and Pre-requisites

The cause is a program error.

Solution instructions

Implement the attached program correction.

Solution instructions

Please import the corrections attached to this OSS note into your SAP system using SNOTE.

You can also view the full details of this OSS note and download it to your SAP system ready for implementation using transaction code SNOTE. Once it has been downloaded you can read the full details, check out any installation instructions including manual changes and see if there are any pre-requisites.

You can also check if a new version of note 710742 has been released as well as see if the note is valid for your current SAP system landscape.

Check if SAP OSS note 710742 has already been downloaded and is valid

To check if this note has already been download, what status it has and if it is valid for your system first execute t-code SNOTE and click on the SAP Note Browser icon

From here you can just enter the note number 710742 and press execute. If the note already exists it’s details will be displayed. See here for full step by step instructions on how to check if an SAP note has been downloaded and is valid for your system.

If note 710742 does not exist on your system you will receive the message «Unable to find SAP Note that meets specified criteria»

If this is the case you will need to download the note to you SAP system also using transaction SNOTE. For further details see Download note using SNOTE. Even if it does exist you may still want to check if you have downloaded the latest version of the note.

Alternatively you can find full details of this note on the SAP service market place(SNumber / Service market place login will be required)