Что такое стандартная ошибка оценки? (Определение и пример)

17 авг. 2022 г.

читать 3 мин

Стандартная ошибка оценки — это способ измерения точности прогнозов, сделанных регрессионной моделью.

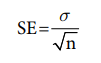

Часто обозначаемый σ est , он рассчитывается как:

σ est = √ Σ(y – ŷ) 2 /n

куда:

- y: наблюдаемое значение

- ŷ: Прогнозируемое значение

- n: общее количество наблюдений

Стандартная ошибка оценки дает нам представление о том, насколько хорошо регрессионная модель соответствует набору данных. Особенно:

- Чем меньше значение, тем лучше соответствие.

- Чем больше значение, тем хуже соответствие.

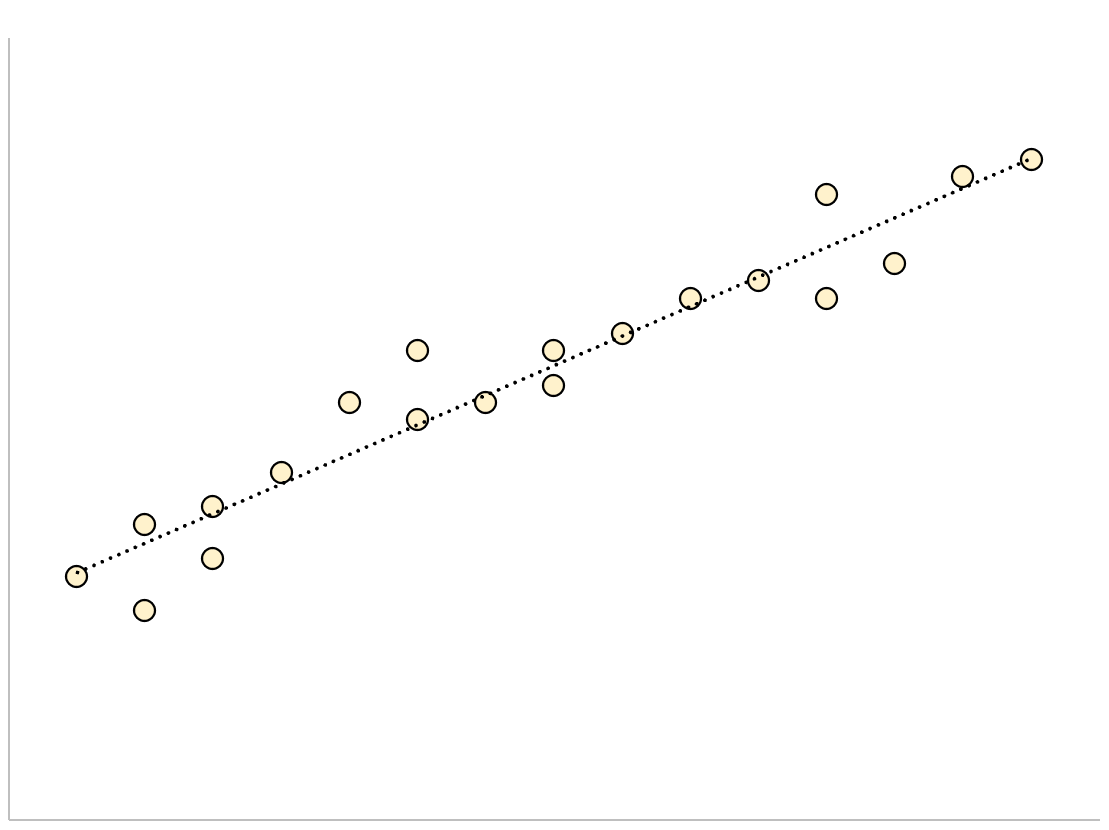

Для регрессионной модели с небольшой стандартной ошибкой оценки точки данных будут плотно сгруппированы вокруг предполагаемой линии регрессии:

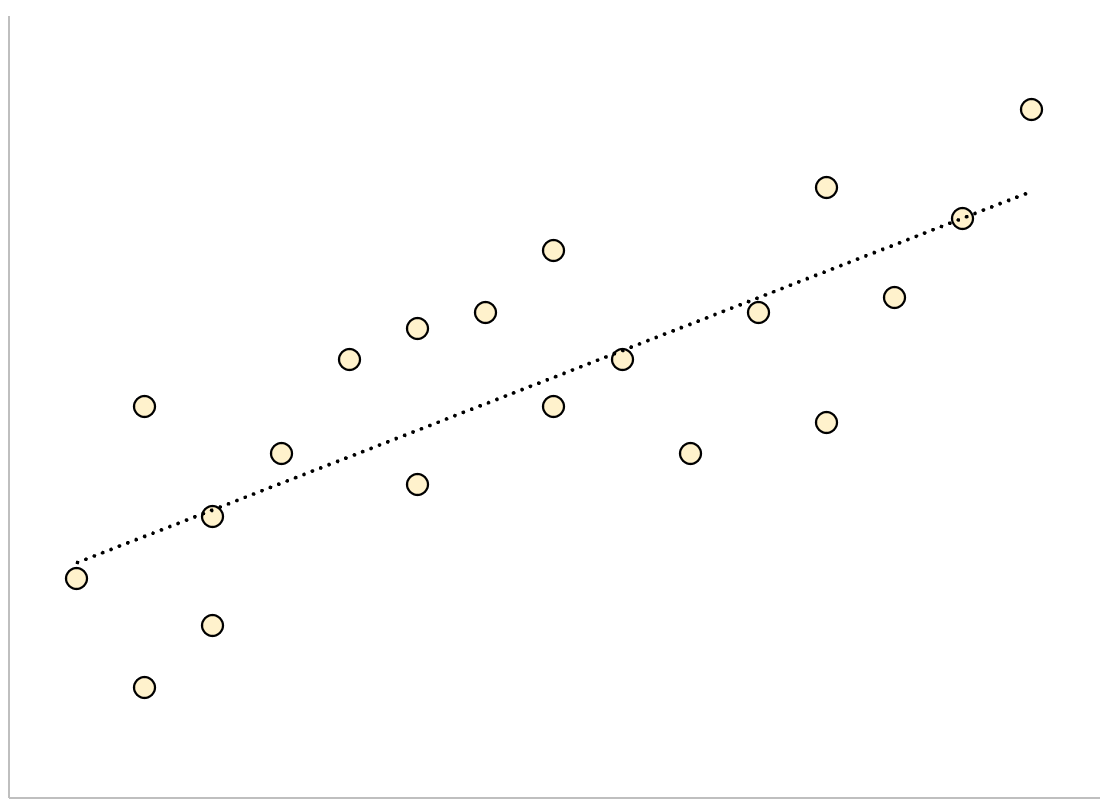

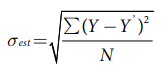

И наоборот, для регрессионной модели с большой стандартной ошибкой оценки точки данных будут более свободно разбросаны по линии регрессии:

В следующем примере показано, как рассчитать и интерпретировать стандартную ошибку оценки для регрессионной модели в Excel.

Пример: стандартная ошибка оценки в Excel

Используйте следующие шаги, чтобы вычислить стандартную ошибку оценки для регрессионной модели в Excel.

Шаг 1: введите данные

Сначала введите значения для набора данных:

Шаг 2: выполните линейную регрессию

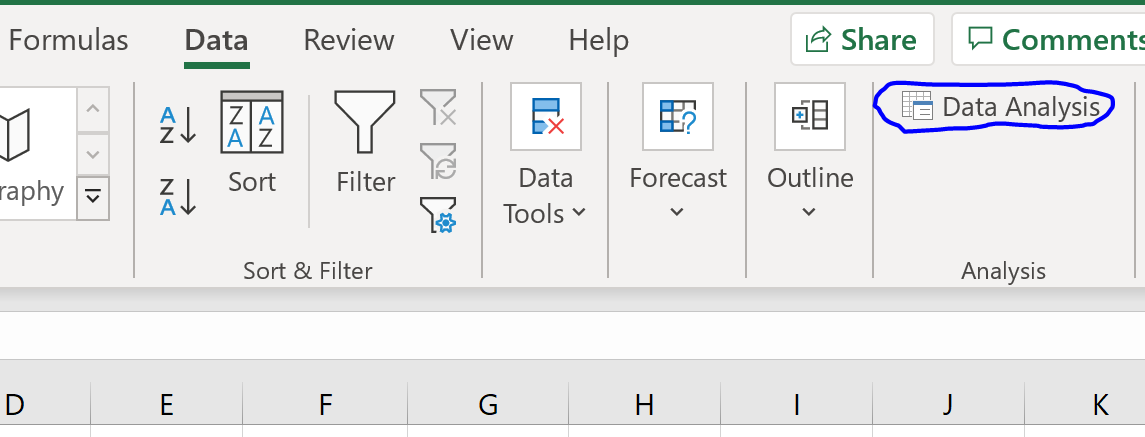

Затем щелкните вкладку « Данные » на верхней ленте. Затем выберите параметр « Анализ данных» в группе « Анализ ».

Если вы не видите эту опцию, вам нужно сначала загрузить пакет инструментов анализа .

В появившемся новом окне нажмите « Регрессия », а затем нажмите « ОК ».

В появившемся новом окне заполните следующую информацию:

Как только вы нажмете OK , появится вывод регрессии:

Мы можем использовать коэффициенты из таблицы регрессии для построения оценочного уравнения регрессии:

ŷ = 13,367 + 1,693 (х)

И мы видим, что стандартная ошибка оценки для этой регрессионной модели оказывается равной 6,006.Проще говоря, это говорит нам о том, что средняя точка данных отклоняется от линии регрессии на 6,006 единицы.

Мы можем использовать оценочное уравнение регрессии и стандартную ошибку оценки, чтобы построить 95% доверительный интервал для прогнозируемого значения определенной точки данных.

Например, предположим, что x равно 10. Используя оценочное уравнение регрессии, мы можем предсказать, что y будет равно:

ŷ = 13,367 + 1,693 * (10) = 30,297

И мы можем получить 95% доверительный интервал для этой оценки, используя следующую формулу:

- 95% ДИ = [ŷ – 1,96*σ расч ., ŷ + 1,96*σ расч .]

Для нашего примера доверительный интервал 95% будет рассчитываться как:

- 95% ДИ = [ŷ – 1,96*σ расч ., ŷ + 1,96*σ расч .]

- 95% ДИ = [30,297 – 1,96*6,006, 30,297 + 1,96*6,006]

- 95% ДИ = [18,525, 42,069]

Дополнительные ресурсы

Как выполнить простую линейную регрессию в Excel

Как выполнить множественную линейную регрессию в Excel

Как создать остаточный график в Excel

Standard Error of Est. = 0,18409

Mean absolute error = 0,0690247

Durbin-Watson statistic = 2,87495

Рисунок 4.2.2 Предварительные результаты построения

модели

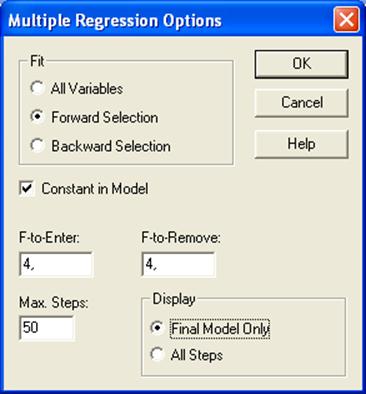

Щелкнем правой

кнопкой мыши, появится меню, в котором нужно выбрать AnalysisOptions (Опции анализа) для

вызова пошаговой регрессии.

Процедура пошаговой

регрессии дает возможность автоматического подбора адекватной модели. При этом

используются два основных подхода: ForwardSelection(Включения

факторов) или Backward Selection(Исключения

Факторов) (рисунок 4.2.3.).

Fit – Подбирать; AllVariable – Все переменные; ForwardSelection —Включение факторов; Backward Selection—

Исключение Факторов; ConstantinModel — Свободный член модели; F—to—Enter – Включение; F—to—Remove – Исключение;

MaxSteps –

Максимальное число шагов; Display – Показать;FinalModelOnly–

Только заключительная модель; AllSteps– Все шаги.

Рисунок 4.2.3. – Окно MultipleRegressionOption (Опции множественной регрессии). Модель пошаговой регрессии

Флажок в поле ConstantinModel (Свободный член модели) предполагает наличие в модели свободного члена.

Установлено также , что F-критерий для включения (F-to-Enter)

и исключения (F-to-Remove) независимых переменных равен 4. Максимальное

количество шагов при построении модели (Max Steps)

— 50. Флажок в поле All Steps (Все шаги) требует вывод на

экран всех промежуточных этапов построения уравнения регрессии.

Отметив поле ForwardSelection(Включения факторов) и FinalModelOnlyполучим результаты

заключительной модели (промежуточные этапы построения модели не показаны)

(рисунок 4.2.4.).

Multiple Regression Analysis

——————————————————————————

Dependent variable: Y

——————————————————————————

Standard T

Parameter Estimate Error

Statistic P-Value

——————————————————————————

CONSTANT 9,99392

0,954915 10,4658 0,0000

X10 0,155791

0,035976 4,33043 0,0019

X2 3,80885

1,02886 3,702 0,0049

X3 0,119721

0,0125751 9,52045 0,0000

X4 0,0685042

0,0250069 2,73941 0,0229

——————————————————————————

Analysis of Variance

——————————————————————————

Source Sum of Squares Df Mean Square F-Ratio P-Value

——————————————————————————

Model 27,2717 4

6,81792 252,92 0,0000

Residual 0,242607 9

0,0269563

——————————————————————————

Total (Corr.) 27,5143 13

R-squared = 99,1183 percent

R-squared (adjusted for d.f.) = 98,7264 percent

Standard Error of Est. = 0,164184

Mean absolute error = 0,0978855

Durbin-Watson statistic = 2,02579

Stepwise regression

——————-

Method: forward selection

F-to-enter: 4,0

F-to-remove: 4,0

Final model selected

Рисунок 4.2.4. Окончательные результаты выбора модели

Основные результаты

расчета сведены в две таблицы: в первой отражены результаты регрессионного

анализа, во второй представлен дисперсионный анализ. Внизу показана

дополнительная информация: R—squared – коэффициент

детерминации; R—squared (adjustedford.f.) —

коэффициент детерминации, приведенный с учетом степеней свободы; StandardErrorofEst. (SE) – стандартная ошибка

оценивания; Meanabsoluteerror–стандартная ошибка оценивания; Durbin—Watsonstatistic–

статистика Дарбина-Уотсона.

На основе частных F-критериев

из 10 независимых переменных в модель средней обеспеченности населения жильём

всего кв. м общей площади на одного жителя включены 4 фактора: средняя

стоимость строительства за 1 кв.м., руб (в сопоставимых ценах) (Х2);

денежные доходы в расчете на душу населения в среднем за месяц, тыс.руб. (в

сопоставимых ценах) (Х3); удельный вес частного жилого фонда, % (Х4);

ввод в действие жилых домов, тыс. кв. метров общей площади; (Х10).

Построена следующая модель:

Y=9,99392 + 3,80885*X2 + 0,119721*X3 +

0,0685042*X4+ 0,155791*X10

Все отобранные

факторы статистически значимы, так как фактический t-критерий

Стьюдента больше табличного (приложение В). Об

этом свидетельствует графа 5 таблицы рисунка 4.2.4. (P-Value),

в которой отражены вероятности наиболее существенных факторов динамики средней

обеспеченности населения жильём.

Дисперсионный анализ

(AnalysisofVariance) позволяет получить F-критерий для

оценки адекватности модели. Представленные на рисунке 4.2.4. данные

свидетельствуют о хорошей адекватности модели . Фактический критерий Фишера (F-Ratio),

равный 252,92, в 69,7 раза больше табличного значения. Стандартная ошибка

остатков (Standard Error of Est.) составляет 0,164184. Приведенный с учетом степеней

свободы коэффициент детерминации (R-squared (adjusted for d.f.) равный

98,7264% свидетельствует о том, что вариация средней обеспеченности населения

жильём на 98,7% обусловлена включенными в модель факторами. Статистика

Дарбина–Уотсона (Durbin-Watson statistic), составляющая 2,02579,

говорит об отсутствии автокорреляции (рисунок 4.2.5. и приложение А)

2,026

_______________________________________________

есть 0,69 ?

1,97 нет 2,03 ? 3,31 есть

(+)

(-)

Рисунок 4.2.5. Таблица определения наличия или

отсутствия автокорреляции на основе критерия Дарбина-Уотсона

ПРЕДСТАВЛЕНИЕ РЕЗУЛЬТАТОВ РЕГРЕССИОННОГО АНАЛИЗА

Очень важно не только правильно выполнить регрессионный анализ, но и представить результаты расчетов в научной публикации.

В качестве примера приведем текст, который должен быть помещен в разделы магистерской диссертации: методы исследования (глава 2) и результаты исследований (глава 3).

Задание: установить зависимость между результатами в прыжке в высоту с места и результатами в толчке у тяжелоатлетов 1 разряда (весовая категория 60 кг), таблица 1.

Таблица 1 — Результаты в прыжке в высоту с места и в толчке у тяжелоатлетов 1 разряда (вес до 60 кг), n=12

| № | Результат прыжка в высоту с места, см | Результат в толчке, кг |

| 1 | 57 | 107,5 |

| 2 | 60 | 110 |

| 3 | 58 | 110 |

| 4 | 61 | 115 |

| 5 | 63 | 115 |

| 6 | 58 | 107,5 |

| 7 | 55 | 107,5 |

| 8 | 64 | 120 |

| 9 | 65 | 122,5 |

| 10 | 64 | 112,5 |

| 11 | 66 | 120 |

| 12 | 61 | 110 |

В результате обработки данных в пакете Statgraphics были получены следующие результаты:

Simple Regression — push vs. jump

Dependent variable: push

Independent variable: jump

Reciprocal-Y squared-X: Y = 1/(a + b*X^2)

Coefficients

| Least Squares | Standard | T | ||

| Parameter | Estimate | Error | Statistic | P-Value |

| Intercept | 0,0120651 | 0,000522695 | 23,0824 | 0,0000 |

| Slope | -8,59439E-7 | 1,39231E-7 | -6,17275 | 0,0001 |

Analysis of Variance

| Source | Sum of Squares | Df | Mean Square | F-Ratio | P-Value |

| Model | 0,00000145898 | 1 | 0,00000145898 | 38,10 | 0,0001 |

| Residual | 3,82906E-7 | 10 | 3,82906E-8 | ||

| Total (Corr.) | 0,00000184189 | 11 |

Correlation Coefficient = -0,890007

R-squared = 79,2112 percent

R-squared (adjusted for d.f.) = 77,1324 percent

Standard Error of Est. = 0,00019568

Mean absolute error = 0,000149912

Durbin-Watson statistic = 1,91663 (P=0,3863)

Lag 1 residual autocorrelation = -0,0248744

Коэффициент детерминации равен 79,2112%. Коэффициенты уравнения регрессии следующие: а=0,0120651; -8,59439E-7. Стандартная ошибка предсказания равна 0,00019568.

Текст в магистерскую или кандидатскую диссертацию

Регрессионный анализ использовался с целью установления зависимости между результатом в прыжке в высоту с места и результатом в толчке у тяжелоатлетов 1 разряда (весовая категория до 60 кг).

Адекватность подобранной модели оценивалась на основе коэффициента детерминации. Наибольший коэффициент детерминации оказался у модели, уравнение регрессии которой имеет вид: Y=1/(a+bX2). Он равен 79,2%. Значимость коэффициентов уравнения регрессии оценивалась по t-критерию Стьюдента, так как P-value <0,001, коэффициенты регрессии значимы. Стандартная ошибка предсказания равна 0,00019568. Полученное уравнение регрессии имеет вид:

Y=1/(0,0120651 – 8,59439 10-7 x),

где: x – результат в прыжке; Y – результат в толчке.

На рис.1 представлен график подобранной модели с достоверными интервалом и интервалом возможных прогнозируемых значений Y. На рис. 2 представлен график предсказанных и наблюдаемых значений.

Литература

- Дюк В. Обработка данных на ПК в примерах.– СПб: Питер, 1997.– 240 с.

- Основы математической статистики: Учебное пособие для ин-тов физ. культ. / /Под ред. В.С. Иванова. М.: Физкультура и спорт, 1990.– 176 с.

The standard error of the estimate is a way to measure the accuracy of the predictions made by a regression model.

Often denoted σest, it is calculated as:

σest = √Σ(y – ŷ)2/n

where:

- y: The observed value

- ŷ: The predicted value

- n: The total number of observations

The standard error of the estimate gives us an idea of how well a regression model fits a dataset. In particular:

- The smaller the value, the better the fit.

- The larger the value, the worse the fit.

For a regression model that has a small standard error of the estimate, the data points will be closely packed around the estimated regression line:

Conversely, for a regression model that has a large standard error of the estimate, the data points will be more loosely scattered around the regression line:

The following example shows how to calculate and interpret the standard error of the estimate for a regression model in Excel.

Example: Standard Error of the Estimate in Excel

Use the following steps to calculate the standard error of the estimate for a regression model in Excel.

Step 1: Enter the Data

First, enter the values for the dataset:

Step 2: Perform Linear Regression

Next, click the Data tab along the top ribbon. Then click the Data Analysis option within the Analyze group.

If you don’t see this option, you need to first load the Analysis ToolPak.

In the new window that appears, click Regression and then click OK.

In the new window that appears, fill in the following information:

Once you click OK, the regression output will appear:

We can use the coefficients from the regression table to construct the estimated regression equation:

ŷ = 13.367 + 1.693(x)

And we can see that the standard error of the estimate for this regression model turns out to be 6.006. In simple terms, this tells us that the average data point falls 6.006 units from the regression line.

We can use the estimated regression equation and the standard error of the estimate to construct a 95% confidence interval for the predicted value of a certain data point.

For example, suppose x is equal to 10. Using the estimated regression equation, we would predict that y would be equal to:

ŷ = 13.367 + 1.693*(10) = 30.297

And we can obtain the 95% confidence interval for this estimate by using the following formula:

- 95% C.I. = [ŷ – 1.96*σest, ŷ + 1.96*σest]

For our example, the 95% confidence interval would be calculated as:

- 95% C.I. = [ŷ – 1.96*σest, ŷ + 1.96*σest]

- 95% C.I. = [30.297 – 1.96*6.006, 30.297 + 1.96*6.006]

- 95% C.I. = [18.525, 42.069]

Additional Resources

How to Perform Simple Linear Regression in Excel

How to Perform Multiple Linear Regression in Excel

How to Create a Residual Plot in Excel

What is the standard error?

Standard error statistics are a class of statistics that are provided as output in many inferential statistics, but function as descriptive statistics. Specifically, the term standard error refers to a group of statistics that provide information about the dispersion of the values within a set. Use of the standard error statistic presupposes the user is familiar with the central limit theorem and the assumptions of the data set with which the researcher is working.

The central limit theorem is a foundation assumption of all parametric inferential statistics. Its application requires that the sample is a random sample, and that the observations on each subject are independent of the observations on any other subject. It states that regardless of the shape of the parent population, the sampling distribution of means derived from a large number of random samples drawn from that parent population will exhibit a normal distribution (1). Specifically, although a small number of samples may produce a non-normal distribution, as the number of samples increases (that is, as n increases), the shape of the distribution of sample means will rapidly approach the shape of the normal distribution. A second generalization from the central limit theorem is that as n increases, the variability of sample means decreases (2). This is important because the concept of sampling distributions forms the theoretical foundation for the mathematics that allows researchers to draw inferences about populations from samples.

Researchers typically draw only one sample. It is not possible for them to take measurements on the entire population. They have neither the time nor the money. For the same reasons, researchers cannot draw many samples from the population of interest. Therefore, it is essential for them to be able to determine the probability that their sample measures are a reliable representation of the full population, so that they can make predictions about the population. The determination of the representativeness of a particular sample is based on the theoretical sampling distribution the behavior of which is described by the central limit theorem. The standard error statistics are estimates of the interval in which the population parameters may be found, and represent the degree of precision with which the sample statistic represents the population parameter. The smaller the standard error, the closer the sample statistic is to the population parameter. The standard error of a statistic is therefore the standard deviation of the sampling distribution for that statistic (3)

How, one might ask, does the standard error differ from the standard deviation? The two concepts would appear to be very similar. They are quite similar, but are used differently. The standard deviation is a measure of the variability of the sample. The standard error is a measure of the variability of the sampling distribution. Just as the standard deviation is a measure of the dispersion of values in the sample, the standard error is a measure of the dispersion of values in the sampling distribution. That is, of the dispersion of means of samples if a large number of different samples had been drawn from the population.

Standard error of the mean

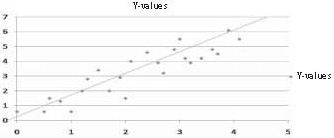

The standard error of a sample mean is represented by the following formula:

That is, the standard error is equal to the standard deviation divided by the square root of the sample size, n. This shows that the larger the sample size, the smaller the standard error. (Given that the larger the divisor, the smaller the result and the smaller the divisor, the larger the result.) The symbol for standard error of the mean is sM or when symbols are difficult to produce, it may be represented as, S.E. mean, or more simply as SEM.

The standard error of the mean can provide a rough estimate of the interval in which the population mean is likely to fall. The SEM, like the standard deviation, is multiplied by 1.96 to obtain an estimate of where 95% of the population sample means are expected to fall in the theoretical sampling distribution. To obtain the 95% confidence interval, multiply the SEM by 1.96 and add the result to the sample mean to obtain the upper limit of the interval in which the population parameter will fall. Then subtract the result from the sample mean to obtain the lower limit of the interval. The resulting interval will provide an estimate of the range of values within which the population mean is likely to fall. In fact, the level of probability selected for the study (typically P < 0.05) is an estimate of the probability of the mean falling within that interval. This interval is a crude estimate of the confidence interval within which the population mean is likely to fall. A more precise confidence interval should be calculated by means of percentiles derived from the t-distribution.

Another use of the value, 1.96 ± SEM is to determine whether the population parameter is zero. If the interval calculated above includes the value, “0”, then it is likely that the population mean is zero or near zero. Consider, for example, a researcher studying bedsores in a population of patients who have had open heart surgery that lasted more than 4 hours. Suppose the mean number of bedsores was 0.02 in a sample of 500 subjects, meaning 10 subjects developed bedsores. If the standard error of the mean is 0.011, then the population mean number of bedsores will fall approximately between 0.04 and -0.0016. This is interpreted as follows: The population mean is somewhere between zero bedsores and 20 bedsores. Given that the population mean may be zero, the researcher might conclude that the 10 patients who developed bedsores are outliers. That in turn should lead the researcher to question whether the bedsores were developed as a function of some other condition rather than as a function of having heart surgery that lasted longer than 4 hours.

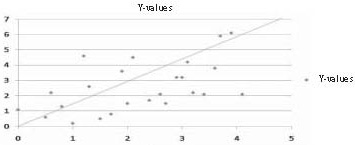

Standard error of the estimate

The standard error of the estimate (S.E.est) is a measure of the variability of predictions in a regression. Specifically, it is calculated using the following formula:

Where Y is a score in the sample and Y’ is a predicted score.

Therefore, the standard error of the estimate is a measure of the dispersion (or variability) in the predicted scores in a regression. In a scatterplot in which the S.E.est is small, one would therefore expect to see that most of the observed values cluster fairly closely to the regression line. When the S.E.est is large, one would expect to see many of the observed values far away from the regression line as in Figures 1 and 2.

Figure 1. Low S.E. estimate – Predicted Y values close to regression line

Figure 2. Large S.E. estimate – Predicted Y values scattered widely above and below regression line

Other standard errors

Every inferential statistic has an associated standard error. Although not always reported, the standard error is an important statistic because it provides information on the accuracy of the statistic (4). As discussed previously, the larger the standard error, the wider the confidence interval about the statistic. In fact, the confidence interval can be so large that it is as large as the full range of values, or even larger. In that case, the statistic provides no information about the location of the population parameter. And that means that the statistic has little accuracy because it is not a good estimate of the population parameter.

In this way, the standard error of a statistic is related to the significance level of the finding. When the standard error is large relative to the statistic, the statistic will typically be non-significant. However, if the sample size is very large, for example, sample sizes greater than 1,000, then virtually any statistical result calculated on that sample will be statistically significant. For example, a correlation of 0.01 will be statistically significant for any sample size greater than 1500. However, a correlation that small is not clinically or scientifically significant. When effect sizes (measured as correlation statistics) are relatively small but statistically significant, the standard error is a valuable tool for determining whether that significance is due to good prediction, or is merely a result of power so large that any statistic is going to be significant. The answer to the question about the importance of the result is found by using the standard error to calculate the confidence interval about the statistic. When the finding is statistically significant but the standard error produces a confidence interval so wide as to include over 50% of the range of the values in the dataset, then the researcher should conclude that the finding is clinically insignificant (or unimportant). This is true because the range of values within which the population parameter falls is so large that the researcher has little more idea about where the population parameter actually falls than he or she had before conducting the research.

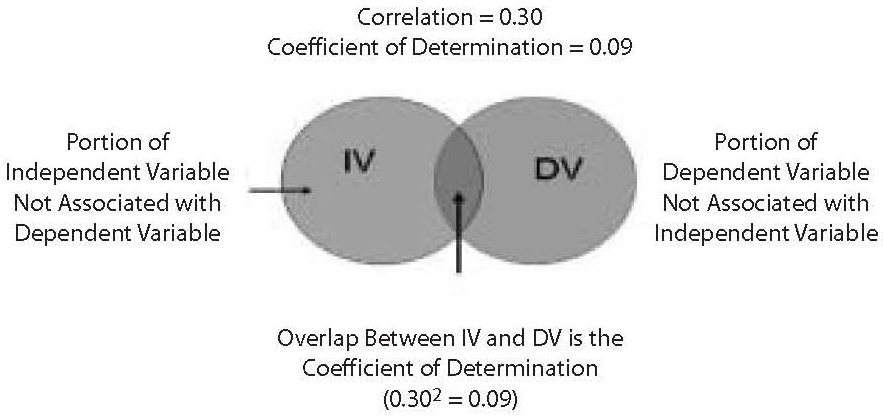

When the statistic calculated involves two or more variables (such as regression, the t-test) there is another statistic that may be used to determine the importance of the finding. That statistic is the effect size of the association tested by the statistic. Consider, for example, a regression. Suppose the sample size is 1,500 and the significance of the regression is 0.001. The obtained P-level is very significant. However, one is left with the question of how accurate are predictions based on the regression? The effect size provides the answer to that question. In a regression, the effect size statistic is the Pearson Product Moment Correlation Coefficient (which is the full and correct name for the Pearson r correlation, often noted simply as, R). If the Pearson R value is below 0.30, then the relationship is weak no matter how significant the result. An R of 0.30 means that the independent variable accounts for only 9% of the variance in the dependent variable. The 9% value is the statistic called the coefficient of determination. It is calculated by squaring the Pearson R. It is an even more valuable statistic than the Pearson because it is a measure of the overlap, or association between the independent and dependent variables. (See Figure 3).

Figure 3. Coefficient of determination

The great value of the coefficient of determination is that through use of the Pearson R statistic and the standard error of the estimate, the researcher can construct a precise estimate of the interval in which the true population correlation will fall. This capability holds true for all parametric correlation statistics and their associated standard error statistics. In fact, even with non-parametric correlation coefficients (i.e., effect size statistics), a rough estimate of the interval in which the population effect size will fall can be estimated through the same type of calculations.

However, many statistical results obtained from a computer statistical package (such as SAS, STATA, or SPSS) do not automatically provide an effect size statistic. In most cases, the effect size statistic can be obtained through an additional command. For example, the effect size statistic for ANOVA is the Eta-square. The SPSS ANOVA command does not automatically provide a report of the Eta-square statistic, but the researcher can obtain the Eta-square as an optional test on the ANOVA menu. For some statistics, however, the associated effect size statistic is not available. When an effect size statistic is not available, the standard error statistic for the statistical test being run is a useful alternative to determining how accurate the statistic is, and therefore how precise is the prediction of the dependent variable from the independent variable.

Summary and conclusions

The standard error is a measure of dispersion similar to the standard deviation. However, while the standard deviation provides information on the dispersion of sample values, the standard error provides information on the dispersion of values in the sampling distribution associated with the population of interest from which the sample was drawn. Standard error statistics measure how accurate and precise the sample is as an estimate of the population parameter. It is particularly important to use the standard error to estimate an interval about the population parameter when an effect size statistic is not available.

The standard error is not the only measure of dispersion and accuracy of the sample statistic. It is, however, an important indicator of how reliable an estimate of the population parameter the sample statistic is. Taken together with such measures as effect size, p-value and sample size, the effect size can be a very useful tool to the researcher who seeks to understand the reliability and accuracy of statistics calculated on random samples.

From Wikipedia, the free encyclopedia

For a value that is sampled with an unbiased normally distributed error, the above depicts the proportion of samples that would fall between 0, 1, 2, and 3 standard deviations above and below the actual value.

The standard error (SE)[1] of a statistic (usually an estimate of a parameter) is the standard deviation of its sampling distribution[2] or an estimate of that standard deviation. If the statistic is the sample mean, it is called the standard error of the mean (SEM).[1]

The sampling distribution of a mean is generated by repeated sampling from the same population and recording of the sample means obtained. This forms a distribution of different means, and this distribution has its own mean and variance. Mathematically, the variance of the sampling mean distribution obtained is equal to the variance of the population divided by the sample size. This is because as the sample size increases, sample means cluster more closely around the population mean.

Therefore, the relationship between the standard error of the mean and the standard deviation is such that, for a given sample size, the standard error of the mean equals the standard deviation divided by the square root of the sample size.[1] In other words, the standard error of the mean is a measure of the dispersion of sample means around the population mean.

In regression analysis, the term «standard error» refers either to the square root of the reduced chi-squared statistic or the standard error for a particular regression coefficient (as used in, say, confidence intervals).

Standard error of the sample mean[edit]

Exact value[edit]

Suppose a statistically independent sample of

.

Practically this tells us that when trying to estimate the value of a population mean, due to the factor

Estimate[edit]

The standard deviation

.

As this is only an estimator for the true «standard error», it is common to see other notations here such as:

or alternately

.

A common source of confusion occurs when failing to distinguish clearly between:

Accuracy of the estimator[edit]

When the sample size is small, using the standard deviation of the sample instead of the true standard deviation of the population will tend to systematically underestimate the population standard deviation, and therefore also the standard error. With n = 2, the underestimate is about 25%, but for n = 6, the underestimate is only 5%. Gurland and Tripathi (1971) provide a correction and equation for this effect.[3] Sokal and Rohlf (1981) give an equation of the correction factor for small samples of n < 20.[4] See unbiased estimation of standard deviation for further discussion.

Derivation[edit]

The standard error on the mean may be derived from the variance of a sum of independent random variables,[5] given the definition of variance and some simple properties thereof. If

which due to the Bienaymé formula, will have variance

where we’ve approximated the standard deviations, i.e., the uncertainties, of the measurements themselves with the best value for the standard deviation of the population. The mean of these measurements

.

The variance of the mean is then

The standard error is, by definition, the standard deviation of

.

For correlated random variables the sample variance needs to be computed according to the Markov chain central limit theorem.

Independent and identically distributed random variables with random sample size[edit]

There are cases when a sample is taken without knowing, in advance, how many observations will be acceptable according to some criterion. In such cases, the sample size

[6]

If

(since the standard deviation is the square root of the variance)

Student approximation when σ value is unknown[edit]

In many practical applications, the true value of σ is unknown. As a result, we need to use a distribution that takes into account that spread of possible σ’s.

When the true underlying distribution is known to be Gaussian, although with unknown σ, then the resulting estimated distribution follows the Student t-distribution. The standard error is the standard deviation of the Student t-distribution. T-distributions are slightly different from Gaussian, and vary depending on the size of the sample. Small samples are somewhat more likely to underestimate the population standard deviation and have a mean that differs from the true population mean, and the Student t-distribution accounts for the probability of these events with somewhat heavier tails compared to a Gaussian. To estimate the standard error of a Student t-distribution it is sufficient to use the sample standard deviation «s» instead of σ, and we could use this value to calculate confidence intervals.

Note: The Student’s probability distribution is approximated well by the Gaussian distribution when the sample size is over 100. For such samples one can use the latter distribution, which is much simpler.

Assumptions and usage[edit]

An example of how

- Upper 95% limit

and

- Lower 95% limit

In particular, the standard error of a sample statistic (such as sample mean) is the actual or estimated standard deviation of the sample mean in the process by which it was generated. In other words, it is the actual or estimated standard deviation of the sampling distribution of the sample statistic. The notation for standard error can be any one of SE, SEM (for standard error of measurement or mean), or SE.

Standard errors provide simple measures of uncertainty in a value and are often used because:

- in many cases, if the standard error of several individual quantities is known then the standard error of some function of the quantities can be easily calculated;

- when the probability distribution of the value is known, it can be used to calculate an exact confidence interval;

- when the probability distribution is unknown, Chebyshev’s or the Vysochanskiï–Petunin inequalities can be used to calculate a conservative confidence interval; and

- as the sample size tends to infinity the central limit theorem guarantees that the sampling distribution of the mean is asymptotically normal.

Standard error of mean versus standard deviation[edit]

In scientific and technical literature, experimental data are often summarized either using the mean and standard deviation of the sample data or the mean with the standard error. This often leads to confusion about their interchangeability. However, the mean and standard deviation are descriptive statistics, whereas the standard error of the mean is descriptive of the random sampling process. The standard deviation of the sample data is a description of the variation in measurements, while the standard error of the mean is a probabilistic statement about how the sample size will provide a better bound on estimates of the population mean, in light of the central limit theorem.[7]

Put simply, the standard error of the sample mean is an estimate of how far the sample mean is likely to be from the population mean, whereas the standard deviation of the sample is the degree to which individuals within the sample differ from the sample mean.[8] If the population standard deviation is finite, the standard error of the mean of the sample will tend to zero with increasing sample size, because the estimate of the population mean will improve, while the standard deviation of the sample will tend to approximate the population standard deviation as the sample size increases.

Extensions[edit]

Finite population correction (FPC)[edit]

The formula given above for the standard error assumes that the population is infinite. Nonetheless, it is often used for finite populations when people are interested in measuring the process that created the existing finite population (this is called an analytic study). Though the above formula is not exactly correct when the population is finite, the difference between the finite- and infinite-population versions will be small when sampling fraction is small (e.g. a small proportion of a finite population is studied). In this case people often do not correct for the finite population, essentially treating it as an «approximately infinite» population.

If one is interested in measuring an existing finite population that will not change over time, then it is necessary to adjust for the population size (called an enumerative study). When the sampling fraction (often termed f) is large (approximately at 5% or more) in an enumerative study, the estimate of the standard error must be corrected by multiplying by a »finite population correction» (a.k.a.: FPC):[9]

[10]

which, for large N:

to account for the added precision gained by sampling close to a larger percentage of the population. The effect of the FPC is that the error becomes zero when the sample size n is equal to the population size N.

This happens in survey methodology when sampling without replacement. If sampling with replacement, then FPC does not come into play.

Correction for correlation in the sample[edit]

Expected error in the mean of A for a sample of n data points with sample bias coefficient ρ. The unbiased standard error plots as the ρ = 0 diagonal line with log-log slope −½.

If values of the measured quantity A are not statistically independent but have been obtained from known locations in parameter space x, an unbiased estimate of the true standard error of the mean (actually a correction on the standard deviation part) may be obtained by multiplying the calculated standard error of the sample by the factor f:

where the sample bias coefficient ρ is the widely used Prais–Winsten estimate of the autocorrelation-coefficient (a quantity between −1 and +1) for all sample point pairs. This approximate formula is for moderate to large sample sizes; the reference gives the exact formulas for any sample size, and can be applied to heavily autocorrelated time series like Wall Street stock quotes. Moreover, this formula works for positive and negative ρ alike.[11] See also unbiased estimation of standard deviation for more discussion.

See also[edit]

- Illustration of the central limit theorem

- Margin of error

- Probable error

- Standard error of the weighted mean

- Sample mean and sample covariance

- Standard error of the median

- Variance

References[edit]

- ^ a b c d Altman, Douglas G; Bland, J Martin (2005-10-15). «Standard deviations and standard errors». BMJ: British Medical Journal. 331 (7521): 903. doi:10.1136/bmj.331.7521.903. ISSN 0959-8138. PMC 1255808. PMID 16223828.

- ^ Everitt, B. S. (2003). The Cambridge Dictionary of Statistics. CUP. ISBN 978-0-521-81099-9.

- ^ Gurland, J; Tripathi RC (1971). «A simple approximation for unbiased estimation of the standard deviation». American Statistician. 25 (4): 30–32. doi:10.2307/2682923. JSTOR 2682923.

- ^ Sokal; Rohlf (1981). Biometry: Principles and Practice of Statistics in Biological Research (2nd ed.). p. 53. ISBN 978-0-7167-1254-1.

- ^ Hutchinson, T. P. (1993). Essentials of Statistical Methods, in 41 pages. Adelaide: Rumsby. ISBN 978-0-646-12621-0.

- ^ Cornell, J R, and Benjamin, C A, Probability, Statistics, and Decisions for Civil Engineers, McGraw-Hill, NY, 1970, ISBN 0486796094, pp. 178–9.

- ^ Barde, M. (2012). «What to use to express the variability of data: Standard deviation or standard error of mean?». Perspect. Clin. Res. 3 (3): 113–116. doi:10.4103/2229-3485.100662. PMC 3487226. PMID 23125963.

- ^ Wassertheil-Smoller, Sylvia (1995). Biostatistics and Epidemiology : A Primer for Health Professionals (Second ed.). New York: Springer. pp. 40–43. ISBN 0-387-94388-9.

- ^ Isserlis, L. (1918). «On the value of a mean as calculated from a sample». Journal of the Royal Statistical Society. 81 (1): 75–81. doi:10.2307/2340569. JSTOR 2340569. (Equation 1)

- ^ Bondy, Warren; Zlot, William (1976). «The Standard Error of the Mean and the Difference Between Means for Finite Populations». The American Statistician. 30 (2): 96–97. doi:10.1080/00031305.1976.10479149. JSTOR 2683803. (Equation 2)

- ^ Bence, James R. (1995). «Analysis of Short Time Series: Correcting for Autocorrelation». Ecology. 76 (2): 628–639. doi:10.2307/1941218. JSTOR 1941218.

Download Article

Download Article

The standard error of estimate is used to determine how well a straight line can describe values of a data set. When you have a collection of data from some measurement, experiment, survey or other source, you can create a line of regression to estimate additional data. With the standard error of estimate, you get a score that describes how good the regression line is.

-

1

Create a five column data table. Any statistical work is generally made easier by having your data in a concise format. A simple table serves this purpose very well. To calculate the standard error of estimate, you will be using five different measurements or calculations. Therefore, creating a five-column table is helpful. Label the five columns as follows:[1]

-

2

Enter the data values for your measured data. After collecting your data, you will have pairs of data values. For these statistical calculations, the independent variable is labeled

and the dependent, or resulting, variable is

. Enter these values into the first two columns of your data table.[2]

- The order of the data and the pairing is important for these calculations. You need to be careful to keep your paired data points together in order.

- For the sample calculations shown above, the data pairs are as follows:

- (1,2)

- (2,4)

- (3,5)

- (4,4)

- (5,5)

Advertisement

-

3

Calculate a regression line. Using your data results, you will be able to calculate a regression line. This is also called a line of best fit or the least squares line. The calculation is tedious but can be done by hand. Alternatively, you can use a handheld graphing calculator or some online programs that will quickly calculate a best fit line using your data.[3]

- For this article, it is assumed that you will have the regression line equation available or that it has been predicted by some prior means.

- For the sample data set in the image above, the regression line is

.

-

4

Calculate predicted values from the regression line. Using the equation of that line, you can calculate predicted y-values for each x-value in your study, or for other theoretical x-values that you did not measure.[4]

Advertisement

-

1

Calculate the error of each predicted value. In the fourth column of your data table, you will calculate and record the error of each predicted value. Specifically, subtract the predicted value (

) from the actual observed value (

).[5]

- For the data in the sample set, these calculations are as follows:

-

2

Calculate the squares of the errors. Take each value in the fourth column and square it by multiplying it by itself. Fill in these results in the final column of your data table.

- For the sample data set, these calculations are as follows:

-

3

Find the sum of the squared errors (SSE). The statistical value known as the sum of squared errors (SSE) is a useful step in finding standard deviation, variance and other measurements. To find the SSE from your data table, add the values in the fifth column of your data table.[6]

- For this sample data set, this calculation is as follows:

- For this sample data set, this calculation is as follows:

-

4

Finalize your calculations. The Standard Error of the Estimate is the square root of the average of the SSE. It is generally represented with the Greek letter

. Therefore, the first calculation is to divide the SSE score by the number of measured data points. Then, find the square root of that result.[7]

- If the measured data represents an entire population, then you will find the average by dividing by N, the number of data points. However, if you are working with a smaller sample set of the population, then substitute N-2 in the denominator.

- For the sample data set in this article, we can assume that it is a sample set and not a population, just because there are only 5 data values. Therefore, calculate the Standard Error of the Estimate as follows:

-

5

Interpret your result. The Standard Error of the Estimate is a statistical figure that tells you how well your measured data relates to a theoretical straight line, the line of regression. A score of 0 would mean a perfect match, that every measured data point fell directly on the line. Widely scattered data will have a much higher score.[8]

- With this small sample set, the standard error score of 0.894 is quite low and represents well organized data results.

Advertisement

Ask a Question

200 characters left

Include your email address to get a message when this question is answered.

Submit

Advertisement

Video

Thanks for submitting a tip for review!

References

About This Article

Article SummaryX

To calculate the standard error of estimate, create a five-column data table. In the first two columns, enter the values for your measured data, and enter the values from the regression line in the third column. In the fourth column, calculate the predicted values from the regression line using the equation from that line. These are the errors. Fill in the fifth column by multiplying each error by itself. Add together all of the values in column 5, then take the square root of that number to get the standard error of estimate. To learn how to organize the data pairs, keep reading!

Did this summary help you?

Thanks to all authors for creating a page that has been read 186,557 times.

Did this article help you?

Correlation and Regression

Andrew F. Siegel, Michael R. Wagner, in Practical Business Statistics (Eighth Edition), 2022

The Standard Error of Estimate: How Large Are the Prediction Errors?

The standard error of estimate, denoted Se here (but often denoted S in computer printouts), tells you approximately how large the prediction errors (residuals) are for your data set in the same units as Y. How well can you predict Y? The answer is to within about Se above or below.16 Because you usually want your forecasts and predictions to be as accurate as possible, you would be glad to find a small value for Se. You can interpret Se as a standard deviation in the sense that if you have a normal distribution for the prediction errors, then you will expect about two-thirds of the data points to fall within a distance Se either above or below the regression line. Also, about 95% of the data values should fall within 2Se, and so forth. This is illustrated in Fig. 11.2.10 for the production cost example.

Fig. 11.2.10. The standard error of estimate, Se, indicates approximately how much error you make when you use the predicted value for Y (on the least-squares line) instead of the actual value of Y. You may expect about two-thirds of the data points to be within Se above or below the least-squares line for a data set with a normal linear relationship, such as this one.

The standard error of estimate may be found using the following formulas:

Standard Error of Estimate

Se=SY(1−r2)n−1n−2(forcomputation)=1n−2∑i=1n[Yi−(a+bXi)]2(forinterpretation)

The first formula shows how Se is computed by reducing SY according to the correlation and sample size. Indeed, Se will usually be smaller than SY because the line a + bX summarizes the relationship and therefore comes closer to the Y values than does the simpler summary, Y¯. The second formula shows how Se can be interpreted as the estimated standard deviation of the residuals: The squared prediction errors are averaged by dividing by n − 2 (the appropriate number of degrees of freedom when two numbers, a and b, have been estimated), and the square root undoes the earlier squaring, giving you an answer in the same measurement units as Y.

For the production cost data, the correlation was found to be r = 0.869193, the variability in the individual cost numbers is SY = $389.6131, and the sample size is n = 18. The standard error of estimate is therefore

Se=SY(1−r2)n−1n−2=389.6131(1−0.8691932)18−118−2=389.6131(0.0244503)1716=389.61310.259785=$198.58

This tells you that, for a typical week, the actual cost was different from the predicted cost (on the least-squares line) by about $198.58. Although the least-squares prediction line takes full advantage of the relationship between cost and number produced, the predictions are far from perfect.

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B9780128200254000117

Detection of a Trend in Population Estimates

William L. Thompson, … Charles Gowan, in Monitoring Vertebrate Populations, 1998

5.2 VARIANCE COMPONENTS

In this section, we discuss sources of variation that must be considered to make inferences from data when trying to detect trends. Three sources of variation must be considered: sampling variation, temporal variation in the population dynamics process, and spatial variation in the dynamics of the population across space. The latter two sources often are referred to as process variation, i.e., variation in the population dynamics process associated with environmental variation (such as rainfall, temperature, community succession, fires, or elevation). Methods to separate process variation from sampling variation will be presented.

Detection of a trend in a population’s size requires at least two abundance estimates. For example, if the population size of Mexican spotted owls in Mesa Verde National Park is determined as 50 pairs in 1990, and as only 10 pairs in 1995, we would be concerned that a significant negative trend in the population exists during this time period, and that action must be taken to alleviate the trend. However, if the 1995 estimate was 40 pairs, we might still be concerned, but would be less confident that immediate action is required. Two sources of variation must be assessed before we are confident of our inference from these estimates.

The first source of variation is the uncertainty we have in our population estimates. We want to be sure that the two estimates are different, i.e., the difference between the two estimates is greater than would be expected from chance alone because of the sampling errors associated with each estimate. Typically, we present our uncertainty in our estimate as its variance, and use this variance to generate a confidence interval for our estimate. Suppose that the 1990 estimate of Nˆ90 = 50 pairs has a sampling variance of Vaˆr(Nˆ90)=25. Then, under the assumption of the estimate being normally distributed with a large sample size (i.e., large degrees of freedom), we would compute a 95% confidence interval as 50 ± 1.96 25, or 40.2–59.8. If the 1995 estimate was Nˆ95 = 40 with a sampling variance of Vâr(Nˆ95) = 20, then the 95% confidence interval for this estimate is 40 ± 1.96 20, or 31.2–48.8. Based on the overlap of the two confidence intervals (Fig. 5.2), we would conclude that by chance alone, these two estimates are probably not different. We also could compute a simple test as

Figure 5.2. The 95% confidence intervals plotted with the 1990 and 1995 population estimates.

(5.3)z=Nˆ90−Nˆ95Vaˆr(Nˆ90)+Vaˆr(Nˆ95),

which for this example results in z = 1.491, with a probability of observing a z statistic this large or larger of P = 0.136. Although we might be alarmed, the chances are that 13.6 times out of 100 we would observe this large of a change just by random chance.

A variation of the previous test is commonly conducted for several reasons: (1) we often are interested in the ratio of two population estimates (rather than the difference) because a ratio represents the rate of change of the population, (2) the variance of Nˆ is usually linked to its estimate by Vaˆr(Nˆ)=NˆC (e.g., Skalski and Robson, 1992, pp. 28–29), and (3) ln(Nˆ) is more likely to be normally distributed than Nˆ. Fortuitously, a log transformation provides some correction to all three of the above reasons and results in a more efficient statistical procedure. Because

(5.4)Var[ln(Nˆ)]=Var(Nˆ)Nˆ2,

we construct the z test as

(5.5)z=ln(Nˆ90)−ln(Nˆ95)Vaˆr[ln(Nˆ90)]+Vaˆr[ln(Nˆ95)]

to provide a more efficient (i.e., more powerful) test.

Suppose we had made a much more intensive effort in sampling the owl population, so that the sampling variances were one-half of the values observed (which would generally take about 4 times the effort). Thus, Vâr(Nˆ90) = 12.5 and Vâr(Nˆ95) = 10, giving a z statistic of 2.108 with probability value of P = 0.035. Now, we would conclude that the owl population was lower in 1995 than in 1990, and that this difference is unlikely due to variation in our samples, i.e., that an actual reduction in population size has taken place.

This leads us to the second variance component associated with determining whether a trend in the population is important. We would expect the size of the owl population (and any other population, for that matter) to fluctuate through time. How can we determine if this reduction is important? The answer lies in determining what the variation in the owl population has been for some period of time in the past, and then if the observed reduction is outside the range expected from this past fluctuation. Consider the example in Fig. 5.3, where the true population size (no sampling variation) is plotted. The population fluctuates around a mean of 50, but values more extreme than the range 40 to 60 are common. Note that a decline from 76 to 29 pairs occurred from 1984 to 1985, and that declines from over 50 pairs to under 40 pairs are fairly common occurrences. Thus, based on our previous example, a decline from 50 to 40 is not at all unreasonable given the past population dynamics of this hypothetical population.

Figure 5.3. Actual number of pairs of owls that exist each year. In reality, we never know these values, and can only estimate them.

To determine the level of change in population size that should receive our attention and suggest management action, we need to know something about the temporal variation in the population. The only way to estimate this variance component is to observe the population across a number of years. The exact number of years will depend on the magnitude of the temporal variation. Thus, if the population does not change much from year to year, a few observations will show this consistency. On the other hand, if the population fluctuates a lot, as in Fig. 5.3, many years of observations are needed to estimate the temporal variance. For the example in Fig. 5.3, we could compute the temporal variance as the variance of the 15 years. We find a variance of 265.7, or a standard deviation of 16.3 (Example 5.1). With a SD of 16.3, we would expect roughly 95% of the population values to be in the range of ±2 SD of the mean population size. This inference is based on the population being stable, i.e., not having an upward or downward trend, and being roughly normally distributed. For a normal distribution, 95% of the values lie in the interval ±2 SD of the mean. Therefore, a change of 2 SD, or 32.6, is not a particularly big change given the temporal variation observed over the 15-year period. Such a change should occur with probability greater than 1/20, or 0.05.

A complicating problem with estimating the temporal variance of a population’s size is that we are seldom allowed to observe the true value of the population size. Rather, we are required to sample the population, and hence only obtain an estimate of the population size each year, with its associated sampling variance. Thus, we would need to include the 95% confidence bars on the annual estimates. As a result of this uncertainty from our sampling procedure, we would conclude that many of the year-to-year changes were not really changes because the estimates were not different. This complication leads to a further problem. If we compute the variance with the usual formula when estimates of population size replace the actual population size shown in Fig. 5.3, we obtain a variance estimate larger than the true temporal variance because our sampling uncertainty is included in the variance. For low levels of sampling effort each year, we would have a high sampling variance associated with each estimate, and as a result, we would have a high variance across years. The noise associated with our low sampling intensity would suggest that the population is fluctuating widely, when in fact the population could be constant (i.e., temporal variance is zero), and the estimated changes in the population are just due to sampling variance.

This mixture of sampling and temporal variation becomes particularly important in population viability analysis (PVA). The objective of a PVA is to estimate the probability of extinction for a population, given current size, and some idea of the variation in the population dynamics (i.e., temporal variation). If our estimate of temporal variation includes sampling variation, and the level of effort to obtain the estimates is relatively low, the high sampling variation causes our naive estimate of temporal variation to be much too large. When we apply our PVA analysis with this inflated estimate of temporal variance, we conclude that the population is much more likely to go extinct than it really is, and hence the importance of separating sampling variation from process variation.

Typically, we estimate variance components with analysis of variance (ANOVA) procedures. For the example considered here, we would have to have at least two estimates of population size for a series of years to obtain valid estimates of sampling and temporal variation. Further, typical ANOVA techniques assume that the sampling variation is constant, and so do not account for differences in levels of effort, or the fact that sampling variance is usually a function of population size. For our example, we have an estimate of sampling variance for each of our estimates, obtained from the population estimation methods considered in this manual. That is, capture–recapture, mark–resight, line transects, removal methods, and quadrat counts all produce estimates of sampling variation. Thus, we do not want to estimate sampling variation by obtaining replicate estimates, but want to use the available estimate. Therefore, we present a method of moments estimator developed in Burnham et al. (1987, Part 5). Skalski and Robson (1992, Chapter 2) also present a similar procedure, but do not develop the weighted estimator presented here.

Example 5.1 Population Size, Estimates, Standard Error of the Estimates, and Confidence Intervals for Owl Pairs in Fig. 5.3

| Standard | |||||

|---|---|---|---|---|---|

| Year | Population | Estimate | error | Lower 95% CI | Upper 95% CI |

| 1980 | 44 | 40.04 | 5.926 | 28.42 | 51.66 |

| 1981 | 48 | 50.51 | 11.004 | 28.94 | 72.08 |

| 1982 | 61 | 61.36 | 15.278 | 31.42 | 91.31 |

| 1983 | 48 | 47.6 | 11.062 | 25.92 | 69.28 |

| 1984 | 76 | 95.51 | 18.988 | 58.3 | 132.72 |

| 1985 | 29 | 33.81 | 8.803 | 16.56 | 51.06 |

| 1986 | 60 | 34.39 | 5.804 | 23.01 | 45.76 |

| 1987 | 59 | 38.52 | 11.168 | 16.63 | 60.41 |

| 1988 | 76 | 84.57 | 21.312 | 42.8 | 126.34 |

| 1989 | 42 | 30.04 | 6.918 | 16.48 | 43.6 |

| 1990 | 29 | 20.29 | 7.529 | 5.54 | 35.05 |

| 1991 | 68 | 68.42 | 17.969 | 33.2 | 103.64 |

| 1992 | 42 | 45.51 | 13.225 | 19.6 | 71.44 |

| 1993 | 27 | 27.01 | 6.137 | 14.98 | 39.04 |

| 1994 | 72 | 71.12 | 14.511 | 42.67 | 99.56 |

| 1995 | 54 | 51.45 | 8.054 | 35.66 | 67.24 |

The variance of the n = 16 populations is 265.628, whereas the variance of the 16 estimates is 450.376. Sampling variation causes the estimates to have a larger variance than the actual population. The difference of these two variances is an estimate of the sampling variation, i.e., 450.376 – 265.628 = 184.748. The square root of 184.748 is 13.592, and is the approximate mean of the 16 reported standard errors.

To obtain an unbiased estimate of the temporal variance, we must remove the sampling variation from the estimate of the total variance. Define σtotal2 as the total variance, estimated for n = 16 estimates of owl pairs (Nˆi, i = 1980, …, 1995) as

(5.6)σˆtotal2=Σi=19801995(Nˆi−N¯)2(n−1)=Σi=19801995Nˆi2(Σi−19801985Nˆi)2n(n−1),

where the symbol indicates the estimate of the parameter. Thus, Nˆi are the estimates of the actual populations, Ni, and σˆtotal2 is an estimate of the total variance σˆi2 For each estimate, Nˆi, we also have an associated sampling variance, σˆi2. Then, a simple estimator of the temporal variance, σ2time, is given by

(5.7)σˆtime2=σˆtotal2−Σi=19801995σˆi2n,

when we can assume that all of the sampling variances, σˆi2, are equal. The above equation corresponds to Eq. (2.6) of Skalski and Robson (1992). When the σˆi2 cannot all be assumed to be equal, a more complex calculation is required (Burnham et al., 1987, Section 4.3) because each estimate must be weighted by its sampling variance. We take as the weight of each estimate the reciprocal of the sum of temporal variance plus the sampling variance, 1/(σˆtime2+σˆi2). That is, Var(Nˆi)=σˆtime2+σˆi2, so wi=1/Var(Nˆi)=1/(σˆtime2+σˆi2). Then, the weighted total variance is computed as

(5.8)σˆtotal2=Σi=19801995wi(Nˆi−N¯)2(n−1)Σi=19801995wi

with the mean of the estimates now computed as a weighted mean,

(5.9)N¯=Σi=19801995wiNˆiΣi=19801995wi.

We now know that the theoretical variance N¯ is

(5.10)Var(N¯)=Var(Σi=19801995wiNˆiΣi=19801995wi)=1Σi=19801995wi

and the empirical variance estimator is Eq. (5.8). Setting these two equations equal,

(5.11)1Σi=19801995wi=Σi=19801995wi(Nˆi−N¯)2(n−1)Σi=19801995wi

or

(5.12)1=Σi=19801995wi(Nˆi−N¯)2(n−1).

Because we cannot solve for σˆtime2 directly, we have to use an iterative numerical approach to estimate σˆtime2 This procedure involves substituting values of σˆtime2 into Eq. (5.12) via the wi until the two sides are equal. When both sides are the same, we have our estimate of σˆtime2. Using this estimate of σˆtime2, we can now decide what level of change in Nˆi to Nˆi+1 is important and deserves attention. If the change from a series of estimates is greater than 2σˆtime2, we may want to take action.

Typically, we do not have the luxury of enough background data to estimate σˆtime2, so we end up trying to evaluate whether a series of estimated population sizes is in fact signaling a decline in the population when both sampling and process variance are present. Note that just because we see a decline of the estimates for 3–4 consecutive years, we cannot be sure that the population is actually in a serious decline without knowledge of the mean population size and the temporal variation prior to the decline. Usually, however, we do not have good knowledge of the population size prior to some observed decline, and make a decision to act based on biological perceptions. Keep in mind the kinds of trends displayed in Fig. 5.1. Is the suggested trend part of a cycle, or are we observing a real change in population size? In this discussion, we have only considered temporal variation. A similar procedure can be used to separate spatial variation from sampling variation.

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B9780126889604500058

Multiple Regression

Andrew F. Siegel, Michael R. Wagner, in Practical Business Statistics (Eighth Edition), 2022

Typical Prediction Error: Standard Error of Estimate

Just as for simple regression, with only one X, the standard error of estimate indicates the approximate size of the prediction errors. For the magazine ads example, Se = $106,072. This tells you that actual page costs for these magazines are typically within about $106,072 from the predicted page costs, in the sense of a standard deviation. That is, if the error distribution is normal, then you would expect about two-thirds of the actual page costs to be within Se of the predicted page costs, about 95% to be within 2Se, and so forth.

The standard error of estimate, Se = $106,072, indicates the remaining variation in page costs after you have used the X variables (audience, percent male, and median income) in the regression equation to predict page costs for each magazine. Compare this to the ordinary univariate standard deviation, SY = $163,549, for the page costs, computed by ignoring all the other variables. This standard deviation, SY, indicates the remaining variation in page costs after you have used only Y¯ to predict the page costs for each magazine. Note that Se = $106,072 is smaller than SY = $163,549; your errors are typically smaller if you use the regression equation instead of just Y¯ to predict page costs. This suggests that the X variables are helpful in explaining page costs.

Think of the situation this way. If you knew nothing of the X variables, you would use the average page costs (Y¯=$187,628) as your best guess, and you would be wrong by about SY = $163,549. But if you knew the audience, percent male readership, and median reader income, you could use the regression equation to find a prediction for page costs that would be wrong by only Se = $106,072. This reduction in prediction error (from $163,549 to $106,072) is one of the helpful payoffs from running a regression analysis.

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B9780128200254000129

Multiple Regression

Gary Smith, in Essential Statistics, Regression, and Econometrics, 2012

Confidence Intervals for the Coefficients

If the error term is normally distributed and satisfies the four assumptions detailed in the simple regression chapter, the estimators are normally distributed with expected values equal to the parameters they estimate:

a∼N[α, standard deviation of a]bi∼N[βi, standard deviation of bi]

To compute the standard errors (the estimated standard deviations) of these estimators, we need to use the standard error of estimate (SEE) to estimate the standard deviation of the error term:

(10.3)SEE=∑(Y−Y^)2n−(k+1)

Because n observations are used to estimate k + 1 parameters, we have n − (k + 1) degrees of freedom. After choosing a confidence level, such as 95 percent, we use the t distribution with n − (k + 1) degrees of freedom to determine the value t* that corresponds to this probability. The confidence interval for each coefficient is equal to the estimate plus or minus the requisite number of standard errors:

(10.4)a±t*(standard error ofa)bi±t*(standard error ofbi)

For our consumption function, statistical software calculates SEE = 59.193 and these standard errors:

standard error ofa=27.327standard error ofb1=0.019standard error ofb2=0.003

With 49 observations and 2 explanatory variables, we have 49 − (2 + 1) = 46 degrees of freedom. Table A.2 gives t* = 2.013 for a 95 percent confidence interval, so that 95 percent confidence intervals are

α:a±t*(standard error ofa)=−110.126±2.013(27.327)=−110.126±55.010β1:b1±t*(standard error ofb1)=0.798±2.013(0.019)=0.798±0.039β2:b2±t*(standard error ofb2)=0.026±2.013(0.003)=0.026±0.006

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B9780123822215000106

Multiple Regression

Gary Smith, in Essential Statistics, Regression, and Econometrics (Second Edition), 2015

Confidence Intervals for the Coefficients

If the error term is normally distributed and satisfies the four assumptions detailed in the simple regression chapter, the estimators are normally distributed with expected values equal to the parameters they estimate:

a∼N[α,standarddeviationofa]bi∼N[βistandarddeviationofbi]

To compute the standard errors (the estimated standard deviations) of these estimators, we need to use the standard error of estimate (SEE) to estimate the standard deviation of the error term:

(10.5)SEE=∑(y−yˆ)2n−(k+1)

Because n observations are used to estimate k + 1 parameters, we have n − (k + 1) degrees of freedom. After choosing a confidence level, such as 95 percent, we use the t distribution with n − (k + 1) degrees of freedom to determine the value t∗ that corresponds to this probability. The confidence interval for each coefficient is equal to the estimate plus or minus the requisite number of standard errors:

(10.6)a±t∗(standarderrorofa)bi±t∗(standarderrorofbi)

For our consumption function, statistical software calculates SEE = 59.193 and these standard errors:

standarderrorofa=27.327standarderrorofb1=0.019standarderrorofb2=0.003

With 49 observations and two explanatory variables, we have 49 − (2 + 1) = 46 degrees of freedom. Table A.2 gives t∗ = 2.013 for a 95 percent confidence interval, so that 95 percent confidence intervals are:

α:a±t∗(standarderrorofa)=−110.126±2.013(27.327)=−110.126±55.010β1:b1±t∗(standarderrorofb1)=0.798±2.013(0.019)=0.798±0.039β2:b2±t∗(standarderrorofb2)=0.026±2.013(0.003)=0.026±0.006

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B9780128034590000108

Simple Regression

Gary Smith, in Essential Statistics, Regression, and Econometrics (Second Edition), 2015

Abstract

The simple regression model assumes a linear relationship, Y = α + βX + ε, between a dependent variable Y and an explanatory variable X, with the error term ε encompassing omitted factors. The least squares estimates a and b minimize the sum of squared errors when the fitted line is used to predict the observed values of Y. The standard error of estimate (SEE) is our estimate of the standard deviation of the error term. The standard errors of the estimates a and b can be used to construct confidence intervals for α and β and test null hypotheses, most often that the value of β is zero (Y and X are not linearly related). The coefficient of determination R2 compares the model’s sum of the squared prediction errors to the sum of the squared deviations of Y about its mean, and can be interpreted as the fraction of the variation in the dependent variable that is explained by the regression model. The correlation coefficient is equal to the square root of R2.

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B978012803459000008X

Bootstrap Method

K. Singh, M. Xie, in International Encyclopedia of Education (Third Edition), 2010

Approximating Standard Error of a Sample Estimate

Let us suppose, information is sought about a population parameter θ. Suppose θˆ is a sample estimator of θ based on a random sample of size n, that is, θˆ is a function of the data (X1, X2, …,Xn). In order to estimate standard error of θˆ, as the sample varies over the class of all possible samples, one has the following simple bootstrap approach.

Computeθ1*,θ2*,…,θN*, using the same computing formula as the one used for θˆ, but now base it on N different bootstrap samples (each of size n). A crude recommendation for the size N could be N = n2 (in our judgment), unless n2 is too large. In that case, it could be reduced to an acceptable size, say nlogen. One defines

SEB(θˆ)=[(1/N)∑i=1N(θi*−θˆ)2]1/2

following the philosophy of bootstrap: replace the population by the empirical population.

An older resampling technique used for this purpose is Jackknife, though bootstrap is more widely applicable. The famous example where Jackknife fails while bootstrap is still useful is that of θˆ = the sample median.

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B9780080448947013099

Pearson, Karl

M. Eileen Magnello, in Encyclopedia of Social Measurement, 2005

The Biometric School

Although Pearson’s success in attracting such large audiences in his Gresham lectures may have played a role in encouraging him to further develop his work in biometry, he resigned from the Gresham Lectureship due to his doctor’s recommendation. Following the success of his Gresham lectures, Pearson began to teach statistics to students at UCL in October 1894. Not only did Galton’s work on his law of ancestral heredity enable Pearson to devise the mathematical properties of the product– moment correlation coefficient (which measures the relationship between two continuous variables) and simple regression (used for the linear prediction between two continuous variables) but also Galton’s ideas led to Pearson’s introduction of multiple correlation and part correlation coefficients, multiple regression and the standard error of estimate (for regression), and the coefficient of variation. By then, Galton had determined graphically the idea of correlation and regression for the normal distribution only. Because Galton’s procedure for measuring correlation involved measuring the slope of the regression line (which was a measure of regression instead), Pearson kept Galton’s “r” to symbolize correlation. Pearson later used the letter b (from the equation for a straight line) to symbolize regression. After Weldon had seen a copy of Pearson’s 1896 paper on correlation, he suggested to Pearson that he should extend the range for correlation from 0 to +1 (as used by Galton) so that it would include all values from −1 to +1.

Pearson achieved a mathematical resolution of multiple correlation and multiple regression, adumbrated in Galton’s law of ancestral heredity in 1885, in his seminal paper Regression, Heredity, and Panmixia in 1896, when he introduced matrix algebra into statistical theory. (Arthur Cayley, who taught at Cambridge when Pearson was a student, created matrix algebra by his discovery of the theory of invariants during the mid-19th century.) Pearson’s theory of multiple regression became important to his work on Mendel in 1904 when he advocated a synthesis of Mendelism and biometry. In the same paper, Pearson also introduced the following statistical methods: eta (η) as a measure for a curvilinear relationship, the standard error of estimate, multiple regression, and multiple and part correlation. He also devised the coefficient of variation as a measure of the ratio of a standard deviation to the corresponding mean expressed as a percentage.

By the end of the 19th century, he began to consider the relationship between two discrete variables, and from 1896 to 1911 Pearson devised more than 18 methods of correlation. In 1900, he devised the tetrachoric correlation and the phi coefficient for dichotomous variables. The tetrachoric correlation requires that both X and Y represent continuous, normally distributed, and linearly related variables, whereas the phi coefficient was designed for so-called point distributions, which implies that the two classes have two point values or merely represent some qualitative attribute. Nine years later, he devised the biserial correlation, where one variable is continuous and the other is discontinuous. With his son Egon, he devised the polychoric correlation in 1922 (which is very similar to canonical correlation today). Although not all of Pearson’s correlational methods have survived him, a number of these methods are still the principal tools used by psychometricians for test construction. Following the publication of his first three statistical papers in Philosophical Transactions of the Royal Society, Pearson was elected a fellow of the Royal Society in 1896. He was awarded the Darwin Medal from the Royal Society in 1898.

Read full chapter

URL:

https://www.sciencedirect.com/science/article/pii/B0123693985002280

Errors are of various types and impact the research process in different ways. Here’s a deep exploration of the standard error, the types, implications, formula, and how to interpret the values

What is a Standard Error?

The standard error is a statistical measure that accounts for the extent to which a sample distribution represents the population of interest using standard deviation. You can also think of it as the standard deviation of your sample in relation to your target population.

The standard error allows you to compare two similar measures in your sample data and population. For example, the standard error of the mean measures how far the sample mean (average) of the data is likely to be from the true population mean—the same applies to other types of standard errors.

Explore: Survey Errors To Avoid: Types, Sources, Examples, Mitigation

Why is Standard Error Important?

First, the standard error of a sample accounts for statistical fluctuation.

Researchers depend on this statistical measure to know how much sampling fluctuation exists in their sample data. In other words, it shows the extent to which a statistical measure varies from sample to population.

In addition, standard error serves as a measure of accuracy. Using standard error, a researcher can estimate the efficiency and consistency of a sample to know precisely how a sampling distribution represents a population.

How Many Types of Standard Error Exist?

There are five types of standard error which are:

- Standard error of the mean

- Standard error of measurement

- Standard error of the proportion

- Standard error of estimate

- Residual Standard Error

1. Standard Error of the Mean (SEM)

The standard error of the mean accounts for the difference between the sample mean and the population mean. In other words, it quantifies how much variation is expected to be present in the sample mean that would be computed from every possible sample, of a given size, taken from the population.

How to Find SEM (With Formula)

SEM = Standard Deviation ÷ √n

Where;

n = sample size

Suppose that the standard deviation of observation is 15 with a sample size of 100. Using this formula, we can deduce the standard error of the mean as follows:

SEM = 15 ÷ √100

Standard Error of Mean in 1.5

2. Standard Error of Measurement

The standard error of measurement accounts for the consistency of scores within individual subjects in a test or examination.

This means it measures the extent to which estimated test or examination scores are spread around a true score.

A more formal way to look at it is through the 1985 lens of Aera, APA, and NCME. Here, they define a standard error as “the standard deviation of errors of measurement that is associated with the test scores for a specified group of test-takers….”

Read: 7 Types of Data Measurement Scales in Research

How to Find Standard Error of Measurement

Where;

rxx is the reliability of the test and is calculated as:

Rxx = S2T / S2X

Where;