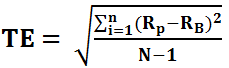

Formula for Tracking Error (Definition)

Tracking Error Formula is used in order to measure the divergence arising between the price behavior of portfolio and price behavior of the respective benchmark and according to the formula Tracking Error calculation is done by calculating the standard deviation of the difference in return of the portfolio and the benchmark over the period of time.

Tracking error is simply a measure to gauge how much the return of a portfolio or a mutual fund deviates from the return of an index it is trying to replicate in terms of the components of an index and also in the term of the return of that index. There are several mutual funds where the fund managers of that fund aim to construct the fund by closely replicating the stocks of a particular index, by trying to add stocks in his fund with the same proportion. There are two formulas to calculate the tracking error for a portfolio.

The first method is to simply make the difference between the portfolio return and the return from the index it is trying to replicate.

Tracking Error = Rp-Ri

- Rp= Return from the portfolio

- Ri= Return from the index

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkArticle Link to be Hyperlinked

For eg:

Source: Tracking Error Formula (wallstreetmojo.com)

There is another method to calculate the tracking error of a portfolio with respect to the return from the index the portfolio is tracking.

The second method takes the standard deviation of the return of the portfolio and the benchmark.

The only difference is in this method; it is like calculating the standard deviation of return of the portfolio and that of the index the portfolio is trying to replicate. The second method is the more popular one and is used when the time series of data has a long history; in other words, when the historical data for the return of two variables are available for a longer period of time.

Table of contents

- Formula for Tracking Error (Definition)

- Explanation

- Examples

- Use of Tracking Error Formula

- Recommended Articles

Explanation

Tracking error is a measure to find out how much the return of a portfolio or a mutual fund deviates from the return of an index it is trying to replicate in terms of the components of an index and also in the term of the return of that index. But most of the time, it doesn’t get replicated exactly in terms of the return, due to various factors like the timing of buying the stocks, the personal judgment of the fund manager to alter the proportion depending on his style of investment.

Other than these, the volatilities of the stocks in the portfolio and the various charges that are attached for an investor when they invest in a mutual fund also result in deviation of the returns of a portfolio and the index the portfolio tracks.

Examples

You can download this Common Stock Formula Excel Template here – Common Stock Formula Excel Template

Example #1

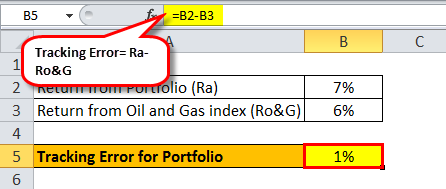

Let us try to do the calculation of the tracking error with the help of an arbitrary example, say for mutual fund A, which is tracking the oil and gas index. It is calculated by the difference in the return of the two variables.

Tracking Error calculation = Ra – Ro&G

- Ra= Return from the portfolio

- Ro&g= return from the oil and gas index

Suppose the return from the portfolio is 7%, and the return from the benchmark is 6%. The calculation will be as follows,

In this case, the tracking errors for the portfolio will be 1%.

Example #2

There is a mutual fund managed by a fund manager in SBI. The name of the fund in question is SBI- ETF Nifty Bank. This particular fund is constructed by taking the components of bank nifty closely in the proportion by which the banking stocks are in the bank nifty index.

Tracking Error = Rp-Ri

One year return from the portfolio is 8.9%, and the one-year return from the Nifty benchmark index is 8.6%.

In this case, the tracking errors for the portfolio will be 0.3%.

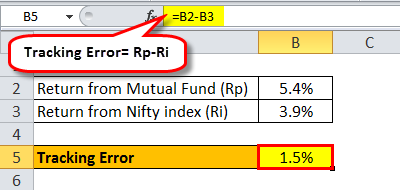

Example #3

There is a mutual fund managed by a fund manager in Axis Bank. The name of the fund in question is Axis Nifty ETF. This particular fund is constructed by taking the components of the nifty 50 closely in the proportion by which the index stocks are in the Nifty index.

One year return from the portfolio is 5.4%, and the one-year return from the Nifty benchmark index is 3.9%.

In this case, the tracking errors for the portfolio will be 1.5%.

Use of Tracking Error Formula

It helps the investors of a fund to understand whether the fund is closely tracking and replicating the components of the index it is putting up as a benchmark. It showcases whether the fund manager is trying to actively track the benchmark or he is putting his style in order to modify it. It also helps the investors to find out whether the charges are high enough for the fund to impact the return of the fund.

Recommended Articles

This has been a guide to Tracking Error Formula. Here we discuss how to calculate tracking error for the portfolio along with examples and a downloadable excel template. You can learn more about financing from the following articles-

- Calculate Sample Standard DeviationSample standard deviation refers to the statistical metric that is used to measure the extent by which a random variable diverges from the mean of the sample.read more

- Margin Error FormulaThe margin of error is a statistical expression to determine the percentage point the result arrived at will differ from the actual value. Standard deviation divided by the sample size, multiplying the resultant figure with the critical factor. Margin of Error = Z * ơ / √nread more

- Risk-Adjusted Return CalculationRisk-adjusted return is a strategy for measuring and analyzing investment returns in which financial, market, credit, and operational risks are evaluated and adjusted so that an individual may decide whether the investment is worthwhile given all of the risks to the capital invested.read more

- 529 Plan529 Plan or qualified tuition plan refers to a tax-advantaged savings plan whereby the parents or grandparents can save money for their children’s or grandchildren’s future education. Such savings are tax-free only when it is used for meeting the relevant educational costs.read more

From Wikipedia, the free encyclopedia

In finance, tracking error or active risk is a measure of the risk in an investment portfolio that is due to active management decisions made by the portfolio manager; it indicates how closely a portfolio follows the index to which it is benchmarked. The best measure is the standard deviation of the difference between the portfolio and index returns.

Many portfolios are managed to a benchmark, typically an index. Some portfolios are expected to replicate, before trading and other costs, the returns of an index exactly (e.g., an index fund), while others are expected to ‘actively manage’ the portfolio by deviating slightly from the index in order to generate active returns. Tracking error is a measure of the deviation from the benchmark; the aforementioned index fund would have a tracking error close to zero, while an actively managed portfolio would normally have a higher tracking error. Thus the tracking error does not include any risk (return) that is merely a function of the market’s movement. In addition to risk (return) from specific stock selection or industry and factor «betas», it can also include risk (return) from market timing decisions.

Dividing portfolio active return by portfolio tracking error gives the information ratio, which is a risk adjusted performance measure.

Definition[edit]

If tracking error is measured historically, it is called ‘realized’ or ‘ex post’ tracking error. If a model is used to predict tracking error, it is called ‘ex ante’ tracking error. Ex-post tracking error is more useful for reporting performance, whereas ex-ante tracking error is generally used by portfolio managers to control risk. Various types of ex-ante tracking error models exist, from simple equity models which use beta as a primary determinant to more complicated multi-factor fixed income models. In a factor model of a portfolio, the non-systematic risk (i.e., the standard deviation of the residuals) is called «tracking error» in the investment field. The latter way to compute the tracking error complements the formulas below but results can vary (sometimes by a factor of 2).

Formulas[edit]

The ex-post tracking error formula is the standard deviation of the active returns, given by:

where

Interpretation[edit]

Under the assumption of normality of returns, an active risk of x per cent would mean that approximately 2/3 of the portfolio’s active returns (one standard deviation from the mean) can be expected to fall between +x and -x per cent of the mean excess return and about 95% of the portfolio’s active returns (two standard deviations from the mean) can be expected to fall between +2x and -2x per cent of the mean excess return.

Examples[edit]

- Index funds are expected to have minimal tracking errors.

- Inverse exchange-traded funds are designed to perform as the inverse of an index or other benchmark, and thus reflect tracking errors relative to short positions in the underlying index or benchmark.

Index fund creation[edit]

Index funds are expected to minimize the tracking error with respect to the index they are attempting to replicate, and this problem may be solved using standard optimization techniques. To begin, define

where

where

References[edit]

- ^ Cornuejols, Gerard; Tütüncü, Reha (2007). Optimization Methods in Finance. Mathematics, Finance and Risk. Cambridge University Press. pp. 178–180. ISBN 978-0521861700.

External links[edit]

- Tracking Error — YouTube

- Tracking error: A hidden cost of passive investing

- Tracking error

- What is the Tracking Error?

What Is a Tracking Error?

Tracking error is the divergence between the price behavior of a position or a portfolio and the price behavior of a benchmark. This is often in the context of a hedge fund, mutual fund, or exchange-traded fund (ETF) that did not work as effectively as intended, creating an unexpected profit or loss.

Tracking error is reported as a standard deviation percentage difference, which reports the difference between the return an investor receives and that of the benchmark they were attempting to imitate.

Key Takeaways

- Tracking error is the difference in actual performance between a position (usually an entire portfolio) and its corresponding benchmark.

- The tracking error can be viewed as an indicator of how actively a fund is managed and its corresponding risk level.

- Evaluating a past tracking error of a portfolio manager may provide insight into the level of benchmark risk control the manager may demonstrate in the future.

Tracking Error

Understanding a Tracking Error

Since portfolio risk is often measured against a benchmark, tracking error is a commonly used metric to gauge how well an investment is performing. Tracking error shows an investment’s consistency versus a benchmark over a given period of time. Even portfolios that are perfectly indexed against a benchmark behave differently than the benchmark, even though this difference on a day-to-day, quarter-to-quarter, or year-to-year basis may be ever so slight. The measure of tracking error is used to quantify this difference.

Tracking error is the standard deviation of the difference between the returns of an investment and its benchmark. Given a sequence of returns for an investment or portfolio and its benchmark, tracking error is calculated as follows:

Tracking Error = Standard Deviation of (P — B)

- Where P is portfolio return and B is benchmark return.

From an investor’s point of view, tracking error can be used to evaluate portfolio managers. If a manager is realizing low average returns and has a large tracking error, it is a sign that there is something significantly wrong with that investment and that the investor should most likely find a replacement.

It may also be used to forecast performance, particularly for quantitative portfolio managers who construct risk models that include the likely factors that influence price changes. The managers then construct a portfolio that uses the type of constituents of a benchmark (such as style, leverage, momentum, or market cap) to create a portfolio that will have a tracking error that closely adheres to the benchmark.

Special Considerations

Factors That Can Affect a Tracking Error

The net asset value (NAV) of an index fund is naturally inclined toward being lower than its benchmark because funds have fees, whereas an index does not. A high expense ratio for a fund can have a significantly negative impact on the fund’s performance. However, it is possible for fund managers to overcome the negative impact of fund fees and outperform the underlying index by doing an above-average job of portfolio rebalancing, managing dividends or interest payments, or securities lending.

Beyond fund fees, a number of other factors can affect a fund’s tracking error. One important factor is the extent to which a fund’s holdings match the holdings of the underlying index or benchmark. Many funds are made up of just the fund manager’s idea of a representative sample of the securities that make up the actual index. There are frequently also differences in weighting between a fund’s assets and the assets of the index.

Illiquid or thinly-traded securities can also increase the chance of a tracking error, since this often leads to prices differing significantly from market price when the fund buys or sells such securities as a result of larger bid-ask spreads. Finally, the level of volatility for an index can also affect the tracking error.

Sector, international, and dividend ETFs tend to have higher absolute tracking errors; broad-based equity and bond ETFs tend to have lower ones. Management expense ratios (MER) are the most prominent cause of tracking error and there tends to be a direct correlation between the size of the MER and tracking error. But other factors can intercede and be more significant at times.

Premiums and Discounts to Net Asset Value

Premiums or discounts to NAV may occur when investors bid the market price of an ETF above or below the NAV of its basket of securities. Such divergences are usually rare. In the case of a premium, the authorized participant typically arbitrages it away by purchasing securities in the ETF basket, exchanging them for ETF units, and selling the units on the stock market to earn a profit (until the premium is gone). Premiums and discounts as high as 5% have been known to occur, particularly for thinly traded ETFs.

Optimization

When there are thinly traded stocks in the benchmark index, the ETF provider can’t buy them without pushing their prices up substantially, so it uses a sample containing the more liquid stocks to proxy the index. This is called portfolio optimization.

Diversification Constraints

ETFs are registered with regulators as mutual funds and need to abide by the applicable regulations. Of note are two diversification requirements: 75% of its assets must be invested in cash, government securities, and securities of other investment companies, and no more than 5% of the total assets can be invested in any one security. This can create problems for ETFs tracking the performance of a sector where there are a lot of dominant companies.

Cash Drag

Indexes don’t have cash holdings, but ETFs do. Cash can accumulate at intervals due to dividend payments, overnight balances, and trading activity. The lag between receiving and reinvesting the cash can lead to a decline in performance known as drag. Dividend funds with high payout yields are most susceptible.

Index Changes

ETFs track indexes and when the indexes are updated, the ETFs have to follow suit. Updating the ETF portfolio incurs transaction costs. And it may not always be possible to do it the same way as the index. For example, a stock added to the ETF may be at a different price than what the index maker selected.

Capital-Gains Distributions

ETFs are more tax-efficient than mutual funds but have nevertheless been known to distribute capital gains that are taxable in the hands of unitholders. Although it may not be immediately apparent, these distributions create a different performance than the index on an after-tax basis. Indexes with a high level of turnover in companies (e.g., mergers, acquisitions, and spin-offs) are one source of capital-gains distributions. The higher the turnover rate, the higher the likelihood the ETF will be compelled to sell securities at a profit.

Securities Lending

Some ETF companies may offset tracking errors through security lending, which is the practice of lending out holdings in the ETF portfolio to hedge funds for short selling. The lending fees collected from this practice can be used to lower tracking error if so desired.

Currency Hedging

International ETFs with currency hedging may not follow a benchmark index due to the costs of currency hedging, which are not always embodied in the MER. Factors affecting hedging costs include market volatility and interest-rate differentials, which impact the pricing and performance of forward contracts.

Futures Roll

Commodity ETFs, in many cases, track the price of a commodity through the futures markets, buying the contract closest to expiry. As the weeks pass and the contract nears expiration, the ETF provider will sell it (to avoid taking delivery) and buy the next month’s contract. This operation, known as the «roll,» is repeated every month. If contracts further from expiration have higher prices (contango), the roll into the next month will be at a higher price, which incurs a loss. Thus, even if the spot price of the commodity stays the same or rises slightly, the ETF could still show a decline. Vice versa, if futures further away from expiration have lower prices (backwardation), the ETF will have an upward bias.

Maintaining Constant Leverage

Leveraged and inverse ETFs use swaps, forwards, and futures to replicate on a daily basis two or three times the direct or inverse return of a benchmark index. This requires rebalancing the basket of derivatives daily to ensure they deliver the specified multiple of the index’s change each day.

Example of a Tracking Error

For example, assume that there is a large-cap mutual fund benchmarked to the S&P 500 index. Next, assume that the mutual fund and the index realized the following returns over a given five-year period:

- Mutual Fund: 11%, 3%, 12%, 14% and 8%.

- S&P 500 index: 12%, 5%, 13%, 9% and 7%.

Given this data, the series of differences is then (11% — 12%), (3% — 5%), (12% — 13%), (14% — 9%) and (8% — 7%). These differences equal -1%, -2%, -1%, 5%, and 1%. The standard deviation of this series of differences, the tracking error, is 2.50%.

A measure of the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark

What is Tracking Error?

Tracking error is a measure of financial performance that determines the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark. The return fluctuations are primarily measured by standard deviations.

Generally, a benchmark is a diversified market index that represents part of the total market. The most common benchmarks for equity portfolios are the S&P 500 and the Dow Jones Industrial Average (DJIA) for portfolios with large-cap stocks, and the Russell 2000 for small-cap portfolios.

Importance of Tracking Error

Tracking error is one of the most important measures used to assess the performance of a portfolio, as well as the ability of a portfolio manager to generate excessive returns and beat the market or the benchmark. Due to the abovementioned reasons, it is used as an input to calculate the information ratio.

Tracking error is frequently categorized by the way it is calculated. A realized (also known as “ex post”) tracking error is calculated using historical returns. A tracking error whose calculations are based on some forecasting model is called an “ex ante” tracking error.

Low errors indicate that the performance of the portfolio is close to the performance of the benchmark. Low errors are common with index funds and ETFs that replicate the composition of major stock market indices.

High errors reveal that the portfolio’s performance is significantly different from the performance of the benchmark. The high errors can indicate that the portfolio substantially beat the benchmark, or signal that the portfolio significantly underperforms the benchmark.

Formula for Tracking

Tracking efficiency is calculated using the following formula:

Where:

- Var – the variance

- rp – the return of a portfolio

- rb – the return of a benchmark

Example of Tracking Error

Five years ago, Sam invested $100,000 in Fund A. The fund primarily invests in large-cap US equities. During the five-year period, the fund showed positive returns. Also, the economy also grew during the period and equity markets rose.

In order to assess how successful his investment was, Sam decides to compare the returns of Fund A against the returns of a benchmark. In such a case, the most appropriate benchmark is the S&P 500 because it tracks the performance of the biggest large-cap companies.

The comparison of the fund against the benchmark can be measured using the tracking error.

The following data is available for the yearly returns for both Fund A and the S&P 500:

We can plug this data into the formula to calculate the tracking error:

In the scenario above, the small tracking error indicates that Fund A does not significantly outperform the benchmark. Therefore, Sam may consider withdrawing his money from the fund and putting it into other, more promising investment opportunities. Alternatively, he may be satisfied with the fact that his portfolio is keeping pace with the gains of the overall market.

Related Readings

Thank you for reading CFI’s guide on Tracking Error. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

- Exchange Traded Funds (ETFs)

- Index Funds

- Nasdaq Composite

- Small Cap Stock

- See all wealth management resources

Что это такое:

Ошибка отслеживания — это разница между доходами портфеля и эталоном или индексом предназначенный для имитации или избиения. Ошибка отслеживания иногда называется активным риском.

Существует два способа измерения ошибки отслеживания. Первый заключается в вычитании суммарной доходности контрольного показателя из возвратов портфеля, как показано ниже:

Возврат p — Возврат i = Ошибка отслеживания

Где:

p = портфель

i = индекс или ориентир

Тем не менее, второй путь более распространен, что заключается в вычислении стандартного отклонения разницы в портфеле и повторных результатов с течением времени. Формула такова:

Как это работает (пример):

Предположим, вы инвестируете в взаимный фонд компании XYZ, который существует для тиражирования индекса Russell 2000 как по составу, так и по доходности. Если взаимный фонд компании XYZ возвращает 5,5% в год, а Russell 2000 (эталон) возвращает 5,0%, то, используя первую формулу выше, мы бы сказали, что у взаимного фонда компании XYZ была ошибка отслеживания 0,5%.

Со временем будет больше периодов, в течение которых мы можем сравнивать доходность. Здесь вторая формула становится более полезной. Консистенция (или несогласованность) «спредов» между доходами портфеля и доходностью эталона позволяет аналитикам попытаться предсказать будущую производительность портфеля. Если, например, мы знали, что годовая доходность портфеля на 0,4% выше, чем в контрольном контроле 67% времени за последние пять лет, мы бы знали, что это, вероятно, произойдет в будущем (предполагая, что управляющий портфелем не сделал никаких крупных изменения). Прогностическая ценность этих вычислений становится еще лучше, когда есть больше точек данных, и когда аналитик объясняет, как ценные бумаги портфеля перемещаются относительно друг друга (это называется со-дисперсией).

Несколько факторов обычно определяют ошибку отслеживания портфеля:

1. Степень, в которой портфель и контрольный показатель имеют общие ценные бумаги

2. Различия в рыночной капитализации, сроках, стиле инвестиций и других фундаментальных характеристиках портфеля и эталонных показателях

3. Различия в взвешивании активов между портфелем и эталоном

4. Плата за управление, сборы за хранение, брокерские расходы и другие расходы, влияющие на портфель, который не влияет на эталонный показатель

5. Волатильность эталона

6. Бета-версия портфеля

Кроме того, портфельные менеджеры должны учитывать приток и отток денежных средств от инвесторов, что заставляет их время от времени перестраивать свои портфели. Это также связано с прямыми и косвенными затратами.

800×600

Почему это имеет значение:

Низкая ошибка отслеживания означает, что портфель внимательно следит за своим эталоном. Высокие ошибки отслеживания указывают на противоположное. Таким образом, ошибка отслеживания дает инвесторам представление о том, как «жесткий» портфель, о котором идет речь, находится вокруг его контрольного показателя или насколько изменчивый портфель по сравнению с его эталоном. Важно отметить, что некоторые контрольные портфели допускают большую ошибку отслеживания, чем другие, поэтому инвесторы должны понять, предназначены ли их ориентированные на портфель портфели, чтобы либо скопировать контрольный показатель, либо инвестировать таким образом, который отражает дух эталона, либо просто попытаться чтобы статистически воссоздать поведение эталона.

Хотя некоторые инвесторы могут быть счастливы, что портфель в нашем примере превысил контрольный показатель, ошибка отслеживания на самом деле свидетельствует о том, что менеджер фонда взял на себя больший риск. Это не всегда то, что хотят инвесторы фонда, и именно поэтому ошибка отслеживания в какой-то мере является показателем избыточного риска.

Хотя эталонный показатель представляет собой возможную альтернативу рассматриваемому портфелю, вычисление ошибки отслеживания не означает разумного инвестор должен ограничивать сравнение только с эталоном; он или она будет также оценивать ошибки отслеживания других портфелей с той же целью.

В конечном счете, ошибка отслеживания является показателем мастерства менеджера и отражает то, насколько активно или пассивно управляется портфель. Активно управляемые портфели стремятся предоставить вышезадачные результаты, и они обычно требуют дополнительного риска и опыта для этого. В этих случаях инвестор стремится максимизировать ошибку отслеживания. С другой стороны, пассивно управляемые портфели стремятся тиражировать доходность индекса, поэтому большая ошибка отслеживания обычно считается нежелательной для этих инвесторов. Вот почему ошибка отслеживания может использоваться для установки допустимых диапазонов производительности для менеджеров портфеля.

Содержание

- Ошибка слежения в биржевых и ETF-фондах: что это такое и почему ее надо учитывать

- Содержание статьи

- Что такое биржевые и ETF-фонды

- Что такое ошибка слежения и зачем на нее смотреть

- Факторы, которые могут повлиять на ошибку отслеживания

- Tracking Error

- What Is a Tracking Error?

- Key Takeaways

- Tracking Error

- Understanding a Tracking Error

- Special Considerations

- Factors That Can Affect a Tracking Error

- Premiums and Discounts to Net Asset Value

- Optimization

- Diversification Constraints

- Cash Drag

- Index Changes

- Capital-Gains Distributions

- Securities Lending

- Currency Hedging

- Futures Roll

- Maintaining Constant Leverage

- Example of a Tracking Error

- Tracking Error

- What is Tracking Error?

- Importance of Tracking Error

- Formula for Tracking

- Example of Tracking Error

- Related Readings

Ошибка слежения в биржевых и ETF-фондах: что это такое и почему ее надо учитывать

Содержание статьи

Разбираемся, что значит данный показатель, как он рассчитывается и почему его важно знать.

Что такое биржевые и ETF-фонды

ETF (exchange-traded fund) дословно переводится как торгуемый на бирже фонд. Это фонд, паи (акции) которого обращаются на бирже. ETF может повторять структуру какого-либо индекса, например индекса S&P 500, а может быть собран из акций или облигаций компаний из конкретного сектора экономики, например, технологического или энергетического.

Суть инструмента в том, чтобы сделать доступными инвестиции розничным инвесторам, которым не по карману покупать много различных акций или облигаций по отдельности. Покупая пай ETF-фонда, который состоит из десятков ценных бумаг, инвестор тоже приобретает их, но опосредованно.

Аналогом ETF-фондов в России выступают биржевые паевые инвестиционные фонды (БПИФы). ETF и БПИФы могут включать самые разные активы, имеют высокую диверсификацию, низкую цену входа и существенно меньшую комиссию, чем другие виды паевых фондов. Чтобы их купить или продать, не нужно обращаться в управляющую компанию, сделку можно совершить самостоятельно, этим ETF и БПИФы схожи с акциями. Принципиальная разница между ETF и БПИФами лежит в юридической плоскости: ETF регистрируются за рубежом (США, Европа, Ирландия), БПИФы — в России.

Что такое ошибка слежения и зачем на нее смотреть

Суть ETF и БПИФов предполагает, что они должны максимально точно повторять динамику выбранного индекса или динамику собранной корзины ценных бумаг (базового актива).

Возьмем БПИФ «Тинькофф — Вечный портфель RUB». Фонд инвестирует в акции, долгосрочные и краткосрочные облигации, а также физическое золото в равных долях по 25%. Изменение стоимости пая всего фонда будет в большей или меньшей степени следовать за теми инструментами, доля которых наиболее велика в его структуре.

Однако именно из-за того, как сформирован фонд и доля каких инструментов в нем выше, а также какие комиссии предусмотрены, может возникнуть ошибка слежения (tracking error).

Ошибка слежения или ошибка отслеживания — это показатель отклонения дневных доходностей фонда от индекса или корзины ценных бумаг в пересчете на год. Простыми словами это разница между доходностью фонда и базового актива с учетом статистической погрешности. Она исчисляется в процентах. Ошибка слежения в инвестициях демонстрирует, насколько точно фонд повторяет динамику выбранного инструмента.

Низкая ошибка слежения показывает, что ETF или БПИФ максимально точно повторяет динамику индекса или корзину ценных бумаг, а значит, и доходность будет схожей. Высокая ошибка слежения, напротив, говорит о том, что фонд не в полной мере следует за изменением стоимости базового актива и, скорее всего, управляется малоэффективно.

Факторы, которые могут повлиять на ошибку отслеживания

В первую очередь на ошибку слежения влияет комиссия управляющей компании (УК) фонда за свои услуги. Чем выше комиссия УК, тем сильнее негативное влияние на результаты фонда, а следовательно, на размер ошибки слежения.

Источник

Tracking Error

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading.

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and is a Chartered Market Technician (CMT).

What Is a Tracking Error?

Tracking error is the divergence between the price behavior of a position or a portfolio and the price behavior of a benchmark. This is often in the context of a hedge fund, mutual fund, or exchange-traded fund (ETF) that did not work as effectively as intended, creating an unexpected profit or loss.

Tracking error is reported as a standard deviation percentage difference, which reports the difference between the return an investor receives and that of the benchmark they were attempting to imitate.

Key Takeaways

- Tracking error is the difference in actual performance between a position (usually an entire portfolio) and its corresponding benchmark.

- The tracking error can be viewed as an indicator of how actively a fund is managed and its corresponding risk level.

- Evaluating a past tracking error of a portfolio manager may provide insight into the level of benchmark risk control the manager may demonstrate in the future.

Tracking Error

Understanding a Tracking Error

Since portfolio risk is often measured against a benchmark, tracking error is a commonly used metric to gauge how well an investment is performing. Tracking error shows an investment’s consistency versus a benchmark over a given period of time. Even portfolios that are perfectly indexed against a benchmark behave differently than the benchmark, even though this difference on a day-to-day, quarter-to-quarter, or year-to-year basis may be ever so slight. The measure of tracking error is used to quantify this difference.

Tracking error is the standard deviation of the difference between the returns of an investment and its benchmark. Given a sequence of returns for an investment or portfolio and its benchmark, tracking error is calculated as follows:

Tracking Error = Standard Deviation of (P — B)

- Where P is portfolio return and B is benchmark return.

From an investor’s point of view, tracking error can be used to evaluate portfolio managers. If a manager is realizing low average returns and has a large tracking error, it is a sign that there is something significantly wrong with that investment and that the investor should most likely find a replacement.

It may also be used to forecast performance, particularly for quantitative portfolio managers who construct risk models that include the likely factors that influence price changes. The managers then construct a portfolio that uses the type of constituents of a benchmark (such as style, leverage, momentum, or market cap) to create a portfolio that will have a tracking error that closely adheres to the benchmark.

Special Considerations

Factors That Can Affect a Tracking Error

The net asset value (NAV) of an index fund is naturally inclined toward being lower than its benchmark because funds have fees, whereas an index does not. A high expense ratio for a fund can have a significantly negative impact on the fund’s performance. However, it is possible for fund managers to overcome the negative impact of fund fees and outperform the underlying index by doing an above-average job of portfolio rebalancing, managing dividends or interest payments, or securities lending.

Beyond fund fees, a number of other factors can affect a fund’s tracking error. One important factor is the extent to which a fund’s holdings match the holdings of the underlying index or benchmark. Many funds are made up of just the fund manager’s idea of a representative sample of the securities that make up the actual index. There are frequently also differences in weighting between a fund’s assets and the assets of the index.

Illiquid or thinly-traded securities can also increase the chance of a tracking error, since this often leads to prices differing significantly from market price when the fund buys or sells such securities as a result of larger bid-ask spreads. Finally, the level of volatility for an index can also affect the tracking error.

Sector, international, and dividend ETFs tend to have higher absolute tracking errors; broad-based equity and bond ETFs tend to have lower ones. Management expense ratios (MER) are the most prominent cause of tracking error and there tends to be a direct correlation between the size of the MER and tracking error. But other factors can intercede and be more significant at times.

Premiums and Discounts to Net Asset Value

Premiums or discounts to NAV may occur when investors bid the market price of an ETF above or below the NAV of its basket of securities. Such divergences are usually rare. In the case of a premium, the authorized participant typically arbitrages it away by purchasing securities in the ETF basket, exchanging them for ETF units, and selling the units on the stock market to earn a profit (until the premium is gone). Premiums and discounts as high as 5% have been known to occur, particularly for thinly traded ETFs.

Optimization

When there are thinly traded stocks in the benchmark index, the ETF provider can’t buy them without pushing their prices up substantially, so it uses a sample containing the more liquid stocks to proxy the index. This is called portfolio optimization.

Diversification Constraints

ETFs are registered with regulators as mutual funds and need to abide by the applicable regulations. Of note are two diversification requirements: 75% of its assets must be invested in cash, government securities, and securities of other investment companies, and no more than 5% of the total assets can be invested in any one security. This can create problems for ETFs tracking the performance of a sector where there are a lot of dominant companies.

Cash Drag

Indexes don’t have cash holdings, but ETFs do. Cash can accumulate at intervals due to dividend payments, overnight balances, and trading activity. The lag between receiving and reinvesting the cash can lead to a decline in performance known as drag. Dividend funds with high payout yields are most susceptible.

Index Changes

ETFs track indexes and when the indexes are updated, the ETFs have to follow suit. Updating the ETF portfolio incurs transaction costs. And it may not always be possible to do it the same way as the index. For example, a stock added to the ETF may be at a different price than what the index maker selected.

Capital-Gains Distributions

ETFs are more tax-efficient than mutual funds but have nevertheless been known to distribute capital gains that are taxable in the hands of unitholders. Although it may not be immediately apparent, these distributions create a different performance than the index on an after-tax basis. Indexes with a high level of turnover in companies (e.g., mergers, acquisitions, and spin-offs) are one source of capital-gains distributions. The higher the turnover rate, the higher the likelihood the ETF will be compelled to sell securities at a profit.

Securities Lending

Some ETF companies may offset tracking errors through security lending, which is the practice of lending out holdings in the ETF portfolio to hedge funds for short selling. The lending fees collected from this practice can be used to lower tracking error if so desired.

Currency Hedging

International ETFs with currency hedging may not follow a benchmark index due to the costs of currency hedging, which are not always embodied in the MER. Factors affecting hedging costs include market volatility and interest-rate differentials, which impact the pricing and performance of forward contracts.

Futures Roll

Commodity ETFs, in many cases, track the price of a commodity through the futures markets, buying the contract closest to expiry. As the weeks pass and the contract nears expiration, the ETF provider will sell it (to avoid taking delivery) and buy the next month’s contract. This operation, known as the «roll,» is repeated every month. If contracts further from expiration have higher prices (contango), the roll into the next month will be at a higher price, which incurs a loss. Thus, even if the spot price of the commodity stays the same or rises slightly, the ETF could still show a decline. Vice versa, if futures further away from expiration have lower prices (backwardation), the ETF will have an upward bias.

Maintaining Constant Leverage

Leveraged and inverse ETFs use swaps, forwards, and futures to replicate on a daily basis two or three times the direct or inverse return of a benchmark index. This requires rebalancing the basket of derivatives daily to ensure they deliver the specified multiple of the index’s change each day.

Example of a Tracking Error

For example, assume that there is a large-cap mutual fund benchmarked to the S&P 500 index. Next, assume that the mutual fund and the index realized the following returns over a given five-year period:

- Mutual Fund: 11%, 3%, 12%, 14% and 8%.

- S&P 500 index: 12%, 5%, 13%, 9% and 7%.

Given this data, the series of differences is then (11% — 12%), (3% — 5%), (12% — 13%), (14% — 9%) and (8% — 7%). These differences equal -1%, -2%, -1%, 5%, and 1%. The standard deviation of this series of differences, the tracking error, is 2.50%.

Источник

Tracking Error

A measure of the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark

What is Tracking Error?

Tracking error is a measure of financial performance that determines the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark. The return fluctuations are primarily measured by standard deviations.

Generally, a benchmark is a diversified market index that represents part of the total market. The most common benchmarks for equity portfolios are the S&P 500 and the Dow Jones Industrial Average (DJIA) for portfolios with large-cap stocks, and the Russell 2000 for small-cap portfolios.

Importance of Tracking Error

Tracking error is one of the most important measures used to assess the performance of a portfolio, as well as the ability of a portfolio manager to generate excessive returns and beat the market or the benchmark. Due to the abovementioned reasons, it is used as an input to calculate the information ratio.

Tracking error is frequently categorized by the way it is calculated. A realized (also known as “ex post”) tracking error is calculated using historical returns. A tracking error whose calculations are based on some forecasting model is called an “ex ante” tracking error.

Low errors indicate that the performance of the portfolio is close to the performance of the benchmark. Low errors are common with index funds and ETFs that replicate the composition of major stock market indices.

High errors reveal that the portfolio’s performance is significantly different from the performance of the benchmark. The high errors can indicate that the portfolio substantially beat the benchmark, or signal that the portfolio significantly underperforms the benchmark.

Formula for Tracking

Tracking efficiency is calculated using the following formula:

- Var – the variance

- rp– the return of a portfolio

- rb– the return of a benchmark

Example of Tracking Error

Five years ago, Sam invested $100,000 in Fund A. The fund primarily invests in large-cap US equities. During the five-year period, the fund showed positive returns. Also, the economy also grew during the period and equity markets rose.

In order to assess how successful his investment was, Sam decides to compare the returns of Fund A against the returns of a benchmark. In such a case, the most appropriate benchmark is the S&P 500 because it tracks the performance of the biggest large-cap companies.

The comparison of the fund against the benchmark can be measured using the tracking error.

The following data is available for the yearly returns for both Fund A and the S&P 500:

We can plug this data into the formula to calculate the tracking error:

In the scenario above, the small tracking error indicates that Fund A does not significantly outperform the benchmark. Therefore, Sam may consider withdrawing his money from the fund and putting it into other, more promising investment opportunities. Alternatively, he may be satisfied with the fact that his portfolio is keeping pace with the gains of the overall market.

Thank you for reading CFI’s guide on Tracking Error. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

Источник

What is tracking error of a portfolio? The index fund tracking error (TE) is the extent to which the returns of the fund do no match the returns of the benchmark that the portfolio manager is trying to replicate. Managing the portfolio tracking error at the lowest possible cost is one of the most important considerations of ETF providers. On this page we provide the tracking error formula, show how to perform a tracking error calculation, discuss ex ante tracking error and ex post tracking error, At the bottom of this page, we provide an Excel example that implements the approach.

Tracking error formula

The way to calculate tracking error is to compare the fund returns with the benchmark returns in the following way. In particular, every day (or week, or month) we compare the performance of the fund with that of the benchmark that is being tracked. The difference is squared, since otherwise negative and positive difference would cancel each other out. The full formula looks as follows:

Where Rp is the return of the manager of the fund, Rb is the return of the benchmark, and N is the number of return periods. Clearly, the TE is nothing more than the standard deviation of the difference between the fund manager’s returns and the returns of the benchmark. So basically, the TE is actually a kind of volatility around the benchmark’s returns.

The resulting TE will be a daily, weekly, or monthly figure. If we want to have the annual TE we take the obtained number and annualize it, to obtain the annualized tracking error. It is clear from the formula that a negative tracking error is not possible, since we first take an even power and then the square root.

The obtained TE is sometimes also referred to as the active return. The TE we have just calculated is the ex post tracking error. This is different from the so-called ex ante tracking error, which is the amount of TE that the manager allows when running the portfolio. Since it is almost impossible to have a TE of zero, managers will try to minimize it. A small level of TE is not necessarily a bad thing, since it may be too costly to avoid it.

Tracking error interpretation

The interpretation of tracking risk is straightforward. The higher the TE, the larger the deviations between the manager’s portfolio returns and the returns of the benchmark the manager is expected to replicate. Depending on the manager’s mandate, a high TE may be allowed in which case it is not a problem.

Clearly, a manager that tries to track an index will be subject to tracking risk. Tracking risk is the risk that his fund deviates too much from the index he or she is trying to track. Proper risk management will try to manage this risk. Managing the ETF tracking error is often done using derivatives to ensure that new money inflows do not generate a TE.

Tracking error example

In the Excel file below we implement the above formula using a simple example where we compare a sample of monthly returns of a manager with the performance of the benchmark. The formula can easily be implemented in Excel.

Summary

We discussed the tracking error (TE) of a portfolio. It is a very important consideration for investors that wish to track the performance of a benchmark. In practice, the TE will almost never be zero, because of real-life frictions such as transaction costs.

If you are planning to invest in passive funds, and index funds in general, you should be well aware of the concerned fund’s tracking error. In fact, tracking error of a mutual fund is as important as the fund’s historical performance. Read on to know what is tracking error is and the impact it could have on the returns of your mutual fund investment.

What is Tracking Error and What are its Consequences?

Tracking error is a measurement of a mutual fund’s financial performance against its benchmark over a period of time. It is calculated as the annualised standard deviation of the tracking difference in a certain period. In other words, you can check a fund’s tracking error to see how closely its portfolio follows the benchmark.

Fund managers of active funds can show a large tracking record as they try to get excess returns through active positioning. In contrast, passively managed funds aim to keep the tracking error as low as possible.

An index fund with a low tracking error shows that it is closely following the benchmark. It can indicate which funds are being more actively managed and their risk levels.

You should avoid index funds with a large tracking error as it indicates that there is something significantly wrong with the investment. This could indicate that a fund is taking unnecessary levels of risk like holding large amounts of cash or maintaining lopsided weightage. Always remember that most of the best index funds come with a low tracking error.

Formula To Calculate Tracking Error

Tracking error could be calculated through two methods. In the first method, the cumulative returns of the index is deducted from the portfolio’s returns. The tracking error formula would be:

Tracking Error = P – I, where P stands for portfolio returns and I stands for index or benchmark.

The second method would be to deduct portfolio returns from the benchmark or index and then the standard deviation of the outcome would be calculated with the following formula:

Tracking Error = P – B, where P stands for portfolio returns and B stands for benchmark returns. Let’s understand this with an example.

Tracking Error Example

For example, if the underlying index has delivered a return of 5% over one year, whereas the index fund has given a return of 4.9% over the same period, the tracking error of the index fund would be 0.1%.

So, as an investor, should you be concerned about tracking errors? Yes, of course!

Continuing with the above example, a tracking error of 0.1% indicates that you would be earning 0.1% less than what you would make if you had directly invested in the underlying index.

However, if the index fund replicates the underlying benchmark, why should there be a tracking difference?

What are the Reasons for Tracking Error?

The probable reasons for tracking error could be as follows:

1. Cash component

An index fund will not be able to invest 100% of the corpus in the index constituents. It has to maintain certain cash to meet redemption requests, day-to-day fund management charges, transaction costs, etc.

2. Corporate actions

Corporate actions such as dividends, bonuses, mergers, rights, preferential issues, etc., require the fund to re-align with the index’s composition. The scheme would require buying and selling portfolio components that add up to the transaction cost, affecting the returns of the fund.

3. Change in portfolio constituents

Sometimes, the underlying index may have new entrants or exits. To maintain the same composition as the underlying index, the index fund must purchase or sell those securities. However, there could be a mismatch in the price, circuit filters, etc., that may create a mismatch in quantities and eventually the returns.

Also read: Key Differences Between Direct Mutual Funds And Regular Mutual Funds

List of Index Funds with the Lowest Tracking Error

The following are the best index funds according to their tracking error:

| Name of the Index Fund | Tracking Error |

| Navi Nifty 50 Index Fund | 0.04% |

| HDFC Index Fund- Sensex Plan | 0.06% |

| SBI Nifty Index Fund | 0.10% |

| HDFC Index Fund- Nifty 50 Plan | 0.10% |

| UTI Nifty Index Fund | 0.11% |

| Nippon India Index Fund- Sensex Plan | 0.12% |

| DSP Nifty 50 Index Fund | 0.13% |

| ICICI Prudential Nifty Next 50 Index Fund | 0.13% |

*Note that the table is for educational purposes only.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully before investing.

Does Tracking Error have Implications in Index Funds?

Tracking error helps measure the performance of a portfolio against its underlying index. An index fund with a low tracking error has a minimum deviation in terms of returns from the benchmark index.

You must check the tracking error of index funds rather than fund returns. It helps to pick an index fund with a lower tracking error to minimise the deviation in return from the benchmark index. Tracking error also helps you measure the consistency of excessive returns.

Also Read

Final Word

If passive funds are your go-to investment avenue, try to invest in funds with low tracking error. It also aids to gauge the performance of a particular fund against its concerned benchmark over a particular period of time.

In case you are looking to invest in funds that could give you market-level returns, try Navi Mutual Fund. With Navi’s mutual funds, you could explore a wide range of low-cost index funds, including the Navi Nifty 50 – a fund that comes with a significantly low tracking error.

FAQs

Q1. What is a good tracking error?

Ans: A smaller number usually indicates better portfolio earnings against the index benchmark. However, determining whether a tracking error is good or bad entirely depends on the objective of the investment.

Q2. When do active fund managers prefer high tracking error?

Ans: Often, active portfolio managers show high tracking error because they try to achieve excess return against the benchmark. On the contrary, passive fund managers seek low tracking error with return deviations coming from trading and liquidity costs, imprecise cash flows, tax costs, etc.

Q3. Why is tracking error important?

Ans: Tracking error helps portfolio managers understand how close they are to the benchmark.

Want to put your savings into action and kick-start your investment journey 💸 But don’t have time to do research? Invest now with Navi Nifty 50 Index Fund, sit back, and earn from the top 50 companies.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

This article has been prepared on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this article is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article.

Fixed Deposits vs Mutual Funds

9 February 2023

8 Kitchen Interior Design Ideas to Suit Every Style in 2023

8 February 2023

10 Best Nifty 50 Index Funds to Invest in 2023

7 February 2023

8 Best Health Insurance Plans in India in 2023

10 Best Personal Loan Apps in India in 2023

8 Living Room Interior Design Ideas to Suit Every Style in 2023

2 February 2023

Union Budget 2023 – 8 Key Highlights You Should Know

1 February 2023

Adani Stocks Have Crashed – Here’s Everything You Should Know

31 January 2023

10 Best Hybrid Funds to Invest in 2023

30 January 2023

Inside Anant & Radhika’s Lavish Engagement

27 January 2023

Любой индексный фонд должен четко следовать за своим индексом. Чем выше точность слежения, тем лучше фонд справляется со своей главной задачей. Владелец качественных индексных инструментов может быть уверен, что на любом горизонте инвестирования в своем портфеле он получит точное отражение рыночных (индексных) бенчмарков. Оценить качество работы фонда как раз и позволяет «ошибка слежения», или Tracking Error. Рассказываем, что обозначает этот показатель и как он рассчитывается.

Зачем нужно смотреть на ошибку слежения

Ошибка слежения (tracking error)— это приведенное к годовым значение отклонений дневных доходностей ETF от индекса-бенчмарка. По сути, ошибка слежения отражает, насколько точно фонд ежедневно отслеживает индекс и как быстро и эффективно происходит перебалансировка портфеля ETF при изменении состава индекса. Другими словами, ошибка слежения — это мера того, насколько надпись на упаковке (название ETF) соответствует ее содержанию (наполнению).

Чем меньше ошибка слежения, тем более полно ETF отображает динамику индекса, а значит, и доходность фонда будет максимально приближена к индексу. Важно помнить, что ETF — это инструмент доступа к рынку акций, облигаций или товаров, и он не должен обыгрывать индекс или демонстрировать лучшие, чем у индекса, характеристики «риск — доходность». Но он должен обеспечивать доход, близкий к бенчмарку.

Высокая ошибка слежения фактически указывает на риск недополучения инвестором дохода из-за низкого качества управления фондом.

Как рассчитывается ошибка слежения

На странице каждого фонда FinEx ETF публикуется информация по ошибке слежения. Давайте посмотрим, как же рассчитывается этот показатель, если вы хотите повторить вычисления самостоятельно или просто желаете увидеть все изнутри.

1. Выгружаем дневную, то есть за каждый торговый день, динамику стоимости чистых активов фонда на 1 акцию (СЧА) и цены отслеживаемого индекса за рассматриваемый период (всё в одной валюте — в базовой валюте фонда).

Для самостоятельного расчета ошибки слежения необходимо иметь данные по динамике стоимости чистых активов на одну акцию фонда и динамике индекса за максимально возможный период (с момента создания фонда). СЧА на одну акцию каждого FinEx ETF обновляется ежедневно на продуктовых страницах, ее можно выгрузить в формате Excel за любой период.

С выгрузкой «индексных» данных, к сожалению, всё сложнее. Дело в том, что многие индекс-провайдеры публикуют динамику своих индексов только в Bloomberg или Reuters, доступа к которым у большинства розничных инвесторов нет. У FinEx ETF такой доступ есть, но размещать эти данные мы, к сожалению, не можем — это нарушение авторских прав.

2. Считаем дневные доходности за каждый торговый день по СЧА фонда и по отслеживаемому индексу.

Следующий шаг — расчет дневных доходностей фонда и индекса по выгруженным данным. Для этого используется стандартная формула прироста:

доходность за день = (значение СЧА на сегодняшний день) / (значение СЧА на вчерашний день) — 1

3. Считаем разницу дневной доходности фонда и индекса.

Разницу дневной доходности СЧА фонда и цен индекса (или Daily Return Difference) посчитать просто: нужно из дневной доходности фонда вычесть дневную доходность индекса. У нас должен получиться ряд данных на каждый торговый день.

4. Проверяем получившиеся разницы на наличие «выбросов».

В процессе анализа могут возникнуть отклонения, которые не связаны с качеством отслеживания. К примеру, если СЧА фонда не обновлялся несколько дней (такое может происходить, если торги по фонду не велись из-за локальных праздников), а значения по индексу рассчитывались. Чтобы эти «выбросы» не привели к искусственному завышению ошибки слежения, необходимо удалить лишние строки.

5. Считаем ошибку слежения с помощью формулы

Чтобы рассчитать финальный показатель, нам достаточно простой статистической функции Excel. Используем функцию поиска стандартного отклонения выборки СТАНДОТКЛОН.В (в нашем случае «выборка» — это ряд данных с разницей дневных доходностей) и приведем получившееся значение к годовым терминам. Для этого его нужно умножить на корень из количества торговых дней — 252. Так мы получим заветный показатель.

Можно ли рассчитать показатель быстрее

В примере выше мы использовали самый точный метод расчета ошибки слежения — на основе дневных данных. Именно таким способом рассчитываются ошибки слежения всех FinEx ETF. Эти данные можно найти на странице каждого ETF.

Однако на практике инвестор может использовать и более грубый способ расчета с помощью годовых данных.

Предположим, что существует ETF, который отслеживает определенный индекс. Результаты работы фонда и индекса за последние 5 лет можно определить всего лишь по десяти точечным данным СЧА и индекса. При этом методика расчета остается абсолютно идентичной, за исключением последнего шага — полученный показатель не нужно приводить к годовым значениям, так как за основу уже взяты годовые данные.

Примечание: данные приведены в качестве примера и не относятся к конкретному фонду

Посмотреть файл Excel со всеми расчетами и формулами из статьи можно по ссылке.

Понравился текст? Вот короткая инструкция, как получать еще больше полезных материалов:

- Чтобы не пропустить новые статьи, подписывайтесь на нашу рассылку.

- Если вы только решили стать инвестором, то читайте наш гайд «С чего начать», где вы найдете ответы на все вопросы, и подписывайтесь на лайфхаки для новичков на канале в телеграме.

- Смотрите обучающие ролики на нашем YouTube-канале.

- А чтобы еще лучше разбираться в инвестициях, подписывайтесь на наш аналитический канал.

Typically, tracking error explains the difference between the price behaviour of an index or benchmark and the position of an investment portfolio. To benefit from the same in terms of investment portfolio management, individuals need to become familiar with the concept and functioning of tracking error.

What is a Tracking Error?

Tracking error can be described as the relative risk of an investment portfolio when compared to its benchmark. It helps to measure the performance of a particular investment. It also aids to compare the performance of said investment against a concerned benchmark over a specific period. As a result, it serves as an indicator that helps to understand how well a fund is managed and what risks accompany it.

In simpler words, tracking error can be defined as the difference between an investment portfolio’s returns and the index it mimics or tries to beat. Often tracking error comes handy in gauging the performance of portfolio managers and is known as active risk and is mostly used for hedge funds, ETFs or mutual funds.

How to Calculate a Tracking Error?

Typically, there are two distinct ways of computing tracking error.

In the first method,

The cumulative returns of the benchmark are deducted from the investment portfolio’s returns –

Tracking Error = Return(P) – Return(i)

Here,

P = portfolio

i = index or benchmark

In the second method,

The portfolio returns are deducted from the benchmark first. Subsequently, the standard deviation of the outcome is calculated using this tracking error formula –

Tracking Error = Standard Deviation of (P – B)

Here,

P = Portfolio returns

B = Benchmark returns

Example of Tracking Error Calculation

Suppose, a large-cap mutual fund is benchmarked to S&P 500 index; its index and mutual fund realised the following returns over 5 years –

For S&P 500 Index –

12%, 5%, 13%, 9% and 7%

For Mutual Fund –

11%, 3%, 12%, 14% and 8%

From the available data, the series of difference stood at –

(11% – 12%) = -1%

(3% – 5%) = -2%

(12% – 13%) = -1%

(14% – 9%) = 5%

(8% – 7%) = 1%

With the help of the tracking error formula–

TE = Standard Deviation of (P – B)

= 2.79%

Any fund which shows a low tracking error signifies that its portfolio is following its benchmark quite closely. Contrarily, a high tracking error signifies that a fund is not following the set benchmark.

Notably, in index funds, the tracking error is never zero because of – expenses ratio, funds’ cash flow, and portfolio realignment due to changes in index composition.

What is a Good Tracking Error?

The type of investment portfolio decides whether a tracking error is good or bad. Typically, a smaller number indicates tightly bound portfolio earnings against benchmark returns. For instance, index fund managers opt for passive management and try to keep the differential returns significantly low to keep the tracking error low. Regardless, the decision of whether a certain degree of tracking error is good or bad depends entirely on the objectives of investment.

Factors Influencing Tracking Error

Several factors tend to influence the tracking error. For example, the table below highlights the factors that affect the ETF’s tracking error.

| Factor | Impact |

| Discounts & Premium to NAV | Bidding the market price of ETFs above or below their NAV results in discounts or premiums, which further leads to divergence. |

| Cash drag | Cash holdings are a factor with ETF as there is a significant time lag between receiving and reinvesting cash. This leads to variance in tracking error. |

| Optimisation | ETF providers cannot purchase thinly traded stock on benchmark without raising their prices upwards. This is why; they use samples that comprise more liquid stocks that can serve as a proxy to index. |

| Currency hedging | Owing to the cost of currency hedging, foreign ETFs with implementing the same usually do not follow any benchmark index. Factors like interest rates and volatility affect the price of hedging and in turn, influence the tracking error. |

| Capital gain distribution | Though ETFs are tax-efficient, they distribute taxable capital gains. Such distributions tend to impact performance differently than the index. |

| Changes in index | ETFs must keep up with the changes in the index. Generally, during the update, an ETF portfolio is likely to incur a transactional cost. |

| Security lending | ETF companies may counterbalance tracking errors with the help of securities lending. It is essentially a practice of lending holdings in ETF-based portfolios so that one could hedge funds for short selling. |

| Expense ratio | A high expense ratio influences the performance of ETF funds negatively. |

| Illiquidity and volatility | Illiquid securities often accompany a bid-ask spread which leads to errors in tracking. Similarly, the volatility of the benchmark also influences the tracking error. |

Significance of Tracking Error

These pointers indicate the importance of tracking error –

- Tracking error helps to measure and compare the performance of a portfolio with its concerned benchmark or index.

- Enables to gauge the consistency of excessive returns.

- It helps to convert the difference between an investment portfolio and concerned benchmark into a one-digit number for better comparison and understanding.

- It helps portfolio managers to ascertain how close a portfolio is to the benchmark.

- Tracking error serves as a neutral point and allows portfolio managers to make an informed decision.

- It helps investors to ascertain the significance of differences between the returns of benchmark and portfolio.

- Further helps to determine how active and proficient a portfolio manager’s investment strategy is.

Though there are numerous benefits of tracking error, it has its shares of limitations too.

Limitations of Tracking Error

Tracking error is extensively used to measure and compare both underperformance and outperformance of a fund against its benchmark. Typically, investors prefer a high tracking error in the event that there is a certain degree of outperformance. Alternatively, a low tracking error is preferred during consistent underperformance. Regardless, tracking error does not help distinguish between the two right away.

![{displaystyle TE=omega ={sqrt {operatorname {Var} (r_{p}-r_{b})}}={sqrt {{E}[(r_{p}-r_{b})^{2}]-({E}[r_{p}-r_{b}])^{2}}}={sqrt {(w_{p}-w_{b})^{T}Sigma (w_{p}-w_{b})}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/fcbdc33801fc0d2e9791f95d3385b8096f049523)

:max_bytes(150000):strip_icc()/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

:max_bytes(150000):strip_icc()/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)